Principal Financial Group Inc. reduced its stake in Flowserve Co. (NYSE:FLS - Free Report) by 30.6% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 304,103 shares of the industrial products company's stock after selling 134,286 shares during the period. Principal Financial Group Inc. owned about 0.23% of Flowserve worth $15,719,000 at the end of the most recent reporting period.

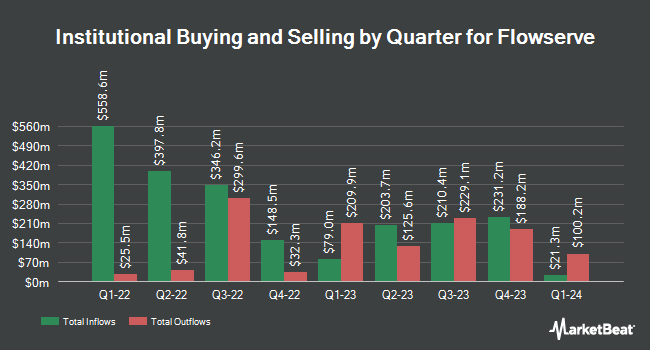

Other hedge funds also recently made changes to their positions in the company. Millennium Management LLC boosted its position in shares of Flowserve by 155.2% during the second quarter. Millennium Management LLC now owns 2,624,919 shares of the industrial products company's stock valued at $126,259,000 after purchasing an additional 1,596,429 shares in the last quarter. Silvercrest Asset Management Group LLC bought a new position in shares of Flowserve during the first quarter valued at $41,413,000. Vaughan Nelson Investment Management L.P. purchased a new stake in Flowserve during the 2nd quarter valued at about $37,100,000. AQR Capital Management LLC raised its holdings in Flowserve by 31.8% in the second quarter. AQR Capital Management LLC now owns 2,748,885 shares of the industrial products company's stock worth $132,221,000 after buying an additional 663,631 shares during the last quarter. Finally, Wealth Enhancement Advisory Services LLC lifted its stake in shares of Flowserve by 5,256.0% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 612,298 shares of the industrial products company's stock worth $29,452,000 after buying an additional 600,866 shares in the last quarter. 93.93% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts recently commented on FLS shares. Stifel Nicolaus increased their price objective on Flowserve from $60.00 to $61.00 and gave the company a "buy" rating in a research report on Wednesday, October 16th. Jefferies Financial Group initiated coverage on Flowserve in a report on Friday, October 18th. They issued a "buy" rating and a $65.00 target price on the stock. Robert W. Baird raised their price objective on shares of Flowserve from $65.00 to $66.00 and gave the stock a "neutral" rating in a report on Wednesday, October 30th. StockNews.com downgraded Flowserve from a "strong-buy" rating to a "buy" rating in a research report on Thursday, August 8th. Finally, The Goldman Sachs Group upped their target price on shares of Flowserve from $46.00 to $52.00 and gave the stock a "sell" rating in a report on Thursday, October 10th. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating and eight have given a buy rating to the company. According to MarketBeat.com, Flowserve has an average rating of "Moderate Buy" and a consensus price target of $60.10.

Get Our Latest Stock Report on FLS

Flowserve Stock Performance

Shares of NYSE:FLS traded up $0.04 during trading on Friday, hitting $59.23. The stock had a trading volume of 676,296 shares, compared to its average volume of 1,097,832. Flowserve Co. has a 12-month low of $37.24 and a 12-month high of $61.60. The company has a quick ratio of 1.39, a current ratio of 1.99 and a debt-to-equity ratio of 0.56. The stock has a market capitalization of $7.78 billion, a price-to-earnings ratio of 29.32, a price-to-earnings-growth ratio of 1.44 and a beta of 1.38. The stock has a 50-day simple moving average of $52.97 and a two-hundred day simple moving average of $49.93.

Flowserve (NYSE:FLS - Get Free Report) last announced its quarterly earnings results on Monday, October 28th. The industrial products company reported $0.62 earnings per share for the quarter, missing the consensus estimate of $0.67 by ($0.05). The company had revenue of $1.13 billion for the quarter, compared to analysts' expectations of $1.12 billion. Flowserve had a net margin of 5.90% and a return on equity of 17.10%. The firm's revenue was up 3.5% compared to the same quarter last year. During the same quarter in the prior year, the business posted $0.50 earnings per share. On average, equities research analysts expect that Flowserve Co. will post 2.72 earnings per share for the current fiscal year.

Flowserve Company Profile

(

Free Report)

Flowserve Corporation designs, manufactures, distributes, and services industrial flow management equipment in the United States, Canada, Mexico, Europe, the Middle East, Africa, and the Asia Pacific. It operates through Flowserve Pump Division (FPD) and Flow Control Division (FCD) segments. The FPD segment offers custom and pre-configured pumps and pump systems, mechanical seals, auxiliary systems, replacement parts, upgrades, and related aftermarket services; and equipment services, including installation and commissioning services, seal systems spare parts, repairs, advanced diagnostics, re-rate and upgrade solutions, retrofit programs, and machining and asset management solutions, as well as manufactures a gas-lubricated mechanical seal for use in high-speed compressors for gas pipelines and in the oil and gas production and process markets.

See Also

Before you consider Flowserve, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flowserve wasn't on the list.

While Flowserve currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.