Principal Financial Group Inc. reduced its position in Alamos Gold Inc. (NYSE:AGI - Free Report) TSE: AGI by 21.8% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,358,400 shares of the basic materials company's stock after selling 378,800 shares during the quarter. Principal Financial Group Inc. owned about 0.32% of Alamos Gold worth $25,049,000 at the end of the most recent quarter.

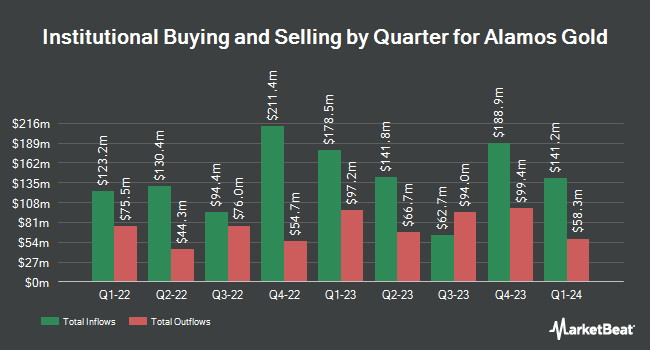

Other hedge funds also recently made changes to their positions in the company. Guyasuta Investment Advisors Inc. boosted its position in Alamos Gold by 10.7% during the 4th quarter. Guyasuta Investment Advisors Inc. now owns 15,500 shares of the basic materials company's stock worth $286,000 after buying an additional 1,500 shares during the period. Compound Global Advisors LLC bought a new stake in Alamos Gold during the 4th quarter valued at $680,000. Entropy Technologies LP bought a new stake in Alamos Gold during the 4th quarter valued at $477,000. Wilmington Savings Fund Society FSB boosted its holdings in Alamos Gold by 4.8% during the 4th quarter. Wilmington Savings Fund Society FSB now owns 21,700 shares of the basic materials company's stock worth $400,000 after acquiring an additional 1,000 shares during the last quarter. Finally, Quattro Financial Advisors LLC raised its holdings in shares of Alamos Gold by 66.0% in the fourth quarter. Quattro Financial Advisors LLC now owns 61,860 shares of the basic materials company's stock valued at $1,241,000 after purchasing an additional 24,595 shares during the last quarter. 64.33% of the stock is currently owned by institutional investors and hedge funds.

Alamos Gold Stock Performance

Shares of Alamos Gold stock traded down $0.93 during trading hours on Thursday, reaching $22.64. 2,978,464 shares of the stock traded hands, compared to its average volume of 2,381,181. The company has a 50 day moving average price of $20.49 and a 200 day moving average price of $19.83. The firm has a market capitalization of $9.52 billion, a price-to-earnings ratio of 32.81, a P/E/G ratio of 0.40 and a beta of 1.16. The company has a quick ratio of 0.96, a current ratio of 1.51 and a debt-to-equity ratio of 0.08. Alamos Gold Inc. has a one year low of $11.36 and a one year high of $24.27.

Alamos Gold (NYSE:AGI - Get Free Report) TSE: AGI last issued its quarterly earnings data on Wednesday, February 19th. The basic materials company reported $0.25 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.24 by $0.01. Alamos Gold had a return on equity of 10.05% and a net margin of 21.11%. The business had revenue of $375.80 million for the quarter, compared to analysts' expectations of $388.06 million. On average, equities research analysts expect that Alamos Gold Inc. will post 1.29 earnings per share for the current fiscal year.

Alamos Gold Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Thursday, March 27th. Stockholders of record on Thursday, March 13th will be given a dividend of $0.025 per share. This represents a $0.10 dividend on an annualized basis and a dividend yield of 0.44%. Alamos Gold's payout ratio is 14.49%.

Wall Street Analyst Weigh In

AGI has been the subject of a number of research reports. Royal Bank of Canada increased their target price on shares of Alamos Gold from $25.00 to $27.00 and gave the stock an "outperform" rating in a research report on Tuesday, February 11th. National Bank Financial raised shares of Alamos Gold from a "sector perform" rating to an "outperform" rating in a research note on Tuesday, December 3rd. Six equities research analysts have rated the stock with a buy rating, According to data from MarketBeat, the company currently has a consensus rating of "Buy" and a consensus price target of $26.06.

View Our Latest Analysis on AGI

Alamos Gold Company Profile

(

Free Report)

Alamos Gold Inc engages in the acquisition, exploration, development, and extraction of precious metals in Canada and Mexico. The company primarily explores for gold deposits. It holds 100% interest in the Young-Davidson mine and Island Gold mine located in the Ontario, Canada; Mulatos mine located in the Sonora, Mexico; and Lynn Lake project situated in the Manitoba, Canada.

Featured Stories

Before you consider Alamos Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alamos Gold wasn't on the list.

While Alamos Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.