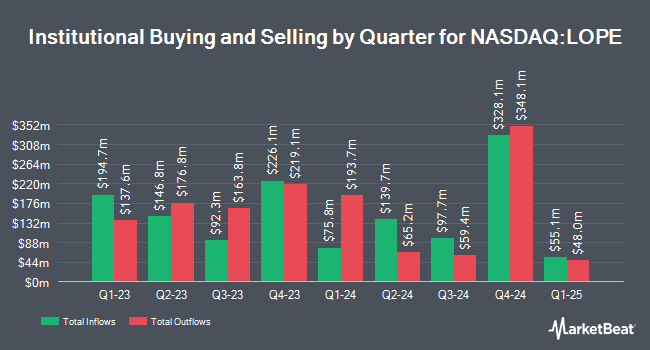

Postrock Partners LLC acquired a new position in Grand Canyon Education, Inc. (NASDAQ:LOPE - Free Report) during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund acquired 10,471 shares of the company's stock, valued at approximately $1,715,000. Grand Canyon Education comprises about 0.8% of Postrock Partners LLC's investment portfolio, making the stock its 25th largest position.

Several other hedge funds and other institutional investors have also bought and sold shares of the business. Wealth Enhancement Advisory Services LLC boosted its position in Grand Canyon Education by 1.5% in the fourth quarter. Wealth Enhancement Advisory Services LLC now owns 4,225 shares of the company's stock worth $692,000 after purchasing an additional 63 shares during the last quarter. DGS Capital Management LLC grew its stake in shares of Grand Canyon Education by 1.5% during the 3rd quarter. DGS Capital Management LLC now owns 4,399 shares of the company's stock worth $624,000 after acquiring an additional 67 shares during the period. Barclays PLC grew its stake in shares of Grand Canyon Education by 0.4% during the 3rd quarter. Barclays PLC now owns 18,977 shares of the company's stock worth $2,692,000 after acquiring an additional 84 shares during the period. MML Investors Services LLC grew its stake in shares of Grand Canyon Education by 1.6% during the 3rd quarter. MML Investors Services LLC now owns 5,740 shares of the company's stock worth $814,000 after acquiring an additional 91 shares during the period. Finally, Geneos Wealth Management Inc. grew its stake in shares of Grand Canyon Education by 22.5% during the 4th quarter. Geneos Wealth Management Inc. now owns 539 shares of the company's stock worth $88,000 after acquiring an additional 99 shares during the period. Hedge funds and other institutional investors own 94.17% of the company's stock.

Analyst Ratings Changes

Several research firms have recently weighed in on LOPE. Barrington Research increased their price target on Grand Canyon Education from $180.00 to $205.00 and gave the stock an "outperform" rating in a research note on Thursday, February 20th. StockNews.com upgraded Grand Canyon Education from a "hold" rating to a "buy" rating in a research note on Tuesday, February 25th. Finally, BMO Capital Markets raised their target price on Grand Canyon Education from $181.00 to $202.00 and gave the stock an "outperform" rating in a research note on Friday, February 21st.

Read Our Latest Report on LOPE

Grand Canyon Education Price Performance

Shares of NASDAQ:LOPE traded down $2.39 on Tuesday, hitting $167.25. The company's stock had a trading volume of 124,185 shares, compared to its average volume of 165,359. The company has a 50-day simple moving average of $174.53 and a 200 day simple moving average of $159.42. Grand Canyon Education, Inc. has a 1 year low of $126.17 and a 1 year high of $192.18. The company has a market capitalization of $4.80 billion, a PE ratio of 21.61, a PEG ratio of 1.42 and a beta of 0.78.

Grand Canyon Education (NASDAQ:LOPE - Get Free Report) last released its quarterly earnings results on Wednesday, February 19th. The company reported $2.95 earnings per share for the quarter, beating the consensus estimate of $2.93 by $0.02. Grand Canyon Education had a return on equity of 30.67% and a net margin of 21.90%. The firm had revenue of $292.57 million for the quarter, compared to analysts' expectations of $289.62 million. On average, equities research analysts expect that Grand Canyon Education, Inc. will post 8.81 earnings per share for the current fiscal year.

Insider Buying and Selling at Grand Canyon Education

In related news, CTO Dilek Marsh sold 1,500 shares of the firm's stock in a transaction dated Wednesday, December 18th. The stock was sold at an average price of $166.07, for a total transaction of $249,105.00. Following the transaction, the chief technology officer now directly owns 21,174 shares of the company's stock, valued at approximately $3,516,366.18. This trade represents a 6.62 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Insiders own 2.00% of the company's stock.

Grand Canyon Education Profile

(

Free Report)

Grand Canyon Education, Inc provides education services to colleges and universities in the United States. It offers technology services, including learning management system, internal administration, infrastructure, and support services; academic services, such as program and curriculum, faculty and related training and development, class scheduling, and skills and simulation lab sites; and counseling services and support services comprising admission, financial aid, and field experience and other counseling services.

Featured Articles

Before you consider Grand Canyon Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grand Canyon Education wasn't on the list.

While Grand Canyon Education currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.