Primecap Management Co. CA lessened its holdings in Sphere Entertainment Co. (NYSE:SPHR - Free Report) by 30.8% during the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 428,918 shares of the company's stock after selling 190,910 shares during the period. Primecap Management Co. CA owned approximately 1.21% of Sphere Entertainment worth $18,950,000 at the end of the most recent reporting period.

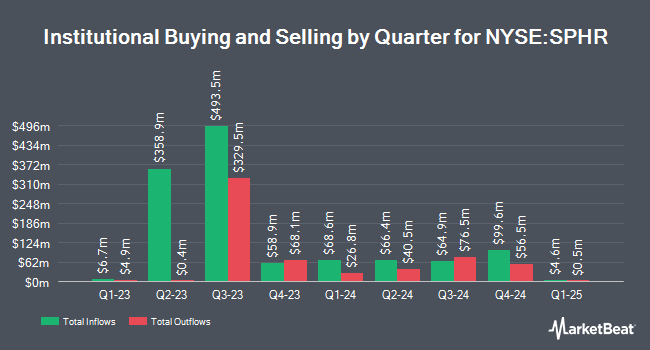

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Ariel Investments LLC grew its position in shares of Sphere Entertainment by 8.2% during the 2nd quarter. Ariel Investments LLC now owns 5,538,121 shares of the company's stock valued at $194,167,000 after purchasing an additional 419,581 shares in the last quarter. Vanguard Group Inc. grew its position in shares of Sphere Entertainment by 0.6% during the 1st quarter. Vanguard Group Inc. now owns 2,807,395 shares of the company's stock valued at $137,787,000 after purchasing an additional 17,613 shares in the last quarter. Jericho Capital Asset Management L.P. grew its position in Sphere Entertainment by 4.4% in the first quarter. Jericho Capital Asset Management L.P. now owns 2,542,865 shares of the company's stock worth $124,804,000 after acquiring an additional 106,651 shares in the last quarter. Millennium Management LLC grew its position in Sphere Entertainment by 356.8% in the second quarter. Millennium Management LLC now owns 335,238 shares of the company's stock worth $11,753,000 after acquiring an additional 261,857 shares in the last quarter. Finally, Renaissance Technologies LLC grew its position in Sphere Entertainment by 134.4% in the second quarter. Renaissance Technologies LLC now owns 332,435 shares of the company's stock worth $11,655,000 after acquiring an additional 190,600 shares in the last quarter. Hedge funds and other institutional investors own 92.03% of the company's stock.

Sphere Entertainment Trading Down 1.8 %

Shares of SPHR stock traded down $0.75 on Friday, hitting $40.29. 1,082,746 shares of the stock traded hands, compared to its average volume of 777,373. Sphere Entertainment Co. has a 52 week low of $27.02 and a 52 week high of $51.83. The firm has a 50 day simple moving average of $43.35 and a two-hundred day simple moving average of $41.42. The company has a quick ratio of 0.56, a current ratio of 0.56 and a debt-to-equity ratio of 0.23.

Sphere Entertainment (NYSE:SPHR - Get Free Report) last announced its quarterly earnings results on Tuesday, November 12th. The company reported ($2.95) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($3.32) by $0.37. Sphere Entertainment had a negative net margin of 32.76% and a negative return on equity of 16.48%. The company had revenue of $227.90 million for the quarter, compared to the consensus estimate of $229.86 million. During the same period in the previous year, the firm posted $1.90 EPS. Sphere Entertainment's revenue for the quarter was up 93.1% compared to the same quarter last year. As a group, equities research analysts anticipate that Sphere Entertainment Co. will post -11.47 EPS for the current year.

Analyst Ratings Changes

Several research firms have issued reports on SPHR. Wolfe Research upgraded shares of Sphere Entertainment from a "peer perform" rating to an "outperform" rating and set a $60.00 price target for the company in a research report on Wednesday, October 2nd. Benchmark reaffirmed a "sell" rating and set a $40.00 target price on shares of Sphere Entertainment in a research note on Tuesday, September 3rd. JPMorgan Chase & Co. upgraded shares of Sphere Entertainment from a "neutral" rating to an "overweight" rating and increased their price target for the company from $37.00 to $57.00 in a report on Friday, August 16th. Macquarie cut their price target on shares of Sphere Entertainment from $47.00 to $45.00 and set a "neutral" rating on the stock in a report on Wednesday, November 13th. Finally, Guggenheim increased their price target on shares of Sphere Entertainment from $58.00 to $63.00 and gave the company a "buy" rating in a report on Thursday, September 19th. One research analyst has rated the stock with a sell rating, four have issued a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat.com, Sphere Entertainment has an average rating of "Hold" and an average price target of $50.43.

Read Our Latest Report on SPHR

About Sphere Entertainment

(

Free Report)

Sphere Entertainment Co engages in the entertainment business. It produces, presents, or hosts various live entertainment events, including concerts, family shows, and special events, as well as sporting events, such as professional boxing, college basketball and hockey, professional bull riding, mixed martial arts, and esports and wrestling in its venues, including The Garden, Hulu Theater, Radio City Music Hall, and the Beacon Theatre in New York City; and The Chicago Theatre.

Featured Stories

Before you consider Sphere Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sphere Entertainment wasn't on the list.

While Sphere Entertainment currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.