FMR LLC lowered its position in Praxis Precision Medicines, Inc. (NASDAQ:PRAX - Free Report) by 5.9% during the third quarter, according to its most recent filing with the SEC. The firm owned 273,895 shares of the company's stock after selling 17,084 shares during the period. FMR LLC owned 1.47% of Praxis Precision Medicines worth $15,760,000 as of its most recent filing with the SEC.

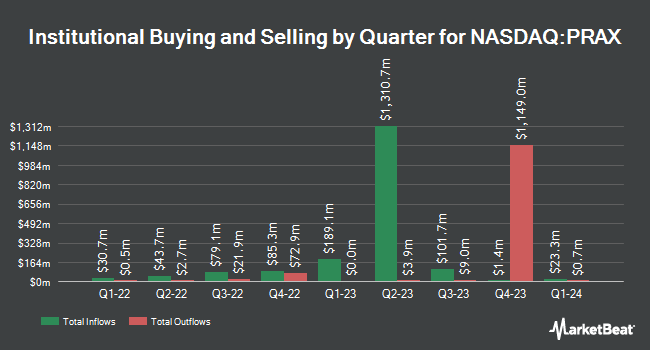

Several other large investors also recently modified their holdings of PRAX. Amalgamated Bank acquired a new stake in Praxis Precision Medicines in the second quarter worth $25,000. US Bancorp DE grew its holdings in shares of Praxis Precision Medicines by 35.9% during the third quarter. US Bancorp DE now owns 2,289 shares of the company's stock valued at $132,000 after buying an additional 605 shares during the last quarter. Quarry LP bought a new stake in Praxis Precision Medicines during the 2nd quarter worth approximately $83,000. Intech Investment Management LLC purchased a new position in Praxis Precision Medicines during the 3rd quarter worth $217,000. Finally, Mesirow Financial Investment Management Inc. purchased a new position in shares of Praxis Precision Medicines in the 3rd quarter worth approximately $231,000. 67.84% of the stock is currently owned by institutional investors and hedge funds.

Praxis Precision Medicines Stock Performance

Shares of PRAX traded up $5.23 on Wednesday, reaching $75.13. The stock had a trading volume of 320,403 shares, compared to its average volume of 283,068. The firm has a market capitalization of $1.40 billion, a price-to-earnings ratio of -6.79 and a beta of 2.67. The company has a 50-day simple moving average of $72.17 and a 200-day simple moving average of $58.17. Praxis Precision Medicines, Inc. has a 12-month low of $14.77 and a 12-month high of $86.93.

Praxis Precision Medicines (NASDAQ:PRAX - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The company reported ($2.75) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($2.01) by ($0.74). Praxis Precision Medicines had a negative net margin of 9,409.22% and a negative return on equity of 54.86%. The business had revenue of $0.30 million for the quarter, compared to analysts' expectations of $0.53 million. During the same period last year, the business earned ($2.70) earnings per share. On average, analysts expect that Praxis Precision Medicines, Inc. will post -10.26 EPS for the current fiscal year.

Insider Transactions at Praxis Precision Medicines

In related news, insider Lauren Mastrocola sold 5,188 shares of the stock in a transaction on Thursday, November 14th. The stock was sold at an average price of $81.78, for a total transaction of $424,274.64. Following the sale, the insider now directly owns 5,613 shares of the company's stock, valued at $459,031.14. This trade represents a 48.03 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, General Counsel Alex Nemiroff sold 8,239 shares of the business's stock in a transaction dated Thursday, November 14th. The stock was sold at an average price of $80.20, for a total value of $660,767.80. Following the completion of the transaction, the general counsel now directly owns 10,301 shares of the company's stock, valued at approximately $826,140.20. This trade represents a 44.44 % decrease in their position. The disclosure for this sale can be found here. Insiders own 2.70% of the company's stock.

Analysts Set New Price Targets

PRAX has been the subject of several research reports. Guggenheim increased their price target on Praxis Precision Medicines from $155.00 to $170.00 and gave the stock a "buy" rating in a research note on Wednesday, August 14th. Needham & Company LLC reiterated a "buy" rating and set a $151.00 target price on shares of Praxis Precision Medicines in a research report on Thursday, November 7th. Oppenheimer lifted their price objective on shares of Praxis Precision Medicines from $143.00 to $163.00 and gave the stock an "outperform" rating in a report on Thursday, October 31st. Wedbush lifted their price target on Praxis Precision Medicines from $40.00 to $48.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 14th. Finally, HC Wainwright reiterated a "buy" rating and set a $120.00 price target on shares of Praxis Precision Medicines in a research report on Thursday, November 7th. One analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $146.33.

Get Our Latest Report on PRAX

Praxis Precision Medicines Company Profile

(

Free Report)

Praxis Precision Medicines, Inc, a clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system disorders characterized by neuronal excitation-inhibition imbalance. It is developing ulixacaltamide, a small molecule inhibitor of T-type calcium channels that is in Phase III clinical trial for the treatment of essential tremor; PRAX-562 for the treatment of pediatric patients with developmental and epileptic encephalopathies (DEE); and PRAX-628 to treat focal epilepsy.

Featured Articles

Before you consider Praxis Precision Medicines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Praxis Precision Medicines wasn't on the list.

While Praxis Precision Medicines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.