Principal Financial Group Inc. reduced its stake in shares of Comerica Incorporated (NYSE:CMA - Free Report) by 5.8% in the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 624,654 shares of the financial services provider's stock after selling 38,446 shares during the period. Principal Financial Group Inc. owned about 0.47% of Comerica worth $37,423,000 at the end of the most recent reporting period.

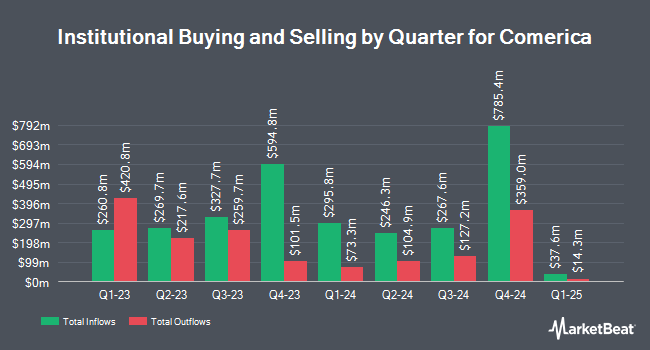

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. V Square Quantitative Management LLC acquired a new stake in shares of Comerica during the 3rd quarter valued at $36,000. Family Firm Inc. acquired a new stake in Comerica in the second quarter valued at about $37,000. UMB Bank n.a. grew its position in Comerica by 39.3% in the 2nd quarter. UMB Bank n.a. now owns 737 shares of the financial services provider's stock valued at $38,000 after purchasing an additional 208 shares during the period. Versant Capital Management Inc lifted its position in shares of Comerica by 2,723.3% during the second quarter. Versant Capital Management Inc now owns 847 shares of the financial services provider's stock valued at $43,000 after purchasing an additional 817 shares in the last quarter. Finally, Abich Financial Wealth Management LLC increased its stake in shares of Comerica by 50.2% in the first quarter. Abich Financial Wealth Management LLC now owns 898 shares of the financial services provider's stock worth $49,000 after purchasing an additional 300 shares in the last quarter. 80.74% of the stock is owned by institutional investors.

Analyst Ratings Changes

CMA has been the topic of several analyst reports. Wedbush raised Comerica from a "neutral" rating to an "outperform" rating and boosted their target price for the stock from $52.00 to $75.00 in a report on Tuesday, September 24th. Royal Bank of Canada lowered their price objective on shares of Comerica from $58.00 to $56.00 and set an "outperform" rating for the company in a research note on Monday, July 22nd. Keefe, Bruyette & Woods upgraded shares of Comerica from a "market perform" rating to an "outperform" rating and lifted their price objective for the company from $50.00 to $69.00 in a research note on Thursday, September 5th. Piper Sandler boosted their price objective on shares of Comerica from $51.00 to $52.00 and gave the company a "neutral" rating in a research note on Monday, July 22nd. Finally, Evercore ISI upped their target price on Comerica from $64.00 to $69.00 and gave the company an "in-line" rating in a report on Wednesday, October 30th. Three investment analysts have rated the stock with a sell rating, twelve have given a hold rating and eight have issued a buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $62.81.

Get Our Latest Stock Report on Comerica

Comerica Trading Down 1.2 %

CMA stock traded down $0.85 during trading on Tuesday, hitting $69.93. The company had a trading volume of 556,927 shares, compared to its average volume of 2,139,153. The firm has a market capitalization of $9.20 billion, a P/E ratio of 17.70 and a beta of 1.22. Comerica Incorporated has a 52-week low of $40.41 and a 52-week high of $71.27. The company has a quick ratio of 0.97, a current ratio of 0.97 and a debt-to-equity ratio of 0.97. The company has a 50 day simple moving average of $60.72 and a 200-day simple moving average of $55.18.

Comerica (NYSE:CMA - Get Free Report) last released its quarterly earnings results on Friday, October 18th. The financial services provider reported $1.33 earnings per share for the quarter, topping analysts' consensus estimates of $1.17 by $0.16. Comerica had a return on equity of 12.54% and a net margin of 11.17%. The firm had revenue of $1.26 billion during the quarter, compared to analysts' expectations of $806.49 million. During the same quarter in the prior year, the business earned $1.84 EPS. As a group, research analysts forecast that Comerica Incorporated will post 5.39 earnings per share for the current fiscal year.

Comerica Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, January 1st. Shareholders of record on Friday, December 13th will be given a $0.71 dividend. The ex-dividend date is Friday, December 13th. This represents a $2.84 dividend on an annualized basis and a dividend yield of 4.06%. Comerica's dividend payout ratio (DPR) is presently 71.00%.

Comerica declared that its Board of Directors has initiated a share buyback plan on Tuesday, November 5th that authorizes the company to buyback 10,000,000 shares. This buyback authorization authorizes the financial services provider to reacquire shares of its stock through open market purchases. Stock buyback plans are usually a sign that the company's management believes its shares are undervalued.

Insiders Place Their Bets

In other news, EVP James Harry Weber sold 6,500 shares of the business's stock in a transaction on Thursday, October 24th. The stock was sold at an average price of $63.23, for a total value of $410,995.00. Following the completion of the transaction, the executive vice president now directly owns 15,773 shares of the company's stock, valued at approximately $997,326.79. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. In other Comerica news, EVP James Harry Weber sold 6,500 shares of the stock in a transaction on Thursday, October 24th. The stock was sold at an average price of $63.23, for a total transaction of $410,995.00. Following the sale, the executive vice president now owns 15,773 shares in the company, valued at approximately $997,326.79. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, EVP Bruce Mitchell sold 7,564 shares of Comerica stock in a transaction dated Tuesday, October 22nd. The stock was sold at an average price of $62.20, for a total value of $470,480.80. Following the completion of the transaction, the executive vice president now owns 16,428 shares of the company's stock, valued at $1,021,821.60. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 16,609 shares of company stock valued at $1,027,839 over the last ninety days. 0.19% of the stock is currently owned by insiders.

About Comerica

(

Free Report)

Comerica Incorporated, through its subsidiaries, provides various financial products and services. The company operates through Commercial Bank, Retail Bank, Wealth Management, and Finance segments. The Commercial Bank segment offers various products and services, including commercial loans and lines of credit, deposits, cash management, payment solutions, card services, capital market products, international trade finance, letters of credit, foreign exchange management services, and loan syndication services for small and middle market businesses, multinational corporations, and governmental entities.

Featured Stories

Before you consider Comerica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comerica wasn't on the list.

While Comerica currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report