Prime Capital Investment Advisors LLC cut its stake in shares of Booking Holdings Inc. (NASDAQ:BKNG - Free Report) by 15.2% in the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 789 shares of the business services provider's stock after selling 141 shares during the quarter. Prime Capital Investment Advisors LLC's holdings in Booking were worth $3,324,000 as of its most recent filing with the SEC.

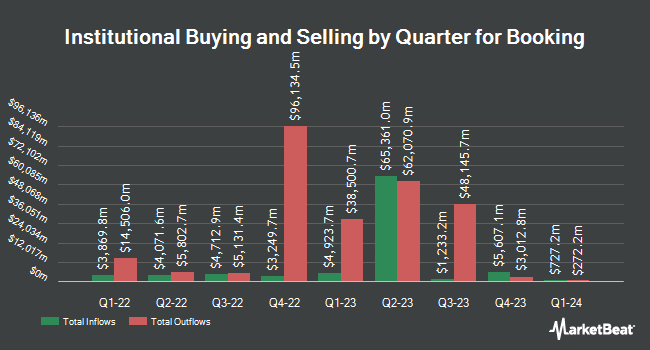

Other institutional investors and hedge funds also recently made changes to their positions in the company. Sheaff Brock Investment Advisors LLC increased its stake in shares of Booking by 0.8% in the first quarter. Sheaff Brock Investment Advisors LLC now owns 403 shares of the business services provider's stock valued at $1,461,000 after buying an additional 3 shares in the last quarter. CVA Family Office LLC raised its stake in shares of Booking by 8.1% in the second quarter. CVA Family Office LLC now owns 40 shares of the business services provider's stock worth $158,000 after acquiring an additional 3 shares during the last quarter. American National Bank lifted its position in shares of Booking by 3.7% during the second quarter. American National Bank now owns 84 shares of the business services provider's stock worth $333,000 after purchasing an additional 3 shares in the last quarter. First Horizon Advisors Inc. grew its stake in shares of Booking by 3.2% during the second quarter. First Horizon Advisors Inc. now owns 96 shares of the business services provider's stock valued at $380,000 after purchasing an additional 3 shares during the last quarter. Finally, Jacobsen Capital Management increased its holdings in shares of Booking by 1.6% in the second quarter. Jacobsen Capital Management now owns 191 shares of the business services provider's stock valued at $757,000 after purchasing an additional 3 shares in the last quarter. Institutional investors and hedge funds own 92.42% of the company's stock.

Booking Trading Down 0.3 %

Shares of NASDAQ BKNG traded down $14.54 during trading hours on Thursday, reaching $4,972.90. The stock had a trading volume of 166,250 shares, compared to its average volume of 247,833. Booking Holdings Inc. has a 52-week low of $3,079.50 and a 52-week high of $5,069.44. The business's fifty day moving average price is $4,311.61 and its two-hundred day moving average price is $3,966.44. The firm has a market cap of $164.60 billion, a price-to-earnings ratio of 33.84, a P/E/G ratio of 1.56 and a beta of 1.38.

Booking Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Friday, December 6th will be paid a dividend of $8.75 per share. The ex-dividend date is Friday, December 6th. This represents a $35.00 dividend on an annualized basis and a yield of 0.70%. Booking's payout ratio is 23.75%.

Analyst Upgrades and Downgrades

A number of research analysts have commented on the company. DA Davidson increased their price objective on Booking from $4,100.00 to $5,005.00 and gave the company a "buy" rating in a research report on Thursday, October 31st. Mizuho raised their price target on Booking from $4,800.00 to $5,400.00 and gave the stock an "outperform" rating in a research report on Tuesday, November 5th. Jefferies Financial Group increased their price target on Booking from $4,200.00 to $4,300.00 and gave the stock a "hold" rating in a report on Tuesday, October 22nd. Wedbush lifted their target price on Booking from $3,900.00 to $4,750.00 and gave the company an "outperform" rating in a research report on Friday, October 25th. Finally, Piper Sandler upped their price target on shares of Booking from $3,560.00 to $4,900.00 and gave the company a "neutral" rating in a research note on Thursday, October 31st. Ten investment analysts have rated the stock with a hold rating, twenty-two have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $4,749.83.

Read Our Latest Analysis on BKNG

Insider Transactions at Booking

In other news, insider Paulo Pisano sold 100 shares of the business's stock in a transaction dated Tuesday, August 27th. The shares were sold at an average price of $3,887.61, for a total transaction of $388,761.00. Following the transaction, the insider now owns 3,787 shares of the company's stock, valued at approximately $14,722,379.07. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Company insiders own 0.12% of the company's stock.

Booking Profile

(

Free Report)

Booking Holdings Inc, formerly The Priceline Group Inc, is a provider of travel and restaurant online reservation and related services. The Company, through its online travel companies (OTCs), connects consumers wishing to make travel reservations with providers of travel services across the world. It offers consumers an array of accommodation reservations (including hotels, bed and breakfasts, hostels, apartments, vacation rentals and other properties) through its Booking.com, priceline.com and agoda.com brands.

Further Reading

Before you consider Booking, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Booking wasn't on the list.

While Booking currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.