Primecap Management Co. CA cut its stake in shares of United Airlines Holdings, Inc. (NASDAQ:UAL - Free Report) by 0.7% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 23,571,002 shares of the transportation company's stock after selling 158,340 shares during the quarter. United Airlines comprises approximately 1.0% of Primecap Management Co. CA's portfolio, making the stock its 29th biggest position. Primecap Management Co. CA owned approximately 7.17% of United Airlines worth $1,344,961,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

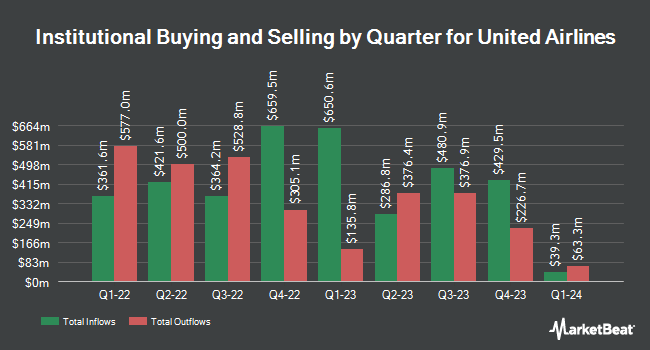

Other institutional investors and hedge funds have also recently modified their holdings of the company. Interval Partners LP bought a new position in shares of United Airlines in the first quarter worth about $103,354,000. Point72 Asset Management L.P. raised its stake in shares of United Airlines by 489.2% in the second quarter. Point72 Asset Management L.P. now owns 2,295,246 shares of the transportation company's stock worth $111,687,000 after buying an additional 1,905,664 shares during the period. Dimensional Fund Advisors LP raised its stake in shares of United Airlines by 29.1% in the second quarter. Dimensional Fund Advisors LP now owns 5,601,425 shares of the transportation company's stock worth $272,559,000 after buying an additional 1,263,604 shares during the period. Assenagon Asset Management S.A. raised its stake in shares of United Airlines by 177.6% in the third quarter. Assenagon Asset Management S.A. now owns 1,324,398 shares of the transportation company's stock worth $75,570,000 after buying an additional 847,348 shares during the period. Finally, Senator Investment Group LP bought a new stake in United Airlines during the 1st quarter valued at approximately $35,910,000. 69.69% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In related news, EVP Kate Gebo sold 17,500 shares of the business's stock in a transaction dated Friday, November 1st. The shares were sold at an average price of $80.44, for a total value of $1,407,700.00. Following the sale, the executive vice president now directly owns 40,012 shares in the company, valued at $3,218,565.28. The trade was a 30.43 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, EVP Torbjorn J. Enqvist sold 14,500 shares of the business's stock in a transaction dated Thursday, October 17th. The stock was sold at an average price of $72.00, for a total transaction of $1,044,000.00. Following the completion of the sale, the executive vice president now owns 30,427 shares in the company, valued at $2,190,744. This represents a 32.27 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.63% of the company's stock.

Wall Street Analysts Forecast Growth

UAL has been the topic of several recent analyst reports. Morgan Stanley lifted their target price on United Airlines from $80.00 to $88.00 and gave the company an "overweight" rating in a research note on Thursday, October 17th. Jefferies Financial Group increased their target price on United Airlines from $75.00 to $95.00 and gave the company a "buy" rating in a research report on Monday, October 21st. The Goldman Sachs Group reiterated a "buy" rating and issued a $119.00 price target on shares of United Airlines in a research report on Friday, November 15th. TD Cowen boosted their price objective on shares of United Airlines from $100.00 to $125.00 and gave the company a "buy" rating in a research report on Tuesday. Finally, Susquehanna raised their target price on shares of United Airlines from $70.00 to $85.00 and gave the stock a "positive" rating in a report on Thursday, October 17th. Two research analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $88.28.

Check Out Our Latest Stock Report on UAL

United Airlines Stock Performance

Shares of United Airlines stock opened at $94.63 on Thursday. The firm's fifty day simple moving average is $69.62 and its 200-day simple moving average is $55.35. The stock has a market capitalization of $31.12 billion, a price-to-earnings ratio of 11.41, a PEG ratio of 1.12 and a beta of 1.39. United Airlines Holdings, Inc. has a 12 month low of $37.02 and a 12 month high of $95.19. The company has a debt-to-equity ratio of 1.95, a current ratio of 0.79 and a quick ratio of 0.72.

United Airlines (NASDAQ:UAL - Get Free Report) last announced its earnings results on Tuesday, October 15th. The transportation company reported $3.33 EPS for the quarter, beating analysts' consensus estimates of $3.10 by $0.23. United Airlines had a net margin of 4.94% and a return on equity of 30.72%. The business had revenue of $14.84 billion for the quarter, compared to analysts' expectations of $14.76 billion. During the same period in the previous year, the company posted $3.65 EPS. As a group, equities analysts forecast that United Airlines Holdings, Inc. will post 10.23 earnings per share for the current year.

United Airlines declared that its Board of Directors has authorized a stock repurchase plan on Tuesday, October 15th that permits the company to repurchase $1.50 billion in shares. This repurchase authorization permits the transportation company to buy up to 7.1% of its shares through open market purchases. Shares repurchase plans are often a sign that the company's management believes its stock is undervalued.

About United Airlines

(

Free Report)

United Airlines Holdings, Inc, through its subsidiaries, provides air transportation services in North America, Asia, Europe, Africa, the Pacific, the Middle East, and Latin America. The company transports people and cargo through its mainline and regional fleets. It also offers catering, ground handling, flight academy, and maintenance services for third parties.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider United Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Airlines wasn't on the list.

While United Airlines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.