Prime Capital Investment Advisors LLC lowered its stake in shares of Biogen Inc. (NASDAQ:BIIB - Free Report) by 50.6% in the third quarter, according to its most recent 13F filing with the SEC. The fund owned 5,079 shares of the biotechnology company's stock after selling 5,201 shares during the period. Prime Capital Investment Advisors LLC's holdings in Biogen were worth $984,000 as of its most recent SEC filing.

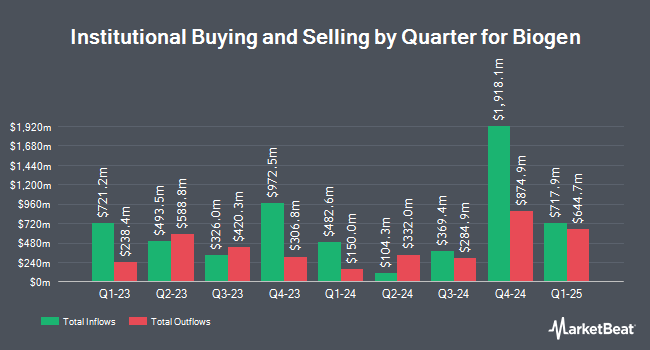

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the stock. Plato Investment Management Ltd lifted its position in shares of Biogen by 82.8% during the first quarter. Plato Investment Management Ltd now owns 117 shares of the biotechnology company's stock valued at $25,000 after purchasing an additional 53 shares in the last quarter. Itau Unibanco Holding S.A. bought a new position in shares of Biogen during the 2nd quarter worth approximately $33,000. Ashton Thomas Securities LLC bought a new position in shares of Biogen during the 3rd quarter worth approximately $33,000. EntryPoint Capital LLC purchased a new position in shares of Biogen in the 1st quarter worth approximately $36,000. Finally, Versant Capital Management Inc grew its holdings in shares of Biogen by 123.2% in the second quarter. Versant Capital Management Inc now owns 154 shares of the biotechnology company's stock valued at $36,000 after acquiring an additional 85 shares in the last quarter. 87.93% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several research analysts have weighed in on BIIB shares. StockNews.com raised Biogen from a "buy" rating to a "strong-buy" rating in a research report on Monday, September 2nd. Wells Fargo & Company dropped their target price on shares of Biogen from $240.00 to $225.00 and set an "equal weight" rating on the stock in a research note on Friday, August 2nd. Citigroup started coverage on shares of Biogen in a research report on Thursday. They set a "neutral" rating and a $190.00 target price for the company. Scotiabank reduced their price objective on Biogen from $275.00 to $244.00 and set a "sector outperform" rating for the company in a report on Friday, August 2nd. Finally, Needham & Company LLC restated a "buy" rating and issued a $270.00 target price on shares of Biogen in a research note on Wednesday, October 30th. Twelve analysts have rated the stock with a hold rating, sixteen have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $258.96.

Check Out Our Latest Stock Report on Biogen

Insider Transactions at Biogen

In other news, insider Priya Singhal sold 431 shares of the company's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $204.22, for a total value of $88,018.82. Following the completion of the transaction, the insider now directly owns 5,316 shares in the company, valued at approximately $1,085,633.52. This represents a 7.50 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Insiders own 0.16% of the company's stock.

Biogen Price Performance

NASDAQ BIIB traded down $4.90 during trading on Friday, reaching $159.99. The company's stock had a trading volume of 1,916,718 shares, compared to its average volume of 1,169,550. The firm has a fifty day moving average of $186.80 and a 200 day moving average of $207.77. Biogen Inc. has a one year low of $159.60 and a one year high of $268.30. The stock has a market capitalization of $23.31 billion, a PE ratio of 14.78, a P/E/G ratio of 1.57 and a beta of -0.06. The company has a debt-to-equity ratio of 0.28, a current ratio of 1.26 and a quick ratio of 0.80.

Biogen (NASDAQ:BIIB - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The biotechnology company reported $4.08 earnings per share for the quarter, topping the consensus estimate of $3.77 by $0.31. The company had revenue of $2.47 billion for the quarter, compared to analysts' expectations of $2.43 billion. Biogen had a net margin of 16.81% and a return on equity of 14.98%. Biogen's revenue for the quarter was down 2.5% compared to the same quarter last year. During the same period in the prior year, the business earned $4.36 earnings per share. Analysts expect that Biogen Inc. will post 16.4 EPS for the current fiscal year.

Biogen Company Profile

(

Free Report)

Biogen Inc discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally. The company provides TECFIDERA, VUMERITY, AVONEX, PLEGRIDY, TYSABRI, and FAMPYRA for multiple sclerosis (MS); SPINRAZA for spinal muscular atrophy; ADUHELM to treat Alzheimer's disease; FUMADERM to treat plaque psoriasis; BENEPALI, an etanercept biosimilar referencing ENBREL; IMRALDI, an adalimumab biosimilar referencing HUMIRA; FLIXABI, an infliximab biosimilar referencing REMICADE; and BYOOVIZ, a ranibizumab biosimilar referencing LUCENTIS.

Read More

Before you consider Biogen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Biogen wasn't on the list.

While Biogen currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.