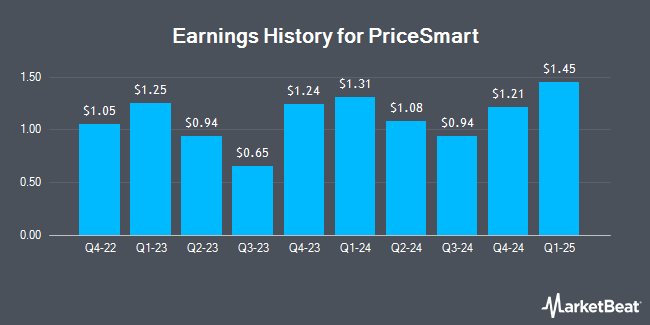

PriceSmart (NASDAQ:PSMT - Get Free Report) released its quarterly earnings results on Wednesday. The company reported $1.21 earnings per share for the quarter, missing the consensus estimate of $1.43 by ($0.22), Zacks reports. PriceSmart had a net margin of 2.83% and a return on equity of 12.63%. The company had revenue of $1.26 billion during the quarter, compared to analyst estimates of $1.24 billion. During the same quarter last year, the company earned $1.24 EPS. The firm's quarterly revenue was up 7.8% compared to the same quarter last year.

PriceSmart Stock Up 1.3 %

Shares of NASDAQ PSMT traded up $1.23 during midday trading on Wednesday, reaching $93.45. The company's stock had a trading volume of 402,193 shares, compared to its average volume of 218,872. The stock has a 50 day simple moving average of $91.18 and a 200-day simple moving average of $88.58. The company has a current ratio of 1.22, a quick ratio of 0.45 and a debt-to-equity ratio of 0.08. The stock has a market capitalization of $2.87 billion, a price-to-earnings ratio of 20.45 and a beta of 0.86. PriceSmart has a fifty-two week low of $72.30 and a fifty-two week high of $99.23.

Analysts Set New Price Targets

Separately, StockNews.com upgraded PriceSmart from a "hold" rating to a "buy" rating in a report on Saturday, November 30th.

Check Out Our Latest Stock Analysis on PSMT

Insider Buying and Selling

In other news, EVP Paul Kovaleski sold 3,235 shares of the company's stock in a transaction that occurred on Wednesday, November 13th. The stock was sold at an average price of $89.96, for a total transaction of $291,020.60. Following the sale, the executive vice president now owns 44,309 shares in the company, valued at $3,986,037.64. This represents a 6.80 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this link. Also, CFO Michael Mccleary sold 4,000 shares of the firm's stock in a transaction on Tuesday, November 12th. The shares were sold at an average price of $89.62, for a total transaction of $358,480.00. Following the completion of the transaction, the chief financial officer now directly owns 62,141 shares of the company's stock, valued at $5,569,076.42. This represents a 6.05 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 16,290 shares of company stock worth $1,476,009. 17.10% of the stock is owned by insiders.

PriceSmart Company Profile

(

Get Free Report)

PriceSmart, Inc owns and operates U.S.-style membership shopping warehouse clubs in the United States, Central America, the Caribbean, and Colombia. The company provides basic and private label consumer products under the Member's Selection brand, including groceries, cleaning supplies, health and beauty aids, meat, produce, deli, seafood, and poultry.

Featured Articles

Before you consider PriceSmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PriceSmart wasn't on the list.

While PriceSmart currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.