Principal Financial Group Inc. decreased its position in shares of W. P. Carey Inc. (NYSE:WPC - Free Report) by 30.5% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 506,688 shares of the real estate investment trust's stock after selling 221,852 shares during the quarter. Principal Financial Group Inc. owned 0.23% of W. P. Carey worth $31,567,000 as of its most recent SEC filing.

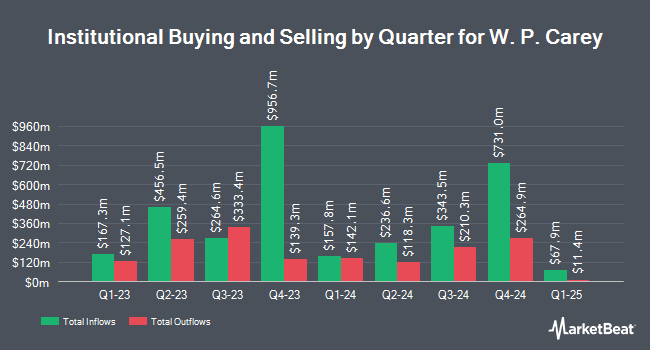

A number of other institutional investors and hedge funds have also recently modified their holdings of WPC. Vanguard Group Inc. increased its position in shares of W. P. Carey by 0.6% in the first quarter. Vanguard Group Inc. now owns 30,971,062 shares of the real estate investment trust's stock valued at $1,748,007,000 after buying an additional 187,022 shares in the last quarter. Massachusetts Financial Services Co. MA raised its stake in W. P. Carey by 22.2% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 3,240,705 shares of the real estate investment trust's stock valued at $178,401,000 after purchasing an additional 588,636 shares during the last quarter. Dimensional Fund Advisors LP raised its stake in W. P. Carey by 6.9% in the 2nd quarter. Dimensional Fund Advisors LP now owns 3,152,879 shares of the real estate investment trust's stock valued at $173,570,000 after purchasing an additional 204,064 shares during the last quarter. Bank of New York Mellon Corp raised its stake in W. P. Carey by 0.3% in the 2nd quarter. Bank of New York Mellon Corp now owns 2,524,490 shares of the real estate investment trust's stock valued at $138,973,000 after purchasing an additional 7,549 shares during the last quarter. Finally, PGGM Investments raised its stake in W. P. Carey by 18.5% in the 2nd quarter. PGGM Investments now owns 2,498,975 shares of the real estate investment trust's stock valued at $137,569,000 after purchasing an additional 389,853 shares during the last quarter. Institutional investors and hedge funds own 73.73% of the company's stock.

Analyst Ratings Changes

WPC has been the subject of several recent research reports. Evercore ISI increased their price objective on W. P. Carey from $63.00 to $66.00 and gave the company an "in-line" rating in a research note on Monday, September 16th. Barclays raised their target price on W. P. Carey from $54.00 to $56.00 and gave the company an "equal weight" rating in a report on Thursday, October 10th. Scotiabank reduced their price target on W. P. Carey from $61.00 to $60.00 and set a "sector perform" rating on the stock in a research report on Wednesday, August 7th. Royal Bank of Canada cut their target price on W. P. Carey from $63.00 to $62.00 and set an "outperform" rating on the stock in a research report on Thursday, August 1st. Finally, UBS Group raised their target price on W. P. Carey from $57.00 to $63.00 and gave the stock a "neutral" rating in a research report on Thursday, July 18th. Eight equities research analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $63.25.

Get Our Latest Research Report on WPC

W. P. Carey Stock Performance

Shares of WPC stock traded down $0.45 during midday trading on Tuesday, hitting $55.28. The company had a trading volume of 673,565 shares, compared to its average volume of 1,215,415. The company's 50 day simple moving average is $59.96 and its 200 day simple moving average is $58.23. W. P. Carey Inc. has a 52-week low of $53.01 and a 52-week high of $67.40. The stock has a market cap of $12.10 billion, a price-to-earnings ratio of 21.92, a PEG ratio of 1.06 and a beta of 0.95. The company has a debt-to-equity ratio of 0.90, a current ratio of 1.00 and a quick ratio of 1.00.

W. P. Carey (NYSE:WPC - Get Free Report) last announced its earnings results on Tuesday, October 29th. The real estate investment trust reported $0.51 earnings per share for the quarter, missing the consensus estimate of $1.13 by ($0.62). W. P. Carey had a net margin of 35.12% and a return on equity of 6.45%. The company had revenue of $394.78 million during the quarter, compared to analysts' expectations of $377.43 million. During the same quarter last year, the business posted $1.32 earnings per share. The company's revenue for the quarter was down 11.9% compared to the same quarter last year. Research analysts anticipate that W. P. Carey Inc. will post 4.52 earnings per share for the current fiscal year.

W. P. Carey Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were paid a $0.875 dividend. The ex-dividend date was Monday, September 30th. This is an increase from W. P. Carey's previous quarterly dividend of $0.87. This represents a $3.50 dividend on an annualized basis and a dividend yield of 6.33%. W. P. Carey's payout ratio is 137.80%.

W. P. Carey Profile

(

Free Report)

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,424 net lease properties covering approximately 173 million square feet and a portfolio of 89 self-storage operating properties as of December 31, 2023.

Featured Articles

Before you consider W. P. Carey, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and W. P. Carey wasn't on the list.

While W. P. Carey currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.