Premier Fund Managers Ltd grew its position in Rollins, Inc. (NYSE:ROL - Free Report) by 8.3% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,300,000 shares of the business services provider's stock after acquiring an additional 100,000 shares during the period. Rollins comprises 2.3% of Premier Fund Managers Ltd's portfolio, making the stock its 10th largest holding. Premier Fund Managers Ltd owned 0.27% of Rollins worth $64,929,000 at the end of the most recent quarter.

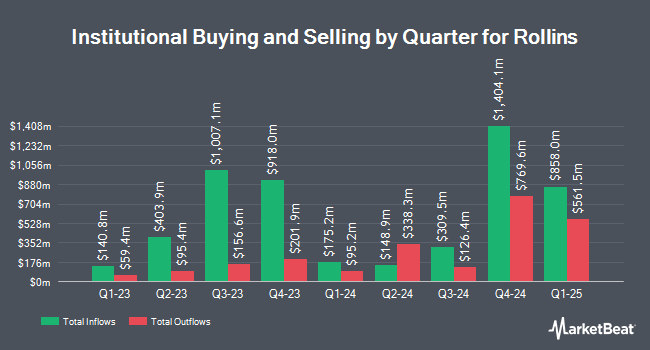

Other large investors have also recently added to or reduced their stakes in the company. Fiera Capital Corp purchased a new stake in Rollins in the 3rd quarter valued at approximately $43,225,000. Cetera Investment Advisers increased its position in Rollins by 4,697.4% during the 1st quarter. Cetera Investment Advisers now owns 324,109 shares of the business services provider's stock worth $14,997,000 after purchasing an additional 317,353 shares in the last quarter. DekaBank Deutsche Girozentrale raised its stake in Rollins by 350.8% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 368,521 shares of the business services provider's stock valued at $17,118,000 after purchasing an additional 286,780 shares during the last quarter. Manning & Napier Advisors LLC purchased a new position in Rollins in the 2nd quarter valued at about $13,580,000. Finally, Assenagon Asset Management S.A. boosted its stake in shares of Rollins by 185.0% during the 2nd quarter. Assenagon Asset Management S.A. now owns 384,935 shares of the business services provider's stock worth $18,781,000 after purchasing an additional 249,860 shares during the last quarter. 51.79% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several analysts have commented on the stock. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $52.00 target price on shares of Rollins in a research note on Thursday, July 25th. Barclays began coverage on Rollins in a research report on Monday, November 4th. They set an "equal weight" rating and a $50.00 target price on the stock. Wells Fargo & Company lifted their price target on Rollins from $54.00 to $56.00 and gave the company an "overweight" rating in a report on Tuesday, October 15th. Finally, StockNews.com lowered shares of Rollins from a "buy" rating to a "hold" rating in a report on Thursday, October 24th. Four research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat.com, Rollins presently has an average rating of "Hold" and an average target price of $49.83.

Read Our Latest Research Report on ROL

Rollins Price Performance

Shares of NYSE ROL traded down $0.44 during midday trading on Wednesday, reaching $49.07. The company's stock had a trading volume of 169,252 shares, compared to its average volume of 1,699,815. The company has a market cap of $23.76 billion, a price-to-earnings ratio of 51.56 and a beta of 0.70. Rollins, Inc. has a one year low of $39.62 and a one year high of $52.16. The company has a current ratio of 0.78, a quick ratio of 0.72 and a debt-to-equity ratio of 0.34. The company has a 50 day moving average price of $49.54 and a 200 day moving average price of $48.79.

Rollins (NYSE:ROL - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The business services provider reported $0.29 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.30 by ($0.01). The company had revenue of $916.27 million during the quarter, compared to analyst estimates of $911.15 million. Rollins had a return on equity of 38.67% and a net margin of 14.18%. The business's revenue was up 9.0% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.28 earnings per share. On average, equities research analysts expect that Rollins, Inc. will post 0.99 EPS for the current year.

Rollins Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Tuesday, November 12th will be issued a dividend of $0.165 per share. This represents a $0.66 annualized dividend and a yield of 1.35%. The ex-dividend date is Tuesday, November 12th. This is an increase from Rollins's previous quarterly dividend of $0.15. Rollins's payout ratio is presently 68.75%.

Insider Buying and Selling at Rollins

In other news, insider Elizabeth B. Chandler sold 4,685 shares of the stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $50.74, for a total transaction of $237,716.90. Following the transaction, the insider now owns 89,338 shares in the company, valued at $4,533,010.12. This represents a 4.98 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, major shareholder Timothy Curtis Rollins sold 14,750 shares of the firm's stock in a transaction dated Friday, November 15th. The shares were sold at an average price of $49.88, for a total value of $735,730.00. Following the transaction, the insider now owns 124,214 shares in the company, valued at approximately $6,195,794.32. This trade represents a 10.61 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 24,120 shares of company stock valued at $1,209,993. 4.69% of the stock is currently owned by corporate insiders.

Rollins Profile

(

Free Report)

Rollins, Inc, through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally. The company offers pest control services to residential properties protecting from common pests, including rodents, insects, and wildlife.

Further Reading

Before you consider Rollins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rollins wasn't on the list.

While Rollins currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.