Prescott Group Capital Management L.L.C. decreased its position in shares of JD.com, Inc. (NASDAQ:JD - Free Report) by 79.5% in the 4th quarter, according to its most recent 13F filing with the SEC. The firm owned 20,000 shares of the information services provider's stock after selling 77,416 shares during the quarter. Prescott Group Capital Management L.L.C.'s holdings in JD.com were worth $693,000 at the end of the most recent quarter.

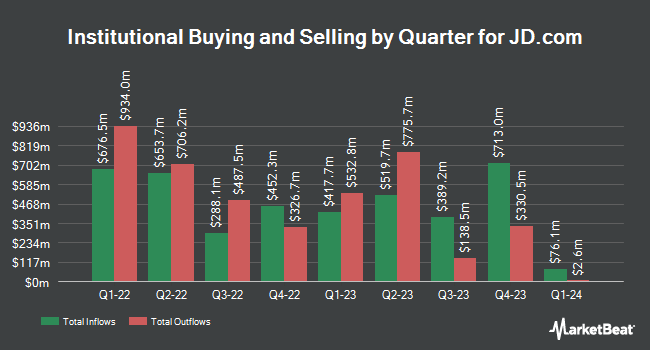

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. FMR LLC lifted its position in JD.com by 41.0% during the third quarter. FMR LLC now owns 15,276,992 shares of the information services provider's stock valued at $611,080,000 after purchasing an additional 4,445,277 shares during the last quarter. Two Sigma Advisers LP raised its holdings in JD.com by 329.9% during the 3rd quarter. Two Sigma Advisers LP now owns 6,306,700 shares of the information services provider's stock valued at $252,268,000 after buying an additional 4,839,700 shares during the last quarter. Fisher Asset Management LLC raised its stake in shares of JD.com by 9.0% during the third quarter. Fisher Asset Management LLC now owns 4,072,599 shares of the information services provider's stock valued at $162,904,000 after acquiring an additional 336,740 shares during the last quarter. Point72 Asset Management L.P. grew its stake in shares of JD.com by 117.1% in the third quarter. Point72 Asset Management L.P. now owns 4,033,900 shares of the information services provider's stock worth $161,356,000 after purchasing an additional 2,175,568 shares during the last quarter. Finally, Maple Rock Capital Partners Inc. increased its holdings in JD.com by 5.9% during the 3rd quarter. Maple Rock Capital Partners Inc. now owns 3,577,138 shares of the information services provider's stock valued at $143,086,000 after purchasing an additional 200,200 shares during the period. Institutional investors own 15.98% of the company's stock.

Wall Street Analyst Weigh In

JD has been the topic of several research analyst reports. JPMorgan Chase & Co. boosted their target price on JD.com from $50.00 to $55.00 and gave the company an "overweight" rating in a research note on Friday. Benchmark boosted their price objective on shares of JD.com from $47.00 to $58.00 and gave the company a "buy" rating in a research report on Friday. Mizuho raised their target price on shares of JD.com from $43.00 to $50.00 and gave the stock an "outperform" rating in a research report on Friday. Citigroup cut their target price on shares of JD.com from $52.00 to $51.00 and set a "buy" rating on the stock in a research note on Friday, November 15th. Finally, Barclays increased their price target on shares of JD.com from $50.00 to $55.00 and gave the stock an "overweight" rating in a research note on Friday, February 28th. Two research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $44.43.

View Our Latest Stock Report on JD

JD.com Stock Up 0.3 %

Shares of NASDAQ JD traded up $0.11 during trading on Tuesday, reaching $40.75. The company had a trading volume of 13,285,430 shares, compared to its average volume of 13,623,484. The business's 50-day moving average is $39.12 and its 200 day moving average is $36.95. The company has a quick ratio of 0.90, a current ratio of 1.17 and a debt-to-equity ratio of 0.18. The stock has a market cap of $64.27 billion, a PE ratio of 12.90, a P/E/G ratio of 0.31 and a beta of 0.43. JD.com, Inc. has a 12-month low of $24.13 and a 12-month high of $47.82.

JD.com Increases Dividend

The company also recently disclosed an annual dividend, which will be paid on Tuesday, April 29th. Shareholders of record on Tuesday, April 8th will be paid a dividend of $0.76 per share. This is a positive change from JD.com's previous annual dividend of $0.74. This represents a yield of 1.7%. The ex-dividend date is Tuesday, April 8th. JD.com's dividend payout ratio (DPR) is currently 19.73%.

About JD.com

(

Free Report)

JD.com, Inc operates as a supply chain-based technology and service provider in the People's Republic of China. The company offers computers, communication, and consumer electronics products, as well as home appliances; and general merchandise products comprising food, beverage and fresh produce, baby and maternity products, furniture and household goods, cosmetics and other personal care items, pharmaceutical and healthcare products, industrial products, books, automobile accessories, apparel and footwear, bags, and jewelry.

See Also

Before you consider JD.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JD.com wasn't on the list.

While JD.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.