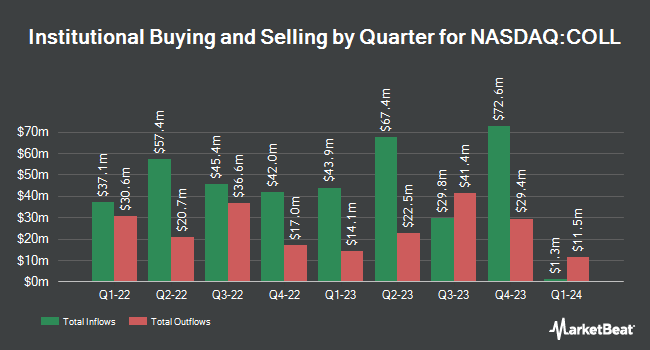

Principal Financial Group Inc. lifted its holdings in Collegium Pharmaceutical, Inc. (NASDAQ:COLL - Free Report) by 3.9% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,745,818 shares of the specialty pharmaceutical company's stock after purchasing an additional 64,958 shares during the quarter. Principal Financial Group Inc. owned 5.34% of Collegium Pharmaceutical worth $67,459,000 as of its most recent SEC filing.

Several other large investors have also added to or reduced their stakes in COLL. Caxton Associates LP acquired a new position in shares of Collegium Pharmaceutical during the 1st quarter worth about $1,730,000. Foundry Partners LLC bought a new position in Collegium Pharmaceutical in the second quarter valued at approximately $492,000. LSV Asset Management grew its stake in Collegium Pharmaceutical by 188.7% in the first quarter. LSV Asset Management now owns 380,551 shares of the specialty pharmaceutical company's stock valued at $14,773,000 after purchasing an additional 248,751 shares in the last quarter. O Shaughnessy Asset Management LLC increased its position in shares of Collegium Pharmaceutical by 159.3% during the 1st quarter. O Shaughnessy Asset Management LLC now owns 45,735 shares of the specialty pharmaceutical company's stock worth $1,775,000 after purchasing an additional 28,100 shares during the last quarter. Finally, Vanguard Group Inc. raised its stake in shares of Collegium Pharmaceutical by 0.8% during the 1st quarter. Vanguard Group Inc. now owns 2,330,728 shares of the specialty pharmaceutical company's stock worth $90,479,000 after purchasing an additional 17,942 shares in the last quarter.

Analyst Ratings Changes

Several research firms recently weighed in on COLL. Truist Financial raised their target price on shares of Collegium Pharmaceutical from $40.00 to $42.00 and gave the company a "buy" rating in a research note on Friday, August 9th. HC Wainwright boosted their price objective on shares of Collegium Pharmaceutical from $47.00 to $50.00 and gave the stock a "buy" rating in a research note on Thursday, September 5th. StockNews.com downgraded shares of Collegium Pharmaceutical from a "strong-buy" rating to a "buy" rating in a research note on Wednesday, October 23rd. Piper Sandler reiterated a "neutral" rating and set a $37.00 price target on shares of Collegium Pharmaceutical in a report on Friday, October 11th. Finally, Needham & Company LLC restated a "hold" rating on shares of Collegium Pharmaceutical in a research note on Friday, August 9th. Two research analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. According to MarketBeat, Collegium Pharmaceutical currently has an average rating of "Moderate Buy" and an average price target of $42.60.

Read Our Latest Stock Analysis on COLL

Collegium Pharmaceutical Stock Performance

Shares of NASDAQ COLL traded down $2.55 during mid-day trading on Friday, reaching $32.16. 1,018,848 shares of the company were exchanged, compared to its average volume of 296,884. The stock has a market capitalization of $1.04 billion, a P/E ratio of 13.86 and a beta of 0.95. The company has a quick ratio of 1.04, a current ratio of 1.11 and a debt-to-equity ratio of 1.71. The company's 50-day simple moving average is $37.07 and its 200-day simple moving average is $35.21. Collegium Pharmaceutical, Inc. has a twelve month low of $23.44 and a twelve month high of $42.29.

Collegium Pharmaceutical (NASDAQ:COLL - Get Free Report) last issued its quarterly earnings data on Thursday, August 8th. The specialty pharmaceutical company reported $1.62 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.40 by $0.22. The company had revenue of $145.28 million during the quarter, compared to analysts' expectations of $143.94 million. Collegium Pharmaceutical had a return on equity of 107.62% and a net margin of 17.32%. The business's revenue was up 7.2% on a year-over-year basis. During the same quarter in the previous year, the company posted $1.13 earnings per share. As a group, research analysts predict that Collegium Pharmaceutical, Inc. will post 5.81 earnings per share for the current year.

Insider Activity

In other Collegium Pharmaceutical news, EVP Shirley R. Kuhlmann sold 19,248 shares of the stock in a transaction that occurred on Thursday, September 5th. The shares were sold at an average price of $38.30, for a total transaction of $737,198.40. Following the transaction, the executive vice president now owns 120,161 shares in the company, valued at $4,602,166.30. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. In related news, EVP Thomas B. Smith sold 9,593 shares of the business's stock in a transaction dated Friday, September 13th. The stock was sold at an average price of $36.62, for a total value of $351,295.66. Following the completion of the transaction, the executive vice president now owns 53,816 shares of the company's stock, valued at $1,970,741.92. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, EVP Shirley R. Kuhlmann sold 19,248 shares of the company's stock in a transaction dated Thursday, September 5th. The stock was sold at an average price of $38.30, for a total transaction of $737,198.40. Following the sale, the executive vice president now directly owns 120,161 shares of the company's stock, valued at $4,602,166.30. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 3.98% of the stock is currently owned by company insiders.

Collegium Pharmaceutical Company Profile

(

Free Report)

Collegium Pharmaceutical, Inc, a specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management. Its portfolio includes Xtampza ER, an abuse-deterrent, extended-release, and oral formulation of oxycodone for the management of pain severe enough to require daily, around-the-clock, long-term opioid treatment; Nucynta ER and Nucynta IR, which are extended-release and immediate-release formulations of tapentadol, indicated for the management of acute, severe, and persistent pain; Belbuca, a buccal film that contains buprenorphine; and Symproic, an oral formulation of naldemedine for the treatment of opioid-induced constipation in adult patients with chronic non-cancer pain.

Featured Stories

Before you consider Collegium Pharmaceutical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Collegium Pharmaceutical wasn't on the list.

While Collegium Pharmaceutical currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report