Premier Fund Managers Ltd increased its holdings in shares of CBRE Group, Inc. (NYSE:CBRE - Free Report) by 7.4% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 580,000 shares of the financial services provider's stock after buying an additional 40,000 shares during the period. CBRE Group comprises approximately 2.5% of Premier Fund Managers Ltd's portfolio, making the stock its 6th largest position. Premier Fund Managers Ltd owned 0.19% of CBRE Group worth $71,439,000 at the end of the most recent quarter.

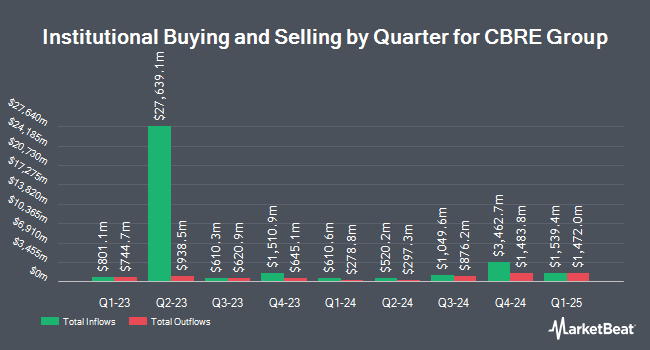

A number of other institutional investors have also recently added to or reduced their stakes in CBRE. Janney Montgomery Scott LLC acquired a new stake in CBRE Group in the first quarter worth $336,000. O Shaughnessy Asset Management LLC raised its stake in CBRE Group by 14.5% during the 1st quarter. O Shaughnessy Asset Management LLC now owns 21,132 shares of the financial services provider's stock worth $2,055,000 after buying an additional 2,673 shares during the period. Lake Street Advisors Group LLC grew its stake in CBRE Group by 112.9% in the first quarter. Lake Street Advisors Group LLC now owns 5,181 shares of the financial services provider's stock valued at $504,000 after acquiring an additional 2,747 shares during the period. CANADA LIFE ASSURANCE Co increased its holdings in shares of CBRE Group by 0.6% during the first quarter. CANADA LIFE ASSURANCE Co now owns 336,984 shares of the financial services provider's stock valued at $32,802,000 after acquiring an additional 2,133 shares in the last quarter. Finally, Healthcare of Ontario Pension Plan Trust Fund acquired a new position in shares of CBRE Group during the first quarter worth approximately $2,820,000. 98.41% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

A number of research analysts have weighed in on CBRE shares. Keefe, Bruyette & Woods raised their price objective on shares of CBRE Group from $125.00 to $138.00 and gave the company a "market perform" rating in a research note on Tuesday, October 29th. Morgan Stanley assumed coverage on CBRE Group in a report on Thursday, July 25th. They set an "equal weight" rating and a $105.00 price objective for the company. Wolfe Research upgraded CBRE Group to a "strong-buy" rating in a report on Friday, August 16th. Raymond James upped their price target on CBRE Group from $122.00 to $124.00 and gave the stock a "strong-buy" rating in a report on Thursday, July 25th. Finally, Evercore ISI raised their price objective on CBRE Group from $123.00 to $132.00 and gave the company an "outperform" rating in a research note on Friday, October 4th. Five analysts have rated the stock with a hold rating, one has issued a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $116.83.

View Our Latest Research Report on CBRE Group

Insider Transactions at CBRE Group

In other news, CFO Emma E. Giamartino sold 1,815 shares of CBRE Group stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $131.34, for a total value of $238,382.10. Following the sale, the chief financial officer now directly owns 70,154 shares of the company's stock, valued at approximately $9,214,026.36. The trade was a 2.52 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Daniel G. Queenan sold 10,000 shares of the stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $114.67, for a total value of $1,146,700.00. Following the transaction, the chief executive officer now directly owns 217,094 shares of the company's stock, valued at approximately $24,894,168.98. The trade was a 4.40 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 0.54% of the company's stock.

CBRE Group Stock Down 0.3 %

CBRE stock traded down $0.40 during midday trading on Wednesday, hitting $131.76. The stock had a trading volume of 335,354 shares, compared to its average volume of 1,663,441. The company has a debt-to-equity ratio of 0.34, a current ratio of 1.13 and a quick ratio of 1.13. The firm has a market cap of $40.32 billion, a price-to-earnings ratio of 42.50 and a beta of 1.39. The business has a 50-day moving average of $125.92 and a two-hundred day moving average of $107.82. CBRE Group, Inc. has a 52-week low of $76.63 and a 52-week high of $137.93.

CBRE Group (NYSE:CBRE - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The financial services provider reported $1.20 EPS for the quarter, beating the consensus estimate of $1.06 by $0.14. The company had revenue of $9.04 billion for the quarter, compared to the consensus estimate of $8.80 billion. CBRE Group had a net margin of 2.79% and a return on equity of 13.91%. CBRE Group's revenue for the quarter was up 14.8% on a year-over-year basis. During the same period in the prior year, the firm posted $0.72 EPS. As a group, equities research analysts forecast that CBRE Group, Inc. will post 4.94 earnings per share for the current fiscal year.

CBRE Group Profile

(

Free Report)

CBRE Group, Inc operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally. The Advisory Services segment offers strategic advice and execution to owners, investors, and occupiers of real estate in connection with leasing of offices, and industrial and retail space; clients fully integrated property sales services under the CBRE Capital Markets brand; clients commercial mortgage and structured financing services; originates and sells commercial mortgage loans; property management services, such as marketing, building engineering, accounting, and financial services on a contractual basis for owners of and investors in office, industrial, and retail properties; and valuation services that include market value appraisals, litigation support, discounted cash flow analyses, and feasibility studies, as well as consulting services, such as property condition reports, hotel advisory, and environmental consulting.

Further Reading

Before you consider CBRE Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CBRE Group wasn't on the list.

While CBRE Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.