Prime Capital Investment Advisors LLC reduced its stake in shares of Devon Energy Co. (NYSE:DVN - Free Report) by 8.4% during the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 159,489 shares of the energy company's stock after selling 14,616 shares during the period. Prime Capital Investment Advisors LLC's holdings in Devon Energy were worth $6,239,000 as of its most recent filing with the SEC.

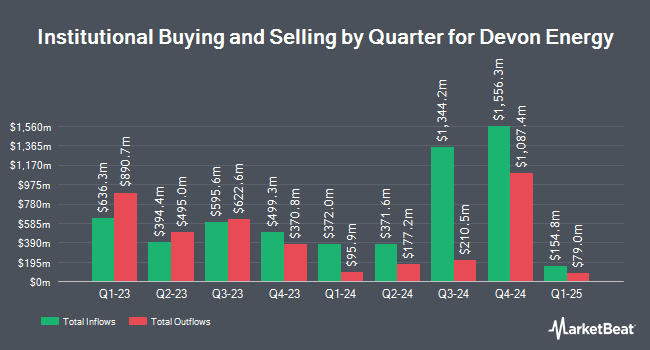

A number of other institutional investors have also recently bought and sold shares of the stock. Sei Investments Co. lifted its position in shares of Devon Energy by 3.6% in the first quarter. Sei Investments Co. now owns 228,499 shares of the energy company's stock worth $11,462,000 after purchasing an additional 7,931 shares in the last quarter. NorthRock Partners LLC bought a new position in shares of Devon Energy in the 1st quarter valued at about $230,000. Russell Investments Group Ltd. increased its position in shares of Devon Energy by 62.3% in the first quarter. Russell Investments Group Ltd. now owns 701,950 shares of the energy company's stock valued at $35,222,000 after acquiring an additional 269,319 shares during the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. boosted its position in Devon Energy by 28.3% during the first quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 22,975 shares of the energy company's stock valued at $1,153,000 after purchasing an additional 5,074 shares during the last quarter. Finally, State Board of Administration of Florida Retirement System grew its stake in Devon Energy by 5.7% in the first quarter. State Board of Administration of Florida Retirement System now owns 796,732 shares of the energy company's stock valued at $40,323,000 after purchasing an additional 43,263 shares in the last quarter. Institutional investors own 69.72% of the company's stock.

Devon Energy Price Performance

Shares of NYSE DVN traded up $0.76 during mid-day trading on Wednesday, reaching $39.10. The company had a trading volume of 8,313,337 shares, compared to its average volume of 7,445,225. Devon Energy Co. has a one year low of $37.76 and a one year high of $55.09. The business's 50-day simple moving average is $40.27 and its 200 day simple moving average is $44.59. The company has a debt-to-equity ratio of 0.61, a quick ratio of 1.01 and a current ratio of 1.11. The firm has a market cap of $25.68 billion, a price-to-earnings ratio of 7.19, a PEG ratio of 1.19 and a beta of 2.03.

Devon Energy (NYSE:DVN - Get Free Report) last issued its earnings results on Tuesday, November 5th. The energy company reported $1.10 EPS for the quarter, beating the consensus estimate of $1.09 by $0.01. The company had revenue of $4.02 billion during the quarter, compared to analysts' expectations of $3.72 billion. Devon Energy had a net margin of 21.71% and a return on equity of 24.73%. The business's revenue for the quarter was up 4.9% compared to the same quarter last year. During the same period in the previous year, the company earned $1.65 EPS. On average, research analysts predict that Devon Energy Co. will post 4.86 earnings per share for the current fiscal year.

Devon Energy Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 30th. Shareholders of record on Friday, December 13th will be issued a $0.22 dividend. This represents a $0.88 dividend on an annualized basis and a dividend yield of 2.25%. The ex-dividend date of this dividend is Friday, December 13th. Devon Energy's dividend payout ratio is presently 16.33%.

Analyst Ratings Changes

A number of brokerages recently weighed in on DVN. TD Cowen lowered their target price on shares of Devon Energy from $54.00 to $46.00 and set a "hold" rating on the stock in a report on Tuesday, November 5th. Jefferies Financial Group initiated coverage on shares of Devon Energy in a report on Thursday, October 3rd. They issued a "hold" rating and a $45.00 target price on the stock. BMO Capital Markets reduced their price target on Devon Energy from $52.00 to $48.00 and set an "outperform" rating for the company in a report on Friday, October 4th. Piper Sandler dropped their price objective on Devon Energy from $57.00 to $56.00 and set an "overweight" rating on the stock in a research note on Tuesday, October 15th. Finally, JPMorgan Chase & Co. reduced their target price on Devon Energy from $64.00 to $51.00 and set an "overweight" rating for the company in a research note on Thursday, September 12th. One analyst has rated the stock with a sell rating, ten have given a hold rating and twelve have assigned a buy rating to the stock. According to MarketBeat, the company has an average rating of "Hold" and an average price target of $51.80.

Get Our Latest Stock Analysis on DVN

About Devon Energy

(

Free Report)

Devon Energy Corporation, an independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States. It operates in Delaware, Eagle Ford, Anadarko, Williston, and Powder River Basins. The company was founded in 1971 and is headquartered in Oklahoma City, Oklahoma.

See Also

Before you consider Devon Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Devon Energy wasn't on the list.

While Devon Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.