Principal Financial Group Inc. trimmed its position in shares of Brixmor Property Group Inc. (NYSE:BRX - Free Report) by 30.5% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 697,482 shares of the real estate investment trust's stock after selling 305,735 shares during the quarter. Principal Financial Group Inc. owned 0.23% of Brixmor Property Group worth $19,432,000 as of its most recent filing with the Securities & Exchange Commission.

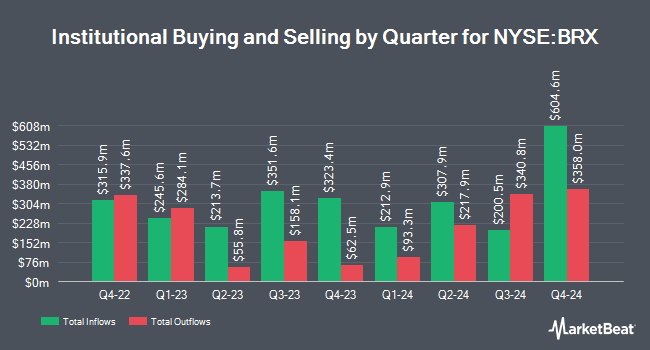

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. UMB Bank n.a. grew its holdings in Brixmor Property Group by 328.6% during the 3rd quarter. UMB Bank n.a. now owns 943 shares of the real estate investment trust's stock worth $26,000 after acquiring an additional 723 shares in the last quarter. Blue Trust Inc. increased its holdings in Brixmor Property Group by 258.9% during the second quarter. Blue Trust Inc. now owns 1,396 shares of the real estate investment trust's stock valued at $33,000 after buying an additional 1,007 shares during the period. Maryland Capital Advisors Inc. purchased a new position in shares of Brixmor Property Group in the 3rd quarter valued at $46,000. Abich Financial Wealth Management LLC lifted its position in shares of Brixmor Property Group by 50.7% during the first quarter. Abich Financial Wealth Management LLC now owns 2,305 shares of the real estate investment trust's stock valued at $54,000 after buying an additional 775 shares during the last quarter. Finally, Fifth Third Bancorp boosted its holdings in shares of Brixmor Property Group by 19.1% in the 2nd quarter. Fifth Third Bancorp now owns 2,684 shares of the real estate investment trust's stock valued at $62,000 after buying an additional 431 shares in the last quarter. 98.43% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities research analysts have weighed in on the stock. Mizuho raised their target price on shares of Brixmor Property Group from $23.00 to $27.00 and gave the company a "neutral" rating in a research note on Monday, August 19th. The Goldman Sachs Group boosted their target price on Brixmor Property Group from $26.00 to $29.00 and gave the stock a "buy" rating in a research note on Thursday, August 1st. Evercore ISI increased their price target on Brixmor Property Group from $27.00 to $28.00 and gave the company an "in-line" rating in a research note on Monday, September 16th. StockNews.com downgraded shares of Brixmor Property Group from a "buy" rating to a "hold" rating in a report on Wednesday, August 7th. Finally, Piper Sandler reiterated an "overweight" rating and issued a $33.00 target price (up from $30.00) on shares of Brixmor Property Group in a research note on Wednesday, July 31st. Five research analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. According to MarketBeat, Brixmor Property Group currently has a consensus rating of "Moderate Buy" and an average price target of $29.13.

View Our Latest Report on BRX

Brixmor Property Group Trading Up 0.8 %

Shares of BRX stock traded up $0.23 during trading hours on Friday, hitting $28.91. The company had a trading volume of 818,609 shares, compared to its average volume of 2,281,633. The stock has a market capitalization of $8.73 billion, a PE ratio of 26.56, a price-to-earnings-growth ratio of 3.93 and a beta of 1.57. The company has a debt-to-equity ratio of 1.85, a current ratio of 1.38 and a quick ratio of 1.38. Brixmor Property Group Inc. has a fifty-two week low of $20.80 and a fifty-two week high of $29.19. The company's fifty day moving average is $27.76 and its 200 day moving average is $25.15.

Brixmor Property Group (NYSE:BRX - Get Free Report) last posted its quarterly earnings data on Monday, October 28th. The real estate investment trust reported $0.32 EPS for the quarter, missing the consensus estimate of $0.53 by ($0.21). Brixmor Property Group had a net margin of 25.81% and a return on equity of 11.48%. The business had revenue of $320.68 million during the quarter, compared to analysts' expectations of $320.22 million. During the same period in the previous year, the business posted $0.50 EPS. The company's revenue for the quarter was up 4.3% compared to the same quarter last year. Research analysts expect that Brixmor Property Group Inc. will post 2.14 earnings per share for the current fiscal year.

Brixmor Property Group Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Friday, January 3rd will be given a dividend of $0.287 per share. This is a boost from Brixmor Property Group's previous quarterly dividend of $0.27. This represents a $1.15 annualized dividend and a dividend yield of 3.97%. The ex-dividend date is Friday, January 3rd. Brixmor Property Group's dividend payout ratio is currently 100.93%.

About Brixmor Property Group

(

Free Report)

Brixmor NYSE: BRX is a real estate investment trust (REIT) that owns and operates a high-quality, national portfolio of open-air shopping centers. Its 362 retail centers comprise approximately 64 million square feet of prime retail space in established trade areas. The Company strives to own and operate shopping centers that reflect Brixmor's vision to be the center of the communities we serve and are home to a diverse mix of thriving national, regional and local retailers.

Recommended Stories

Before you consider Brixmor Property Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brixmor Property Group wasn't on the list.

While Brixmor Property Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.