Premier Fund Managers Ltd increased its position in MercadoLibre, Inc. (NASDAQ:MELI - Free Report) by 40.2% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 7,301 shares of the company's stock after buying an additional 2,094 shares during the quarter. Premier Fund Managers Ltd's holdings in MercadoLibre were worth $15,059,000 as of its most recent filing with the Securities & Exchange Commission.

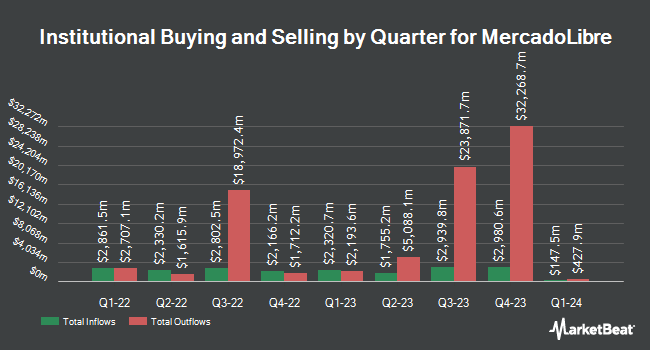

A number of other institutional investors also recently modified their holdings of the company. Avior Wealth Management LLC boosted its stake in MercadoLibre by 268.1% during the third quarter. Avior Wealth Management LLC now owns 173 shares of the company's stock worth $355,000 after acquiring an additional 126 shares in the last quarter. West Family Investments Inc. bought a new position in MercadoLibre during the third quarter valued at $228,000. Parnassus Investments LLC grew its stake in shares of MercadoLibre by 3.0% in the 3rd quarter. Parnassus Investments LLC now owns 14,903 shares of the company's stock worth $30,580,000 after buying an additional 436 shares in the last quarter. B. Metzler seel. Sohn & Co. Holding AG bought a new stake in shares of MercadoLibre in the 3rd quarter worth about $26,403,000. Finally, Banque Cantonale Vaudoise raised its position in shares of MercadoLibre by 48.0% during the 3rd quarter. Banque Cantonale Vaudoise now owns 814 shares of the company's stock valued at $1,670,000 after buying an additional 264 shares in the last quarter. 87.62% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

MELI has been the subject of a number of recent research reports. Bank of America lifted their target price on MercadoLibre from $2,250.00 to $2,500.00 and gave the stock a "buy" rating in a report on Thursday, September 12th. Barclays dropped their price objective on shares of MercadoLibre from $2,500.00 to $2,200.00 and set an "overweight" rating for the company in a research note on Tuesday, November 12th. BTIG Research dropped their price target on shares of MercadoLibre from $2,250.00 to $2,200.00 and set a "buy" rating for the company in a research note on Thursday, November 7th. Cantor Fitzgerald reduced their price objective on shares of MercadoLibre from $2,530.00 to $2,300.00 and set an "overweight" rating on the stock in a research report on Thursday, November 7th. Finally, Wedbush reissued an "outperform" rating and issued a $2,200.00 price objective (up previously from $2,000.00) on shares of MercadoLibre in a research note on Thursday, November 7th. Three research analysts have rated the stock with a hold rating, fourteen have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $2,269.67.

Get Our Latest Research Report on MELI

MercadoLibre Stock Up 0.2 %

Shares of NASDAQ MELI traded up $3.71 during midday trading on Wednesday, hitting $1,920.22. The company's stock had a trading volume of 194,806 shares, compared to its average volume of 367,235. The firm has a market capitalization of $97.36 billion, a price-to-earnings ratio of 67.63, a price-to-earnings-growth ratio of 1.28 and a beta of 1.61. MercadoLibre, Inc. has a 1 year low of $1,324.99 and a 1 year high of $2,161.73. The company has a debt-to-equity ratio of 0.78, a current ratio of 1.25 and a quick ratio of 1.22. The business's fifty day simple moving average is $2,033.32 and its two-hundred day simple moving average is $1,851.27.

MercadoLibre Company Profile

(

Free Report)

MercadoLibre, Inc operates online commerce platforms in the United States. It operates Mercado Libre Marketplace, an automated online commerce platform that enables businesses, merchants, and individuals to list merchandise and conduct sales and purchases digitally; and Mercado Pago FinTech platform, a financial technology solution platform, which facilitates transactions on and off its marketplaces by providing a mechanism that allows its users to send and receive payments online, as well as allows users to transfer money through their websites or on the apps.

Featured Articles

Before you consider MercadoLibre, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MercadoLibre wasn't on the list.

While MercadoLibre currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.