American Century Companies Inc. lifted its holdings in shares of PriceSmart, Inc. (NASDAQ:PSMT - Free Report) by 4.1% during the 4th quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 1,230,696 shares of the company's stock after acquiring an additional 48,108 shares during the period. American Century Companies Inc. owned 4.01% of PriceSmart worth $113,434,000 at the end of the most recent reporting period.

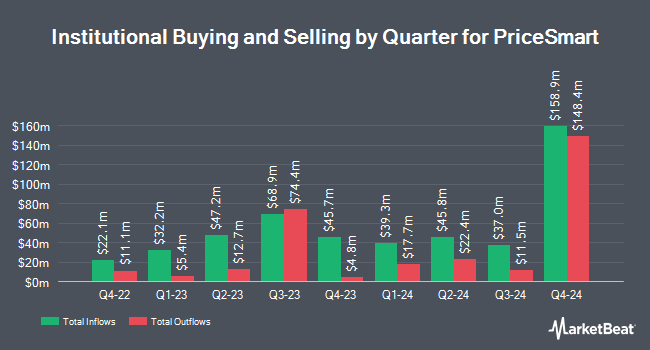

Several other institutional investors have also recently added to or reduced their stakes in PSMT. Personal CFO Solutions LLC raised its holdings in PriceSmart by 4.8% during the fourth quarter. Personal CFO Solutions LLC now owns 3,036 shares of the company's stock worth $280,000 after purchasing an additional 140 shares in the last quarter. US Bancorp DE raised its stake in PriceSmart by 4.6% during the 4th quarter. US Bancorp DE now owns 3,614 shares of the company's stock worth $333,000 after acquiring an additional 160 shares in the last quarter. Blue Trust Inc. lifted its position in PriceSmart by 22.8% in the fourth quarter. Blue Trust Inc. now owns 1,278 shares of the company's stock valued at $117,000 after acquiring an additional 237 shares during the last quarter. Atria Investments Inc lifted its position in PriceSmart by 11.4% in the fourth quarter. Atria Investments Inc now owns 2,488 shares of the company's stock valued at $229,000 after acquiring an additional 254 shares during the last quarter. Finally, Swiss National Bank boosted its stake in PriceSmart by 0.6% in the fourth quarter. Swiss National Bank now owns 51,200 shares of the company's stock valued at $4,719,000 after acquiring an additional 300 shares in the last quarter. Hedge funds and other institutional investors own 80.46% of the company's stock.

PriceSmart Stock Performance

Shares of PSMT traded up $0.80 during mid-day trading on Thursday, reaching $86.72. 149,689 shares of the company's stock were exchanged, compared to its average volume of 170,294. The business's fifty day simple moving average is $89.02 and its 200-day simple moving average is $90.15. The stock has a market capitalization of $2.66 billion, a PE ratio of 19.10 and a beta of 0.84. PriceSmart, Inc. has a 52-week low of $77.51 and a 52-week high of $99.23. The company has a debt-to-equity ratio of 0.08, a current ratio of 1.26 and a quick ratio of 0.43.

PriceSmart (NASDAQ:PSMT - Get Free Report) last issued its quarterly earnings data on Wednesday, January 8th. The company reported $1.21 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.43 by ($0.22). PriceSmart had a return on equity of 12.29% and a net margin of 2.76%. The business had revenue of $1.26 billion for the quarter, compared to analysts' expectations of $1.24 billion. During the same period in the previous year, the business posted $1.24 earnings per share. The company's revenue for the quarter was up 7.8% on a year-over-year basis. On average, equities research analysts expect that PriceSmart, Inc. will post 5.28 earnings per share for the current year.

PriceSmart Dividend Announcement

The business also recently declared a dividend, which was paid on Friday, February 28th. Investors of record on Tuesday, February 18th were given a $0.63 dividend. The ex-dividend date of this dividend was Tuesday, February 18th. PriceSmart's dividend payout ratio (DPR) is presently 27.75%.

Insider Buying and Selling at PriceSmart

In other PriceSmart news, COO John D. Hildebrandt sold 8,020 shares of the business's stock in a transaction on Thursday, January 23rd. The shares were sold at an average price of $90.51, for a total value of $725,890.20. Following the transaction, the chief operating officer now directly owns 123,547 shares of the company's stock, valued at approximately $11,182,238.97. The trade was a 6.10 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, Director Gordon H. Hanson sold 1,107 shares of the firm's stock in a transaction on Wednesday, January 15th. The stock was sold at an average price of $87.22, for a total transaction of $96,552.54. Following the completion of the sale, the director now owns 6,862 shares of the company's stock, valued at $598,503.64. This trade represents a 13.89 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 21,162 shares of company stock valued at $1,930,402 in the last ninety days. Insiders own 17.10% of the company's stock.

Wall Street Analyst Weigh In

Separately, StockNews.com raised PriceSmart from a "hold" rating to a "buy" rating in a report on Monday, March 10th.

Check Out Our Latest Stock Analysis on PSMT

PriceSmart Profile

(

Free Report)

PriceSmart, Inc owns and operates U.S.-style membership shopping warehouse clubs in the United States, Central America, the Caribbean, and Colombia. The company provides basic and private label consumer products under the Member's Selection brand, including groceries, cleaning supplies, health and beauty aids, meat, produce, deli, seafood, and poultry.

Featured Stories

Before you consider PriceSmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PriceSmart wasn't on the list.

While PriceSmart currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.