Principal Financial Group Inc. increased its stake in shares of Magnite, Inc. (NASDAQ:MGNI - Free Report) by 552.2% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 107,515 shares of the company's stock after purchasing an additional 91,031 shares during the quarter. Principal Financial Group Inc. owned approximately 0.08% of Magnite worth $1,489,000 as of its most recent filing with the Securities and Exchange Commission.

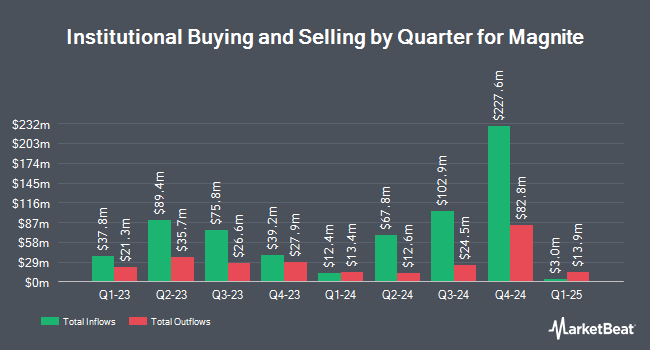

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. UMB Bank n.a. grew its holdings in Magnite by 111.8% in the 2nd quarter. UMB Bank n.a. now owns 2,251 shares of the company's stock valued at $30,000 after buying an additional 1,188 shares during the period. Asset Dedication LLC purchased a new stake in Magnite in the 2nd quarter valued at about $52,000. Blue Trust Inc. purchased a new stake in Magnite in the 2nd quarter valued at about $56,000. Benjamin F. Edwards & Company Inc. grew its holdings in Magnite by 973.5% in the 2nd quarter. Benjamin F. Edwards & Company Inc. now owns 4,380 shares of the company's stock valued at $58,000 after buying an additional 3,972 shares during the period. Finally, DekaBank Deutsche Girozentrale purchased a new stake in Magnite in the 2nd quarter valued at about $93,000. Hedge funds and other institutional investors own 73.40% of the company's stock.

Insider Buying and Selling at Magnite

In other Magnite news, insider Aaron Saltz sold 5,112 shares of the company's stock in a transaction that occurred on Thursday, November 7th. The stock was sold at an average price of $13.50, for a total value of $69,012.00. Following the transaction, the insider now directly owns 307,745 shares of the company's stock, valued at $4,154,557.50. This represents a 1.63 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Also, CRO Sean Patrick Buckley sold 10,001 shares of the company's stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $15.60, for a total value of $156,015.60. Following the completion of the transaction, the executive now directly owns 303,743 shares in the company, valued at approximately $4,738,390.80. The trade was a 3.19 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 140,051 shares of company stock valued at $2,233,314 in the last three months. Corporate insiders own 4.30% of the company's stock.

Magnite Stock Up 3.5 %

Magnite stock traded up $0.58 during midday trading on Friday, hitting $17.13. 2,459,039 shares of the company were exchanged, compared to its average volume of 2,324,619. The company's fifty day moving average price is $13.39 and its 200-day moving average price is $13.19. The company has a market cap of $2.41 billion, a PE ratio of 285.50, a price-to-earnings-growth ratio of 1.35 and a beta of 2.43. The company has a debt-to-equity ratio of 0.76, a current ratio of 1.11 and a quick ratio of 1.11. Magnite, Inc. has a fifty-two week low of $7.97 and a fifty-two week high of $17.19.

Wall Street Analysts Forecast Growth

Several research firms have commented on MGNI. Wells Fargo & Company began coverage on Magnite in a research note on Monday, October 28th. They issued an "equal weight" rating and a $13.00 price objective on the stock. Craig Hallum reaffirmed a "buy" rating and issued a $20.00 price objective on shares of Magnite in a research note on Wednesday, August 21st. Needham & Company LLC reaffirmed a "buy" rating and issued a $15.00 price objective on shares of Magnite in a research note on Wednesday, October 2nd. Macquarie reaffirmed an "outperform" rating and issued a $18.00 price objective on shares of Magnite in a research note on Friday, November 8th. Finally, Benchmark reaffirmed a "buy" rating and issued a $21.00 price objective on shares of Magnite in a research note on Wednesday, October 2nd. One investment analyst has rated the stock with a hold rating and eleven have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $16.96.

Check Out Our Latest Research Report on Magnite

Magnite Profile

(

Free Report)

Magnite, Inc, together with its subsidiaries, operates an independent omni-channel sell-side advertising platform in the United States and internationally. The company's platform offers applications and services for sellers of digital advertising inventory or publishers that own and operate CTV channels, applications, websites, and other digital media properties to manage and monetize their inventory; and applications and services for buyers, including advertisers, agencies, agency trading desks, and demand side platforms to buy digital advertising inventory, as well as an independent marketplace that connects buyers and sellers.

Read More

Before you consider Magnite, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Magnite wasn't on the list.

While Magnite currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.