Principal Financial Group Inc. acquired a new position in shares of Madison Square Garden Entertainment Corp. (NYSE:MSGE - Free Report) during the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm acquired 18,532 shares of the company's stock, valued at approximately $788,000.

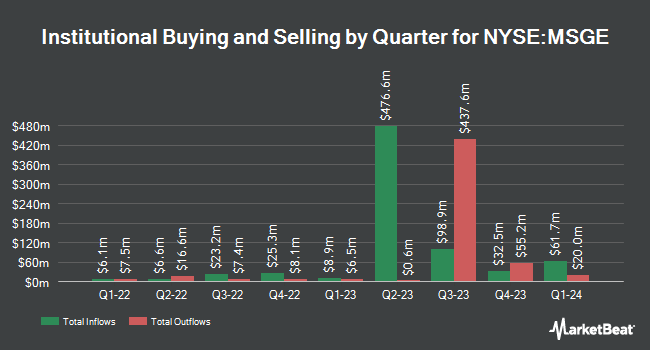

Several other institutional investors have also added to or reduced their stakes in MSGE. Jericho Capital Asset Management L.P. lifted its position in shares of Madison Square Garden Entertainment by 7.0% in the first quarter. Jericho Capital Asset Management L.P. now owns 2,465,724 shares of the company's stock worth $96,681,000 after purchasing an additional 162,000 shares in the last quarter. Assenagon Asset Management S.A. boosted its stake in shares of Madison Square Garden Entertainment by 1,425.2% during the 3rd quarter. Assenagon Asset Management S.A. now owns 899,614 shares of the company's stock worth $38,261,000 after buying an additional 840,631 shares during the last quarter. Duquesne Family Office LLC grew its holdings in shares of Madison Square Garden Entertainment by 8.5% in the 2nd quarter. Duquesne Family Office LLC now owns 694,225 shares of the company's stock valued at $23,763,000 after acquiring an additional 54,425 shares in the last quarter. Federated Hermes Inc. increased its position in shares of Madison Square Garden Entertainment by 48.6% in the second quarter. Federated Hermes Inc. now owns 569,884 shares of the company's stock valued at $19,507,000 after acquiring an additional 186,475 shares during the last quarter. Finally, New York State Common Retirement Fund boosted its position in Madison Square Garden Entertainment by 5.5% during the third quarter. New York State Common Retirement Fund now owns 469,261 shares of the company's stock valued at $19,958,000 after purchasing an additional 24,644 shares during the last quarter. 96.86% of the stock is owned by institutional investors.

Analysts Set New Price Targets

MSGE has been the topic of a number of analyst reports. Bank of America upped their price objective on Madison Square Garden Entertainment from $43.00 to $48.00 and gave the stock a "buy" rating in a research note on Monday, August 19th. Morgan Stanley lowered their price objective on shares of Madison Square Garden Entertainment from $45.00 to $44.00 and set an "equal weight" rating on the stock in a research note on Monday, November 11th. Macquarie lowered their price target on Madison Square Garden Entertainment from $47.00 to $45.00 and set an "outperform" rating on the stock in a research report on Monday, November 11th. Finally, Guggenheim cut their price objective on Madison Square Garden Entertainment from $49.00 to $48.00 and set a "buy" rating for the company in a research report on Tuesday, November 12th. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the stock. According to MarketBeat.com, Madison Square Garden Entertainment presently has a consensus rating of "Moderate Buy" and a consensus price target of $46.00.

Read Our Latest Stock Analysis on Madison Square Garden Entertainment

Insider Buying and Selling

In related news, EVP Philip Gerard D'ambrosio sold 6,000 shares of the firm's stock in a transaction dated Monday, September 30th. The stock was sold at an average price of $42.43, for a total value of $254,580.00. Following the sale, the executive vice president now directly owns 12,192 shares of the company's stock, valued at $517,306.56. This trade represents a 32.98 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. 17.85% of the stock is owned by company insiders.

Madison Square Garden Entertainment Stock Performance

NYSE:MSGE traded up $0.06 during mid-day trading on Friday, hitting $36.28. 367,689 shares of the stock were exchanged, compared to its average volume of 404,534. The firm's 50-day simple moving average is $40.91 and its 200 day simple moving average is $38.45. Madison Square Garden Entertainment Corp. has a fifty-two week low of $29.71 and a fifty-two week high of $44.14. The stock has a market capitalization of $1.74 billion, a price-to-earnings ratio of 9.91, a price-to-earnings-growth ratio of 3.30 and a beta of 0.17.

Madison Square Garden Entertainment (NYSE:MSGE - Get Free Report) last issued its quarterly earnings data on Friday, November 8th. The company reported ($0.40) earnings per share for the quarter, topping the consensus estimate of ($0.79) by $0.39. Madison Square Garden Entertainment had a net margin of 18.38% and a negative return on equity of 261.70%. The business had revenue of $138.70 million during the quarter, compared to analysts' expectations of $139.46 million. During the same quarter in the previous year, the company earned ($0.73) EPS. The business's revenue was down 2.5% on a year-over-year basis. On average, analysts predict that Madison Square Garden Entertainment Corp. will post 1.58 EPS for the current fiscal year.

About Madison Square Garden Entertainment

(

Free Report)

Madison Square Garden Entertainment Corp. engages in live entertainment business. The company produces, presents, and hosts live entertainment events, including concerts, sports events, and other live events, such as family shows, performing arts events, and special events. Its operations include a collection of venues, the entertainment and sports bookings business, and the Christmas Spectacular Starring the Radio City Rockettes production.

Featured Stories

Before you consider Madison Square Garden Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Madison Square Garden Entertainment wasn't on the list.

While Madison Square Garden Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.