Premier Fund Managers Ltd bought a new stake in shares of Edwards Lifesciences Co. (NYSE:EW - Free Report) in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 176,738 shares of the medical research company's stock, valued at approximately $11,763,000.

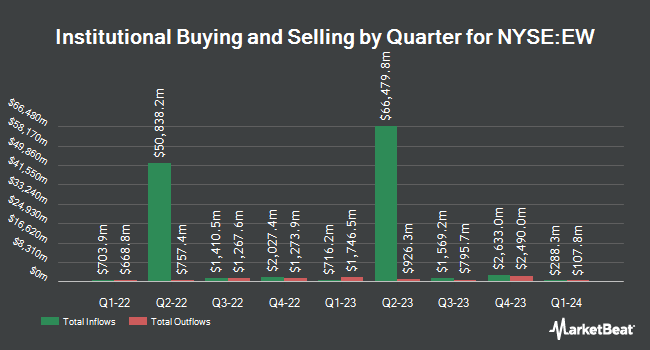

A number of other hedge funds have also recently made changes to their positions in the stock. Crewe Advisors LLC bought a new stake in Edwards Lifesciences in the first quarter worth $28,000. First Community Trust NA bought a new stake in Edwards Lifesciences during the 2nd quarter valued at about $29,000. Avior Wealth Management LLC lifted its stake in shares of Edwards Lifesciences by 138.7% in the third quarter. Avior Wealth Management LLC now owns 530 shares of the medical research company's stock worth $35,000 after buying an additional 308 shares in the last quarter. Webster Bank N. A. purchased a new stake in shares of Edwards Lifesciences during the second quarter valued at approximately $39,000. Finally, Peoples Bank KS bought a new stake in shares of Edwards Lifesciences during the third quarter valued at approximately $40,000. 79.46% of the stock is owned by institutional investors.

Insider Buying and Selling at Edwards Lifesciences

In related news, insider Larry L. Wood sold 25,000 shares of Edwards Lifesciences stock in a transaction dated Tuesday, November 5th. The stock was sold at an average price of $65.91, for a total value of $1,647,750.00. Following the completion of the transaction, the insider now owns 198,526 shares in the company, valued at approximately $13,084,848.66. This trade represents a 11.18 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, VP Donald E. Bobo, Jr. sold 5,000 shares of the firm's stock in a transaction that occurred on Wednesday, November 13th. The shares were sold at an average price of $65.57, for a total value of $327,850.00. Following the completion of the sale, the vice president now directly owns 46,936 shares of the company's stock, valued at $3,077,593.52. The trade was a 9.63 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 40,000 shares of company stock worth $2,657,000 in the last quarter. 1.27% of the stock is owned by corporate insiders.

Analyst Ratings Changes

Several analysts have commented on the company. Baird R W downgraded Edwards Lifesciences from a "strong-buy" rating to a "hold" rating in a research note on Thursday, July 25th. Daiwa America downgraded Edwards Lifesciences from a "strong-buy" rating to a "hold" rating in a report on Wednesday, October 30th. Bank of America cut shares of Edwards Lifesciences from a "buy" rating to a "neutral" rating and lowered their target price for the company from $105.00 to $75.00 in a research note on Thursday, July 25th. Truist Financial reduced their price target on shares of Edwards Lifesciences from $71.00 to $70.00 and set a "hold" rating for the company in a research note on Friday, October 25th. Finally, Piper Sandler lowered their price objective on shares of Edwards Lifesciences from $73.00 to $70.00 and set a "neutral" rating on the stock in a research report on Friday, October 25th. Seventeen analysts have rated the stock with a hold rating and ten have given a buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $75.67.

Get Our Latest Stock Analysis on Edwards Lifesciences

Edwards Lifesciences Trading Up 0.4 %

Shares of EW stock opened at $70.20 on Wednesday. The firm has a market capitalization of $41.40 billion, a PE ratio of 10.13, a PEG ratio of 3.81 and a beta of 1.12. The company has a debt-to-equity ratio of 0.06, a quick ratio of 2.89 and a current ratio of 3.46. The stock has a fifty day simple moving average of $67.59 and a two-hundred day simple moving average of $75.91. Edwards Lifesciences Co. has a 52-week low of $58.93 and a 52-week high of $96.12.

Edwards Lifesciences (NYSE:EW - Get Free Report) last issued its earnings results on Thursday, October 24th. The medical research company reported $0.67 earnings per share for the quarter, hitting analysts' consensus estimates of $0.67. The firm had revenue of $1.35 billion during the quarter, compared to analyst estimates of $1.57 billion. Edwards Lifesciences had a net margin of 70.82% and a return on equity of 20.76%. Edwards Lifesciences's revenue for the quarter was up 8.9% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.59 earnings per share. On average, analysts predict that Edwards Lifesciences Co. will post 2.57 EPS for the current fiscal year.

Edwards Lifesciences Profile

(

Free Report)

Edwards Lifesciences Corporation provides products and technologies for structural heart disease and critical care monitoring in the United States, Europe, Japan, and internationally. It offers transcatheter heart valve replacement products for the minimally invasive replacement of aortic heart valves under the Edwards SAPIEN family of valves system; and transcatheter heart valve repair and replacement products to treat mitral and tricuspid valve diseases under the PASCAL PRECISION and Cardioband names.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Edwards Lifesciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Edwards Lifesciences wasn't on the list.

While Edwards Lifesciences currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.