Principal Financial Group Inc. lifted its position in Brookfield Renewable Partners L.P. (NYSE:BEP - Free Report) TSE: BEP by 4.5% in the 3rd quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 7,605,679 shares of the utilities provider's stock after acquiring an additional 330,648 shares during the period. Principal Financial Group Inc. owned 2.67% of Brookfield Renewable Partners worth $214,328,000 as of its most recent SEC filing.

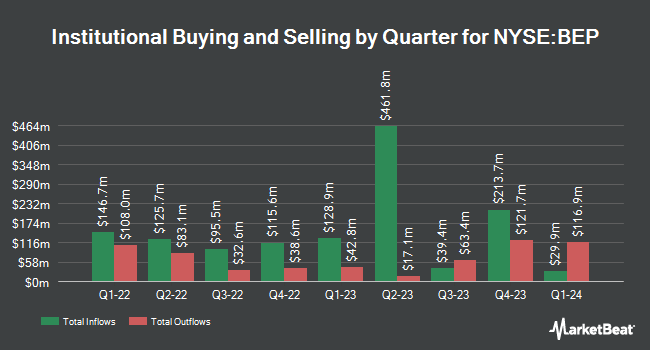

A number of other institutional investors and hedge funds also recently made changes to their positions in the company. GAMMA Investing LLC raised its holdings in Brookfield Renewable Partners by 86.5% in the third quarter. GAMMA Investing LLC now owns 953 shares of the utilities provider's stock worth $27,000 after purchasing an additional 442 shares in the last quarter. Clearbridge Investments LLC lifted its position in Brookfield Renewable Partners by 0.9% during the 1st quarter. Clearbridge Investments LLC now owns 86,830 shares of the utilities provider's stock valued at $2,017,000 after acquiring an additional 768 shares during the period. Tidal Investments LLC boosted its stake in Brookfield Renewable Partners by 2.5% during the first quarter. Tidal Investments LLC now owns 37,258 shares of the utilities provider's stock worth $866,000 after acquiring an additional 894 shares in the last quarter. The Manufacturers Life Insurance Company grew its holdings in Brookfield Renewable Partners by 0.5% in the second quarter. The Manufacturers Life Insurance Company now owns 282,574 shares of the utilities provider's stock worth $6,988,000 after purchasing an additional 1,333 shares during the period. Finally, SFE Investment Counsel increased its stake in shares of Brookfield Renewable Partners by 3.1% during the second quarter. SFE Investment Counsel now owns 51,927 shares of the utilities provider's stock valued at $1,286,000 after purchasing an additional 1,580 shares in the last quarter. Hedge funds and other institutional investors own 63.16% of the company's stock.

Brookfield Renewable Partners Stock Performance

NYSE:BEP traded up $0.26 during trading hours on Friday, reaching $26.47. The company had a trading volume of 222,033 shares, compared to its average volume of 478,479. The firm's 50 day moving average price is $26.45 and its 200-day moving average price is $25.74. The firm has a market cap of $7.55 billion, a price-to-earnings ratio of -40.90 and a beta of 0.95. The company has a current ratio of 0.52, a quick ratio of 0.52 and a debt-to-equity ratio of 0.91. Brookfield Renewable Partners L.P. has a 52 week low of $19.92 and a 52 week high of $29.56.

Analysts Set New Price Targets

A number of research firms recently weighed in on BEP. Royal Bank of Canada reaffirmed an "outperform" rating and set a $31.00 price objective on shares of Brookfield Renewable Partners in a research report on Wednesday, October 9th. UBS Group upgraded Brookfield Renewable Partners from a "neutral" rating to a "buy" rating and raised their price target for the company from $24.00 to $31.00 in a report on Monday, September 30th. CIBC lifted their price target on Brookfield Renewable Partners from $33.00 to $34.00 and gave the stock an "outperformer" rating in a research report on Tuesday, October 22nd. StockNews.com lowered shares of Brookfield Renewable Partners from a "hold" rating to a "sell" rating in a research note on Friday, August 2nd. Finally, National Bankshares lifted their target price on shares of Brookfield Renewable Partners from $32.00 to $33.00 and gave the stock an "outperform" rating in a report on Friday, July 19th. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $31.78.

View Our Latest Analysis on Brookfield Renewable Partners

Brookfield Renewable Partners Profile

(

Free Report)

Brookfield Renewable Partners L.P. owns a portfolio of renewable power generating facilities primarily in North America, Colombia, and Brazil. The company generates electricity through hydroelectric, wind, solar, distributed generation, and pumped storage, as well as renewable natural gas, carbon capture and storage, recycling, cogeneration biomass, nuclear services, and power transformation.

Featured Articles

Before you consider Brookfield Renewable Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Renewable Partners wasn't on the list.

While Brookfield Renewable Partners currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.