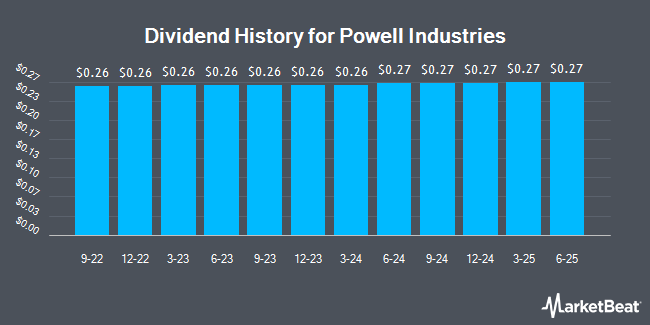

Powell Industries, Inc. (NASDAQ:POWL - Get Free Report) declared a quarterly dividend on Tuesday, February 4th,RTT News reports. Investors of record on Wednesday, February 19th will be paid a dividend of 0.2675 per share by the industrial products company on Wednesday, March 19th. This represents a $1.07 dividend on an annualized basis and a yield of 0.47%. The ex-dividend date of this dividend is Wednesday, February 19th. This is an increase from Powell Industries's previous quarterly dividend of $0.27.

Powell Industries has raised its dividend by an average of 0.6% per year over the last three years. Powell Industries has a payout ratio of 7.2% indicating that its dividend is sufficiently covered by earnings. Research analysts expect Powell Industries to earn $14.80 per share next year, which means the company should continue to be able to cover its $1.06 annual dividend with an expected future payout ratio of 7.2%.

Powell Industries Trading Down 6.5 %

POWL stock traded down $16.01 during midday trading on Friday, hitting $228.83. 874,293 shares of the company's stock were exchanged, compared to its average volume of 477,425. The firm has a 50 day moving average price of $249.01 and a 200-day moving average price of $230.50. Powell Industries has a 12-month low of $122.00 and a 12-month high of $364.98. The stock has a market capitalization of $2.76 billion, a price-to-earnings ratio of 17.38, a price-to-earnings-growth ratio of 1.28 and a beta of 0.87.

Powell Industries (NASDAQ:POWL - Get Free Report) last issued its quarterly earnings results on Thursday, February 6th. The industrial products company reported $2.86 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.83 by $0.03. Powell Industries had a net margin of 15.15% and a return on equity of 36.66%. On average, sell-side analysts forecast that Powell Industries will post 13.7 EPS for the current fiscal year.

Analysts Set New Price Targets

Several research analysts have recently commented on the stock. Roth Capital raised shares of Powell Industries to a "strong-buy" rating in a report on Tuesday, December 10th. Roth Mkm began coverage on Powell Industries in a research note on Wednesday, December 11th. They issued a "buy" rating and a $312.00 target price on the stock. Finally, StockNews.com upgraded shares of Powell Industries from a "hold" rating to a "buy" rating in a research report on Friday.

Check Out Our Latest Report on Powell Industries

About Powell Industries

(

Get Free Report)

Powell Industries, Inc, together with its subsidiaries, designs, develops, manufactures, sells, and services custom-engineered equipment and systems. The company's principal products include integrated power control room substations, custom-engineered modules, electrical houses, medium-voltage circuit breakers, monitoring and control communications systems, motor control centers, switches, and bus duct systems, as well as traditional and arc-resistant distribution switchgears and control gears.

Featured Articles

Before you consider Powell Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Powell Industries wasn't on the list.

While Powell Industries currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.