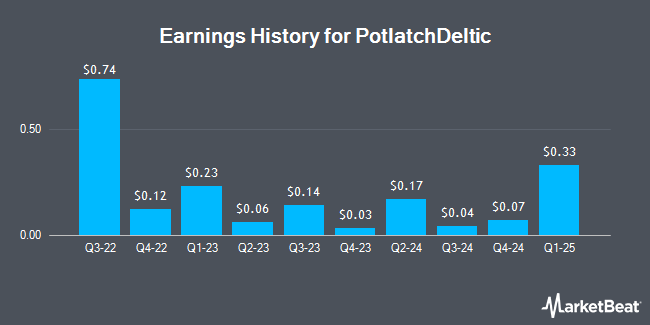

PotlatchDeltic (NASDAQ:PCH - Get Free Report) is expected to be issuing its Q1 2025 quarterly earnings data after the market closes on Monday, April 28th. Analysts expect the company to announce earnings of $0.19 per share and revenue of $243.68 million for the quarter.

PotlatchDeltic (NASDAQ:PCH - Get Free Report) last announced its earnings results on Monday, January 27th. The real estate investment trust reported $0.07 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.03) by $0.10. PotlatchDeltic had a net margin of 2.06% and a return on equity of 1.05%. On average, analysts expect PotlatchDeltic to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

PotlatchDeltic Stock Performance

NASDAQ:PCH traded down $0.28 during mid-day trading on Wednesday, reaching $39.02. 395,626 shares of the company's stock were exchanged, compared to its average volume of 448,307. PotlatchDeltic has a one year low of $36.82 and a one year high of $48.12. The company has a debt-to-equity ratio of 0.46, a quick ratio of 1.08 and a current ratio of 1.49. The business's fifty day simple moving average is $43.36 and its two-hundred day simple moving average is $42.62. The firm has a market capitalization of $3.07 billion, a PE ratio of 139.36 and a beta of 1.12.

PotlatchDeltic Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, March 31st. Stockholders of record on Friday, March 7th were issued a dividend of $0.45 per share. The ex-dividend date of this dividend was Friday, March 7th. This represents a $1.80 annualized dividend and a dividend yield of 4.61%. PotlatchDeltic's dividend payout ratio is presently 642.86%.

Analyst Ratings Changes

A number of equities research analysts recently issued reports on the company. Citigroup reduced their price target on PotlatchDeltic from $52.00 to $46.00 and set a "buy" rating on the stock in a research report on Wednesday, January 15th. DA Davidson set a $54.00 price target on PotlatchDeltic in a research note on Wednesday, January 29th. Truist Financial reduced their price objective on shares of PotlatchDeltic from $44.00 to $42.00 and set a "hold" rating on the stock in a research note on Tuesday. Finally, StockNews.com upgraded shares of PotlatchDeltic from a "sell" rating to a "hold" rating in a research report on Friday, January 31st. Two analysts have rated the stock with a hold rating and six have given a buy rating to the company. According to data from MarketBeat.com, PotlatchDeltic presently has a consensus rating of "Moderate Buy" and a consensus price target of $48.43.

Read Our Latest Research Report on PCH

Insiders Place Their Bets

In related news, CEO Eric J. Cremers sold 14,188 shares of the firm's stock in a transaction on Monday, February 10th. The stock was sold at an average price of $44.76, for a total transaction of $635,054.88. Following the completion of the transaction, the chief executive officer now directly owns 281,133 shares of the company's stock, valued at $12,583,513.08. This trade represents a 4.80 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Also, VP Michele Tyler sold 3,170 shares of the stock in a transaction dated Monday, February 10th. The shares were sold at an average price of $44.72, for a total value of $141,762.40. Following the completion of the sale, the vice president now directly owns 39,446 shares of the company's stock, valued at approximately $1,764,025.12. The trade was a 7.44 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 18,651 shares of company stock valued at $834,770. 1.00% of the stock is currently owned by insiders.

About PotlatchDeltic

(

Get Free Report)

PotlatchDeltic Corporation Nasdaq: PCH is a leading Real Estate Investment Trust (REIT) that owns nearly 2.2 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina. Through its taxable REIT subsidiary, the company also operates six sawmills, an industrial-grade plywood mill, a residential and commercial real estate development business and a rural timberland sales program.

Further Reading

Before you consider PotlatchDeltic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PotlatchDeltic wasn't on the list.

While PotlatchDeltic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.