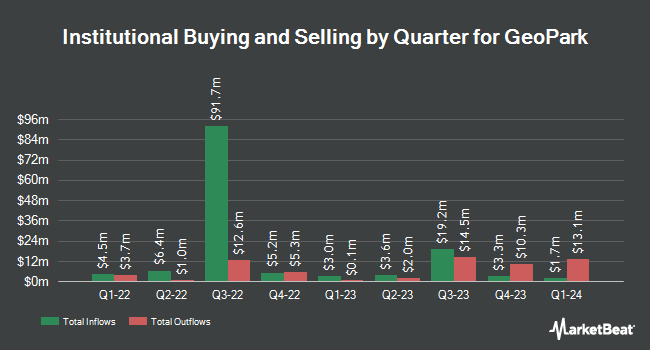

Principal Financial Group Inc. increased its stake in shares of GeoPark Limited (NYSE:GPRK - Free Report) by 77.4% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 366,380 shares of the oil and gas company's stock after buying an additional 159,861 shares during the period. Principal Financial Group Inc. owned about 0.72% of GeoPark worth $2,883,000 as of its most recent filing with the Securities and Exchange Commission.

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. Employees Retirement System of Texas purchased a new position in shares of GeoPark in the second quarter valued at $34,000. nVerses Capital LLC acquired a new position in GeoPark during the second quarter worth about $35,000. Blue Trust Inc. acquired a new position in GeoPark during the third quarter worth about $38,000. Public Employees Retirement System of Ohio purchased a new stake in shares of GeoPark in the third quarter valued at about $44,000. Finally, Barclays PLC grew its position in shares of GeoPark by 392.3% in the third quarter. Barclays PLC now owns 8,974 shares of the oil and gas company's stock valued at $71,000 after purchasing an additional 7,151 shares during the last quarter. 68.21% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several research analysts recently issued reports on the company. JPMorgan Chase & Co. cut their price objective on GeoPark from $12.00 to $11.00 and set an "overweight" rating for the company in a research report on Wednesday, October 30th. StockNews.com lowered GeoPark from a "strong-buy" rating to a "buy" rating in a research note on Saturday, December 28th.

Read Our Latest Research Report on GeoPark

GeoPark Trading Up 3.9 %

GPRK stock traded up $0.40 during midday trading on Friday, hitting $10.54. The stock had a trading volume of 1,090,866 shares, compared to its average volume of 884,733. The company's 50-day moving average price is $9.21 and its 200 day moving average price is $9.17. The company has a debt-to-equity ratio of 2.53, a current ratio of 1.28 and a quick ratio of 1.23. The firm has a market cap of $539.26 million, a PE ratio of 5.35 and a beta of 1.35. GeoPark Limited has a 12-month low of $7.24 and a 12-month high of $11.72.

GeoPark (NYSE:GPRK - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The oil and gas company reported $0.48 EPS for the quarter, missing analysts' consensus estimates of $0.59 by ($0.11). GeoPark had a net margin of 14.97% and a return on equity of 57.93%. The business had revenue of $159.50 million during the quarter, compared to analysts' expectations of $156.99 million. On average, equities research analysts predict that GeoPark Limited will post 2.56 earnings per share for the current fiscal year.

GeoPark Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, December 6th. Investors of record on Thursday, November 21st were given a dividend of $0.147 per share. This represents a $0.59 annualized dividend and a yield of 5.58%. The ex-dividend date was Thursday, November 21st. GeoPark's dividend payout ratio (DPR) is 29.44%.

GeoPark Profile

(

Free Report)

GeoPark Limited operates as an oil and natural gas exploration and production company primarily in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries. It engages in the exploration, development, and production of oil and gas reserves. The company was formerly known as GeoPark Holdings Limited and changed its name to GeoPark Limited in July 2013.

Featured Stories

Before you consider GeoPark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GeoPark wasn't on the list.

While GeoPark currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.