Premier Fund Managers Ltd reduced its position in Merit Medical Systems, Inc. (NASDAQ:MMSI - Free Report) by 95.1% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 461 shares of the medical instruments supplier's stock after selling 8,980 shares during the quarter. Premier Fund Managers Ltd's holdings in Merit Medical Systems were worth $44,000 at the end of the most recent quarter.

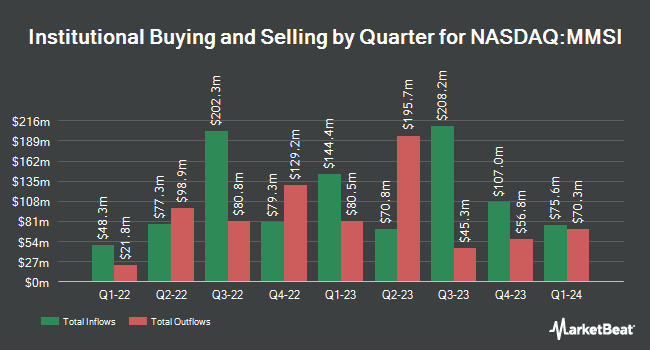

Several other hedge funds and other institutional investors also recently made changes to their positions in MMSI. Pictet Asset Management Holding SA boosted its holdings in shares of Merit Medical Systems by 13.8% during the 4th quarter. Pictet Asset Management Holding SA now owns 8,675 shares of the medical instruments supplier's stock valued at $839,000 after acquiring an additional 1,049 shares in the last quarter. New Age Alpha Advisors LLC bought a new position in Merit Medical Systems in the fourth quarter valued at about $414,000. Norges Bank acquired a new stake in shares of Merit Medical Systems during the fourth quarter valued at about $66,638,000. Zions Bancorporation N.A. grew its holdings in shares of Merit Medical Systems by 19.8% during the fourth quarter. Zions Bancorporation N.A. now owns 44,428 shares of the medical instruments supplier's stock worth $4,297,000 after purchasing an additional 7,358 shares during the last quarter. Finally, EntryPoint Capital LLC acquired a new position in shares of Merit Medical Systems in the fourth quarter valued at approximately $396,000. 99.66% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

MMSI has been the topic of a number of research reports. Barrington Research reduced their target price on shares of Merit Medical Systems from $115.00 to $111.00 and set an "outperform" rating on the stock in a report on Wednesday, February 26th. Piper Sandler reissued an "overweight" rating and issued a $116.00 price objective (up previously from $114.00) on shares of Merit Medical Systems in a research note on Wednesday, January 29th. Wells Fargo & Company lowered their target price on Merit Medical Systems from $120.00 to $117.00 and set an "overweight" rating for the company in a research report on Wednesday, February 26th. JPMorgan Chase & Co. started coverage on Merit Medical Systems in a research report on Friday, March 28th. They issued an "overweight" rating and a $120.00 price target on the stock. Finally, Needham & Company LLC lowered their price objective on Merit Medical Systems from $122.00 to $116.00 and set a "buy" rating for the company in a research report on Wednesday, February 26th. Two analysts have rated the stock with a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, Merit Medical Systems currently has an average rating of "Moderate Buy" and a consensus price target of $111.70.

Read Our Latest Analysis on MMSI

Merit Medical Systems Trading Up 1.0 %

Shares of MMSI stock traded up $1.10 during trading hours on Wednesday, hitting $106.55. 116,015 shares of the company were exchanged, compared to its average volume of 452,296. The company has a debt-to-equity ratio of 0.57, a quick ratio of 3.82 and a current ratio of 5.36. Merit Medical Systems, Inc. has a fifty-two week low of $70.70 and a fifty-two week high of $111.45. The company has a 50 day simple moving average of $104.38 and a two-hundred day simple moving average of $101.20. The firm has a market cap of $6.27 billion, a P/E ratio of 52.23, a P/E/G ratio of 2.34 and a beta of 0.91.

Insiders Place Their Bets

In other news, Director Stephen C. Evans sold 5,000 shares of the firm's stock in a transaction dated Monday, March 3rd. The stock was sold at an average price of $105.31, for a total value of $526,550.00. Following the completion of the sale, the director now directly owns 4,657 shares in the company, valued at $490,428.67. This trade represents a 51.78 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. Also, CEO Fred P. Lampropoulos sold 31,320 shares of the company's stock in a transaction that occurred on Wednesday, March 5th. The stock was sold at an average price of $103.86, for a total value of $3,252,895.20. Following the transaction, the chief executive officer now directly owns 1,086,028 shares in the company, valued at approximately $112,794,868.08. This trade represents a 2.80 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 109,132 shares of company stock worth $11,139,521. 3.70% of the stock is currently owned by company insiders.

Merit Medical Systems Company Profile

(

Free Report)

Merit Medical Systems, Inc designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally. It operates in two segments, Cardiovascular and Endoscopy. The company provides micropuncture kits, angiographic needles, sheaths, guide wires, and safety products; peripheral intervention, including angiography, drainage, delivery systems, and embolotherapy products; spine products, such as vertebral augmentation, radiofrequency ablation, and bone biopsy systems; oncology products; and cardiac intervention products, such as access, angiography, electrophysiology and cardiac rhythm management, fluid management, hemodynamic monitoring, hemostasis, and intervention to treat various heart conditions.

Featured Articles

Before you consider Merit Medical Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merit Medical Systems wasn't on the list.

While Merit Medical Systems currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.