Primecap Management Co. CA cut its position in shares of BioNTech SE (NASDAQ:BNTX - Free Report) by 5.7% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 4,516,518 shares of the company's stock after selling 273,000 shares during the period. Primecap Management Co. CA owned about 1.90% of BioNTech worth $536,427,000 as of its most recent filing with the Securities & Exchange Commission.

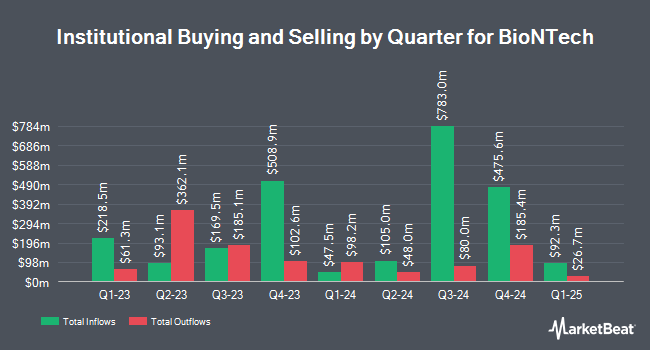

Several other large investors have also recently made changes to their positions in BNTX. Candriam S.C.A. raised its position in shares of BioNTech by 261.2% in the 2nd quarter. Candriam S.C.A. now owns 578,998 shares of the company's stock worth $46,526,000 after acquiring an additional 418,695 shares in the last quarter. Point72 Asset Management L.P. increased its position in BioNTech by 283.5% during the 2nd quarter. Point72 Asset Management L.P. now owns 461,711 shares of the company's stock valued at $37,103,000 after buying an additional 341,311 shares in the last quarter. New York State Common Retirement Fund increased its position in BioNTech by 457.9% during the 3rd quarter. New York State Common Retirement Fund now owns 218,067 shares of the company's stock valued at $25,900,000 after buying an additional 178,981 shares in the last quarter. abrdn plc increased its position in BioNTech by 334.4% during the 3rd quarter. abrdn plc now owns 225,992 shares of the company's stock valued at $26,841,000 after buying an additional 173,969 shares in the last quarter. Finally, Lodestone Wealth Management LLC purchased a new stake in BioNTech during the 3rd quarter valued at about $8,373,000. 15.52% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several research firms have weighed in on BNTX. TD Cowen dropped their price target on BioNTech from $132.00 to $122.00 and set a "hold" rating on the stock in a research note on Tuesday, November 5th. The Goldman Sachs Group raised BioNTech from a "neutral" rating to a "buy" rating and upped their price target for the stock from $90.00 to $137.00 in a report on Friday, November 8th. Jefferies Financial Group raised BioNTech from a "hold" rating to a "buy" rating and increased their target price for the company from $96.00 to $150.00 in a report on Tuesday, September 17th. Morgan Stanley raised BioNTech from an "equal weight" rating to an "overweight" rating and increased their target price for the company from $93.00 to $145.00 in a report on Tuesday, September 24th. Finally, Berenberg Bank initiated coverage on BioNTech in a report on Tuesday. They set a "buy" rating and a $130.00 target price for the company. Four research analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $138.79.

Get Our Latest Research Report on BNTX

BioNTech Trading Down 4.0 %

BNTX opened at $102.14 on Thursday. BioNTech SE has a 52 week low of $76.53 and a 52 week high of $131.49. The business has a fifty day simple moving average of $113.74 and a 200-day simple moving average of $97.49. The firm has a market cap of $24.49 billion, a P/E ratio of -48.64 and a beta of 0.26. The company has a quick ratio of 7.21, a current ratio of 7.33 and a debt-to-equity ratio of 0.01.

BioNTech (NASDAQ:BNTX - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The company reported $0.81 EPS for the quarter, topping the consensus estimate of ($1.26) by $2.07. BioNTech had a negative return on equity of 2.35% and a negative net margin of 15.16%. The business had revenue of $1.24 billion during the quarter, compared to analyst estimates of $514.08 million. During the same period last year, the business posted $0.73 earnings per share. The company's quarterly revenue was up 38.9% on a year-over-year basis. On average, equities analysts expect that BioNTech SE will post -3.68 earnings per share for the current year.

BioNTech Profile

(

Free Report)

BioNTech SE, a biotechnology company, develops and commercializes immunotherapies for cancer and other infectious diseases. The company is developing FixVac product candidates, including BNT111, which is in Phase II clinical trial for advance melanoma; BNT112 that is in Phase I/IIa clinical trial for prostate cancer; BNT113, which is in Phase II clinical trial to treat HPV 16+ head and neck cancers; BNT114 to treat triple negative breast cancer; BNT115, which is in Phase I clinical trial in ovarian cancer; and BNT116, which is in Phase I clinical trial for non-small cell lung cancer.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BioNTech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioNTech wasn't on the list.

While BioNTech currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.