Primecap Management Co. CA lessened its holdings in Bank of America Co. (NYSE:BAC) by 1.1% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 10,228,232 shares of the financial services provider's stock after selling 115,900 shares during the quarter. Primecap Management Co. CA owned 0.13% of Bank of America worth $405,856,000 as of its most recent SEC filing.

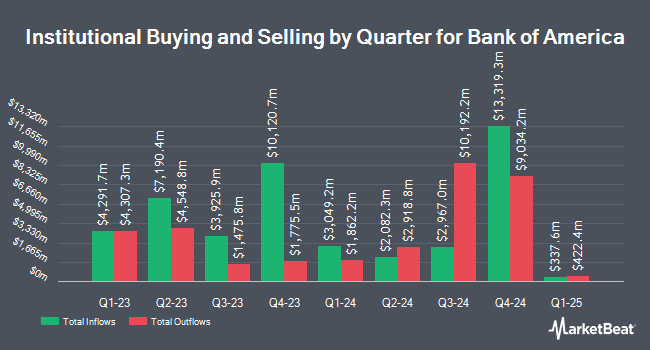

Several other institutional investors and hedge funds have also recently bought and sold shares of BAC. Accent Capital Management LLC grew its holdings in shares of Bank of America by 43.0% in the 3rd quarter. Accent Capital Management LLC now owns 39,500 shares of the financial services provider's stock worth $1,567,000 after purchasing an additional 11,873 shares during the last quarter. Summit Global Investments grew its holdings in shares of Bank of America by 237.6% in the 3rd quarter. Summit Global Investments now owns 51,278 shares of the financial services provider's stock worth $2,035,000 after purchasing an additional 36,089 shares during the last quarter. Baker Avenue Asset Management LP grew its holdings in shares of Bank of America by 125.8% in the 3rd quarter. Baker Avenue Asset Management LP now owns 61,002 shares of the financial services provider's stock worth $2,421,000 after purchasing an additional 33,983 shares during the last quarter. Citizens Financial Group Inc. RI lifted its position in Bank of America by 27.1% during the 1st quarter. Citizens Financial Group Inc. RI now owns 98,189 shares of the financial services provider's stock worth $3,734,000 after buying an additional 20,916 shares in the last quarter. Finally, SteelPeak Wealth LLC lifted its position in Bank of America by 37.7% during the 2nd quarter. SteelPeak Wealth LLC now owns 54,393 shares of the financial services provider's stock worth $2,163,000 after buying an additional 14,901 shares in the last quarter. Institutional investors own 70.71% of the company's stock.

Insider Buying and Selling at Bank of America

In other Bank of America news, major shareholder Berkshire Hathaway Inc sold 10,975,008 shares of the firm's stock in a transaction on Monday, August 26th. The stock was sold at an average price of $39.87, for a total transaction of $437,573,568.96. Following the completion of the sale, the insider now owns 910,731,659 shares of the company's stock, valued at $36,310,871,244.33. This trade represents a 1.19 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, insider Bernard A. Mensah sold 92,000 shares of Bank of America stock in a transaction on Tuesday, August 27th. The stock was sold at an average price of $39.80, for a total value of $3,661,600.00. Following the sale, the insider now directly owns 96,082 shares of the company's stock, valued at $3,824,063.60. This represents a 48.91 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 102,848,970 shares of company stock valued at $4,145,103,288 in the last quarter. 0.29% of the stock is currently owned by insiders.

Bank of America Trading Down 0.8 %

NYSE BAC opened at $46.06 on Thursday. The company has a market cap of $353.41 billion, a PE ratio of 16.75, a PEG ratio of 1.57 and a beta of 1.32. The company has a current ratio of 0.80, a quick ratio of 0.80 and a debt-to-equity ratio of 1.09. Bank of America Co. has a 12 month low of $29.32 and a 12 month high of $47.02. The stock has a 50 day moving average of $41.92 and a 200-day moving average of $40.55.

Bank of America (NYSE:BAC - Get Free Report) last released its quarterly earnings data on Tuesday, October 15th. The financial services provider reported $0.81 EPS for the quarter, beating the consensus estimate of $0.78 by $0.03. The company had revenue of $25.30 billion during the quarter, compared to the consensus estimate of $25.25 billion. Bank of America had a return on equity of 10.09% and a net margin of 12.48%. The firm's revenue for the quarter was up .4% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $0.90 EPS. On average, equities research analysts anticipate that Bank of America Co. will post 3.27 EPS for the current fiscal year.

Bank of America announced that its board has authorized a share buyback program on Wednesday, July 24th that permits the company to buyback $25.00 billion in shares. This buyback authorization permits the financial services provider to reacquire up to 7.6% of its shares through open market purchases. Shares buyback programs are typically a sign that the company's board believes its shares are undervalued.

Bank of America Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Shareholders of record on Friday, December 6th will be issued a dividend of $0.26 per share. This represents a $1.04 annualized dividend and a yield of 2.26%. The ex-dividend date of this dividend is Friday, December 6th. Bank of America's dividend payout ratio is 37.82%.

Analyst Ratings Changes

Several research analysts recently issued reports on BAC shares. Citigroup upgraded shares of Bank of America from a "neutral" rating to a "buy" rating and upped their price target for the stock from $46.00 to $54.00 in a research report on Friday, November 8th. Barclays upped their target price on shares of Bank of America from $49.00 to $53.00 and gave the company an "overweight" rating in a research report on Wednesday, October 16th. Wells Fargo & Company increased their price target on shares of Bank of America from $52.00 to $56.00 and gave the company an "overweight" rating in a research report on Friday, November 15th. StockNews.com upgraded shares of Bank of America from a "sell" rating to a "hold" rating in a research report on Wednesday, October 16th. Finally, Phillip Securities upgraded shares of Bank of America from a "neutral" rating to an "accumulate" rating and set a $44.00 price target on the stock in a research report on Friday, October 18th. One investment analyst has rated the stock with a sell rating, eight have given a hold rating, fourteen have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $44.26.

View Our Latest Analysis on BAC

About Bank of America

(

Free Report)

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. It operates in four segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets.

See Also

Want to see what other hedge funds are holding BAC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Bank of America Co. (NYSE:BAC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bank of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of America wasn't on the list.

While Bank of America currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report