Primecap Management Co. CA reduced its position in Ross Stores, Inc. (NASDAQ:ROST - Free Report) by 1.1% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 10,535,967 shares of the apparel retailer's stock after selling 114,750 shares during the period. Ross Stores accounts for approximately 1.2% of Primecap Management Co. CA's investment portfolio, making the stock its 23rd largest holding. Primecap Management Co. CA owned approximately 3.18% of Ross Stores worth $1,585,768,000 at the end of the most recent reporting period.

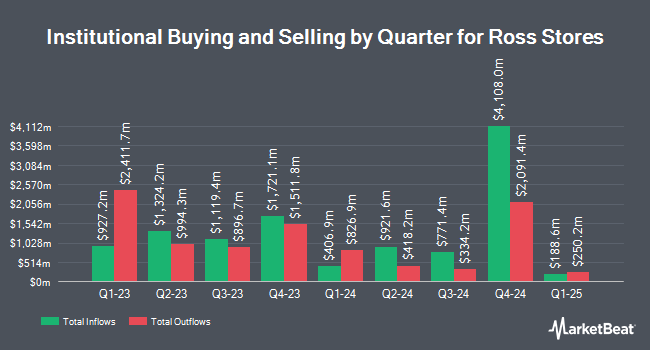

Other institutional investors and hedge funds also recently made changes to their positions in the company. PGGM Investments boosted its holdings in Ross Stores by 724.1% during the second quarter. PGGM Investments now owns 24,848 shares of the apparel retailer's stock worth $3,611,000 after buying an additional 21,833 shares during the last quarter. Canada Pension Plan Investment Board boosted its stake in Ross Stores by 140.2% during the 1st quarter. Canada Pension Plan Investment Board now owns 464,062 shares of the apparel retailer's stock worth $68,106,000 after acquiring an additional 270,844 shares during the last quarter. Diversified Trust Co grew its holdings in Ross Stores by 47.5% during the second quarter. Diversified Trust Co now owns 13,124 shares of the apparel retailer's stock valued at $1,907,000 after purchasing an additional 4,228 shares during the period. Janus Henderson Group PLC increased its stake in Ross Stores by 42.1% in the first quarter. Janus Henderson Group PLC now owns 63,105 shares of the apparel retailer's stock valued at $9,260,000 after purchasing an additional 18,685 shares in the last quarter. Finally, Legal & General Group Plc raised its holdings in Ross Stores by 10.3% in the second quarter. Legal & General Group Plc now owns 2,737,042 shares of the apparel retailer's stock worth $397,747,000 after purchasing an additional 254,720 shares during the period. Institutional investors own 86.86% of the company's stock.

Ross Stores Trading Up 0.0 %

Shares of Ross Stores stock opened at $139.32 on Thursday. The stock has a market cap of $46.22 billion, a P/E ratio of 22.47, a P/E/G ratio of 2.34 and a beta of 1.09. The company has a quick ratio of 1.05, a current ratio of 1.56 and a debt-to-equity ratio of 0.30. The business's 50 day moving average is $145.52 and its 200-day moving average is $144.44. Ross Stores, Inc. has a 12-month low of $127.53 and a 12-month high of $163.60.

Ross Stores (NASDAQ:ROST - Get Free Report) last posted its earnings results on Thursday, August 22nd. The apparel retailer reported $1.59 earnings per share for the quarter, topping analysts' consensus estimates of $1.50 by $0.09. The business had revenue of $5.29 billion for the quarter, compared to analyst estimates of $5.25 billion. Ross Stores had a return on equity of 42.43% and a net margin of 9.82%. The firm's revenue was up 7.1% compared to the same quarter last year. During the same period in the previous year, the firm earned $1.32 EPS. Equities research analysts predict that Ross Stores, Inc. will post 6.11 earnings per share for the current fiscal year.

Ross Stores Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Tuesday, December 10th will be issued a dividend of $0.3675 per share. This represents a $1.47 annualized dividend and a yield of 1.06%. Ross Stores's payout ratio is currently 23.71%.

Insiders Place Their Bets

In other Ross Stores news, CEO Barbara Rentler sold 48,885 shares of Ross Stores stock in a transaction on Tuesday, August 27th. The stock was sold at an average price of $153.93, for a total value of $7,524,868.05. Following the completion of the transaction, the chief executive officer now directly owns 311,853 shares of the company's stock, valued at $48,003,532.29. The trade was a 13.55 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, COO Michael J. Hartshorn sold 8,366 shares of the stock in a transaction on Monday, September 16th. The stock was sold at an average price of $155.64, for a total value of $1,302,084.24. Following the sale, the chief operating officer now directly owns 103,049 shares in the company, valued at approximately $16,038,546.36. This trade represents a 7.51 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 72,138 shares of company stock worth $11,093,051 in the last 90 days. Company insiders own 2.10% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have recently issued reports on the stock. UBS Group boosted their price target on shares of Ross Stores from $147.00 to $167.00 and gave the company a "neutral" rating in a report on Friday, August 23rd. Bank of America boosted their target price on Ross Stores from $170.00 to $180.00 and gave the company a "buy" rating in a research note on Friday, August 23rd. Gordon Haskett upgraded Ross Stores to a "strong-buy" rating in a report on Friday, August 23rd. Wells Fargo & Company lowered their target price on Ross Stores from $175.00 to $165.00 and set an "overweight" rating for the company in a research note on Thursday, November 14th. Finally, Citigroup downgraded shares of Ross Stores from a "buy" rating to a "neutral" rating and dropped their target price for the stock from $179.00 to $152.00 in a report on Tuesday, November 12th. Five research analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $169.50.

View Our Latest Report on ROST

Ross Stores Company Profile

(

Free Report)

Ross Stores, Inc, together with its subsidiaries, operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd's DISCOUNTS brand names in the United States. Its stores primarily offer apparel, accessories, footwear, and home fashions. The company's Ross Dress for Less stores sell its products at department and specialty stores to middle income households; and dd's DISCOUNTS stores sell its products at department and discount stores for households with moderate income.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ross Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ross Stores wasn't on the list.

While Ross Stores currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.