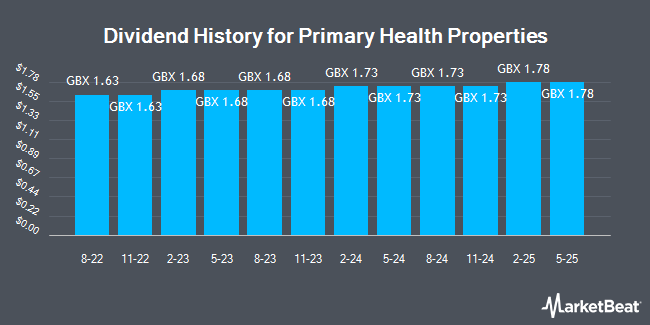

Primary Health Properties Plc (LON:PHP - Get Free Report) declared a dividend on Tuesday, March 11th, DividendData.Co.Uk reports. Stockholders of record on Thursday, March 27th will be paid a dividend of GBX 1.78 ($0.02) per share by the real estate investment trust on Friday, May 9th. This represents a dividend yield of 1.85%. The ex-dividend date is Thursday, March 27th. The official announcement can be accessed at this link.

Primary Health Properties Trading Up 1.4 %

Shares of LON PHP traded up GBX 1.35 ($0.02) during trading hours on Friday, reaching GBX 94.60 ($1.22). The stock had a trading volume of 5,607,732 shares, compared to its average volume of 7,669,358. Primary Health Properties has a 52-week low of GBX 85.40 ($1.11) and a 52-week high of GBX 105.50 ($1.37). The firm has a market cap of £1.27 billion, a price-to-earnings ratio of -147.67, a P/E/G ratio of 5.64 and a beta of 0.41. The business's fifty day moving average price is GBX 92.71 and its two-hundred day moving average price is GBX 94.59. The company has a current ratio of 0.50, a quick ratio of 0.62 and a debt-to-equity ratio of 96.73.

Primary Health Properties (LON:PHP - Get Free Report) last released its quarterly earnings data on Friday, February 28th. The real estate investment trust reported GBX 7 ($0.09) earnings per share for the quarter. Primary Health Properties had a negative net margin of 4.84% and a negative return on equity of 0.61%. Analysts expect that Primary Health Properties will post 7.0875912 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Separately, Jefferies Financial Group reissued a "buy" rating and set a GBX 105 ($1.36) price objective on shares of Primary Health Properties in a report on Monday, March 3rd.

View Our Latest Stock Report on Primary Health Properties

Insider Activity at Primary Health Properties

In other news, insider Harry Abraham Hyman bought 3,808 shares of the stock in a transaction on Friday, February 21st. The stock was bought at an average cost of GBX 93 ($1.20) per share, for a total transaction of £3,541.44 ($4,583.79). 2.81% of the stock is owned by corporate insiders.

Primary Health Properties Company Profile

(

Get Free Report)

Primary Health Properties plc is a leading investor in modern primary healthcare properties. The Company acquires or forward funds the development of modern, purpose-built premises that are leased to GP's, government healthcare bodies, pharmacies and other providers of related healthcare services.

Featured Stories

Before you consider Primary Health Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Primary Health Properties wasn't on the list.

While Primary Health Properties currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.