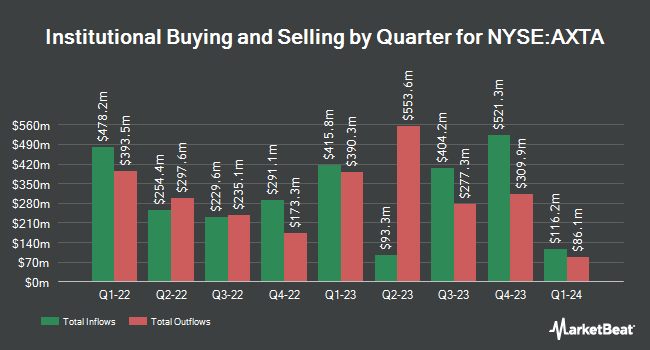

Principal Financial Group Inc. trimmed its holdings in Axalta Coating Systems Ltd. (NYSE:AXTA - Free Report) by 30.9% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 507,707 shares of the specialty chemicals company's stock after selling 226,874 shares during the period. Principal Financial Group Inc. owned about 0.23% of Axalta Coating Systems worth $18,374,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds have also recently made changes to their positions in the company. Plato Investment Management Ltd purchased a new position in shares of Axalta Coating Systems in the 2nd quarter worth approximately $30,000. GAMMA Investing LLC grew its stake in Axalta Coating Systems by 111.5% in the 2nd quarter. GAMMA Investing LLC now owns 1,417 shares of the specialty chemicals company's stock valued at $48,000 after purchasing an additional 747 shares during the period. UMB Bank n.a. increased its position in shares of Axalta Coating Systems by 90.2% during the 3rd quarter. UMB Bank n.a. now owns 1,546 shares of the specialty chemicals company's stock valued at $56,000 after purchasing an additional 733 shares during the last quarter. Versant Capital Management Inc bought a new stake in shares of Axalta Coating Systems during the 2nd quarter worth $71,000. Finally, Quarry LP purchased a new position in shares of Axalta Coating Systems in the 2nd quarter worth about $73,000. 98.28% of the stock is currently owned by institutional investors and hedge funds.

Axalta Coating Systems Price Performance

NYSE AXTA traded down $0.36 during trading on Friday, reaching $40.30. The company's stock had a trading volume of 1,309,040 shares, compared to its average volume of 2,024,540. The firm has a fifty day moving average of $36.68 and a 200 day moving average of $35.58. Axalta Coating Systems Ltd. has a one year low of $30.40 and a one year high of $40.91. The stock has a market capitalization of $8.79 billion, a PE ratio of 27.43, a P/E/G ratio of 0.87 and a beta of 1.43. The company has a debt-to-equity ratio of 1.80, a current ratio of 2.00 and a quick ratio of 1.42.

Axalta Coating Systems (NYSE:AXTA - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The specialty chemicals company reported $0.59 earnings per share for the quarter, topping the consensus estimate of $0.51 by $0.08. Axalta Coating Systems had a net margin of 6.22% and a return on equity of 24.92%. The company had revenue of $1.32 billion for the quarter, compared to analysts' expectations of $1.32 billion. During the same period in the prior year, the business earned $0.45 earnings per share. Axalta Coating Systems's revenue for the quarter was up .8% compared to the same quarter last year. Analysts expect that Axalta Coating Systems Ltd. will post 2.16 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

AXTA has been the topic of several research analyst reports. Robert W. Baird upped their price objective on Axalta Coating Systems from $40.00 to $42.00 and gave the company an "outperform" rating in a research note on Friday, August 2nd. Royal Bank of Canada increased their price target on Axalta Coating Systems from $44.00 to $46.00 and gave the stock an "outperform" rating in a research note on Friday, November 1st. Evercore ISI started coverage on Axalta Coating Systems in a research note on Wednesday. They issued an "outperform" rating and a $47.00 price objective on the stock. Mizuho upped their price objective on shares of Axalta Coating Systems from $42.00 to $43.00 and gave the company an "outperform" rating in a report on Thursday, October 31st. Finally, Barclays lifted their target price on shares of Axalta Coating Systems from $42.00 to $44.00 and gave the stock an "overweight" rating in a research note on Friday, November 1st. Two analysts have rated the stock with a hold rating, eight have assigned a buy rating and two have assigned a strong buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Buy" and an average price target of $42.45.

Check Out Our Latest Stock Report on Axalta Coating Systems

Axalta Coating Systems Company Profile

(

Free Report)

Axalta Coating Systems Ltd., through its subsidiaries, manufactures, markets, and distributes high-performance coatings systems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates through two segments, Performance Coatings and Mobility Coatings.

Read More

Before you consider Axalta Coating Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axalta Coating Systems wasn't on the list.

While Axalta Coating Systems currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.