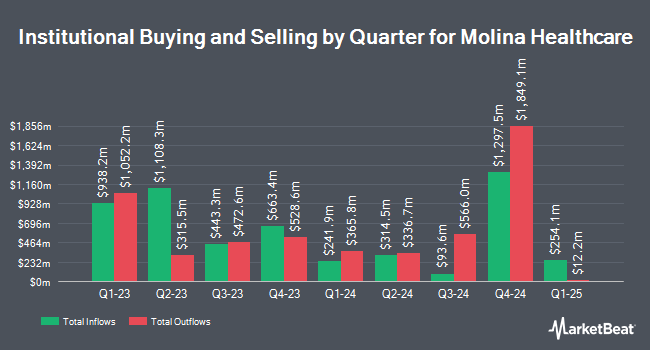

Principal Financial Group Inc. grew its stake in shares of Molina Healthcare, Inc. (NYSE:MOH - Free Report) by 3.3% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 74,160 shares of the company's stock after buying an additional 2,389 shares during the period. Principal Financial Group Inc. owned 0.13% of Molina Healthcare worth $25,553,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also made changes to their positions in the company. National Pension Service raised its holdings in Molina Healthcare by 3.7% in the third quarter. National Pension Service now owns 115,645 shares of the company's stock valued at $39,847,000 after buying an additional 4,087 shares during the period. Van ECK Associates Corp increased its position in shares of Molina Healthcare by 10.1% in the third quarter. Van ECK Associates Corp now owns 13,074 shares of the company's stock worth $4,505,000 after acquiring an additional 1,201 shares in the last quarter. Janney Montgomery Scott LLC raised its stake in shares of Molina Healthcare by 3.0% in the 3rd quarter. Janney Montgomery Scott LLC now owns 2,509 shares of the company's stock valued at $865,000 after acquiring an additional 72 shares during the period. Chicago Partners Investment Group LLC acquired a new position in shares of Molina Healthcare during the 3rd quarter valued at $414,000. Finally, Farther Finance Advisors LLC boosted its position in Molina Healthcare by 43.0% during the 3rd quarter. Farther Finance Advisors LLC now owns 409 shares of the company's stock worth $141,000 after purchasing an additional 123 shares during the period. 98.50% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

MOH has been the topic of a number of recent research reports. Barclays boosted their price objective on Molina Healthcare from $359.00 to $372.00 and gave the stock an "equal weight" rating in a research note on Friday, October 25th. Jefferies Financial Group decreased their price target on Molina Healthcare from $354.00 to $297.00 and set a "hold" rating for the company in a report on Wednesday, July 24th. Stephens reissued an "equal weight" rating and set a $320.00 target price on shares of Molina Healthcare in a research report on Thursday, July 25th. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $406.00 price target on shares of Molina Healthcare in a report on Thursday, October 24th. Finally, TD Cowen cut their price objective on shares of Molina Healthcare from $412.00 to $351.00 and set a "buy" rating on the stock in a report on Wednesday, July 24th. One analyst has rated the stock with a sell rating, six have assigned a hold rating, six have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $367.17.

Check Out Our Latest Analysis on Molina Healthcare

Molina Healthcare Stock Performance

MOH traded down $9.71 during trading hours on Wednesday, hitting $309.20. 559,848 shares of the stock were exchanged, compared to its average volume of 536,522. Molina Healthcare, Inc. has a 12 month low of $272.69 and a 12 month high of $423.92. The stock has a 50-day simple moving average of $329.80 and a 200-day simple moving average of $326.35. The company has a debt-to-equity ratio of 0.53, a current ratio of 1.54 and a quick ratio of 1.55. The stock has a market cap of $17.69 billion, a price-to-earnings ratio of 15.72, a price-to-earnings-growth ratio of 1.10 and a beta of 0.59.

Molina Healthcare (NYSE:MOH - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The company reported $6.01 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $5.96 by $0.05. Molina Healthcare had a return on equity of 27.88% and a net margin of 2.92%. The business had revenue of $10.34 billion during the quarter, compared to analyst estimates of $9.92 billion. During the same quarter in the previous year, the firm posted $5.05 EPS. The business's revenue for the quarter was up 21.0% compared to the same quarter last year. Analysts anticipate that Molina Healthcare, Inc. will post 23.45 earnings per share for the current year.

Insider Buying and Selling at Molina Healthcare

In related news, CAO Maurice Hebert sold 393 shares of the stock in a transaction that occurred on Thursday, August 15th. The stock was sold at an average price of $346.52, for a total value of $136,182.36. Following the completion of the transaction, the chief accounting officer now directly owns 9,473 shares of the company's stock, valued at $3,282,583.96. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. 1.10% of the stock is owned by company insiders.

Molina Healthcare Profile

(

Free Report)

Molina Healthcare, Inc provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces. It operates in four segments: Medicaid, Medicare, Marketplace, and Other. The company served in across 19 states. The company was founded in 1980 and is headquartered in Long Beach, California.

Featured Stories

Before you consider Molina Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molina Healthcare wasn't on the list.

While Molina Healthcare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.