Principal Financial Group Inc. reduced its stake in Berry Global Group, Inc. (NYSE:BERY - Free Report) by 30.4% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 265,354 shares of the industrial products company's stock after selling 115,710 shares during the period. Principal Financial Group Inc. owned 0.23% of Berry Global Group worth $18,039,000 at the end of the most recent reporting period.

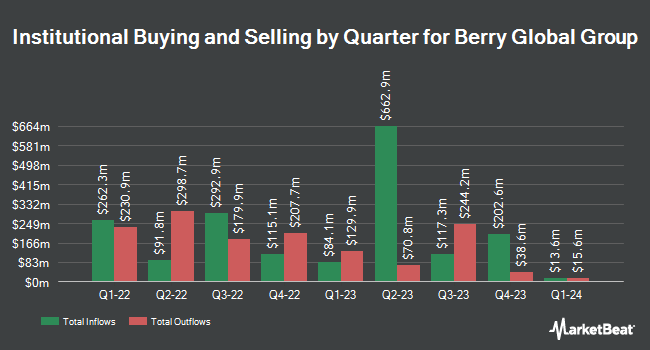

Several other hedge funds have also made changes to their positions in the company. Sei Investments Co. grew its stake in Berry Global Group by 8.3% in the 1st quarter. Sei Investments Co. now owns 161,605 shares of the industrial products company's stock valued at $9,774,000 after acquiring an additional 12,385 shares during the period. State Board of Administration of Florida Retirement System lifted its stake in Berry Global Group by 11.3% during the first quarter. State Board of Administration of Florida Retirement System now owns 131,860 shares of the industrial products company's stock worth $7,767,000 after purchasing an additional 13,398 shares in the last quarter. Russell Investments Group Ltd. increased its stake in Berry Global Group by 33.8% during the first quarter. Russell Investments Group Ltd. now owns 37,552 shares of the industrial products company's stock worth $2,271,000 after purchasing an additional 9,483 shares during the period. Virtu Financial LLC purchased a new position in Berry Global Group in the 1st quarter valued at approximately $691,000. Finally, BOKF NA boosted its stake in shares of Berry Global Group by 26.3% in the 1st quarter. BOKF NA now owns 79,330 shares of the industrial products company's stock valued at $4,809,000 after buying an additional 16,497 shares during the period. 95.36% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several research analysts have recently issued reports on the stock. Truist Financial upped their target price on shares of Berry Global Group from $68.00 to $74.00 and gave the company a "hold" rating in a report on Tuesday, October 15th. StockNews.com raised shares of Berry Global Group from a "hold" rating to a "buy" rating in a report on Friday. Finally, Morgan Stanley initiated coverage on shares of Berry Global Group in a report on Wednesday, September 4th. They issued an "equal weight" rating and a $76.00 price target on the stock. Seven equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $71.22.

View Our Latest Research Report on Berry Global Group

Insider Buying and Selling at Berry Global Group

In other Berry Global Group news, Director Evan Bayh sold 14,000 shares of Berry Global Group stock in a transaction dated Tuesday, October 15th. The stock was sold at an average price of $70.13, for a total value of $981,820.00. Following the completion of the transaction, the director now directly owns 30,228 shares of the company's stock, valued at $2,119,889.64. The trade was a 31.65 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Insiders own 4.00% of the company's stock.

Berry Global Group Trading Up 0.6 %

NYSE:BERY traded up $0.42 during midday trading on Friday, reaching $66.75. 845,608 shares of the stock traded hands, compared to its average volume of 985,109. The company has a fifty day moving average of $67.90 and a 200 day moving average of $64.03. Berry Global Group, Inc. has a 12 month low of $54.06 and a 12 month high of $71.63. The company has a debt-to-equity ratio of 2.57, a quick ratio of 1.08 and a current ratio of 1.82. The stock has a market capitalization of $7.65 billion, a P/E ratio of 14.26, a PEG ratio of 1.10 and a beta of 1.14.

Berry Global Group Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Monday, December 2nd will be issued a $0.31 dividend. This is an increase from Berry Global Group's previous quarterly dividend of $0.28. This represents a $1.24 annualized dividend and a dividend yield of 1.86%. The ex-dividend date is Monday, December 2nd. Berry Global Group's payout ratio is presently 23.50%.

About Berry Global Group

(

Free Report)

Berry Global Group, Inc manufactures and supplies non-woven, flexible, and rigid products in consumer and industrial end markets in the United States, Canada, Europe, and internationally. The company operates through Consumer Packaging International; Consumer Packaging North America; Engineered Materials; and Health, Hygiene & Specialties segments.

Featured Stories

Before you consider Berry Global Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Berry Global Group wasn't on the list.

While Berry Global Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.