Principal Financial Group Inc. lifted its position in Warner Bros. Discovery, Inc. (NASDAQ:WBD - Free Report) by 3.1% during the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 2,579,571 shares of the company's stock after purchasing an additional 78,653 shares during the period. Principal Financial Group Inc. owned about 0.11% of Warner Bros. Discovery worth $21,281,000 as of its most recent SEC filing.

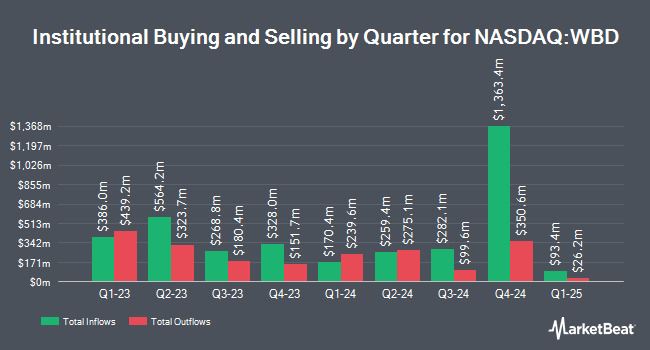

Several other hedge funds also recently made changes to their positions in the company. OFI Invest Asset Management grew its position in shares of Warner Bros. Discovery by 45.9% in the 2nd quarter. OFI Invest Asset Management now owns 3,879 shares of the company's stock worth $27,000 after buying an additional 1,221 shares during the last quarter. GAM Holding AG lifted its stake in Warner Bros. Discovery by 0.3% in the third quarter. GAM Holding AG now owns 457,685 shares of the company's stock worth $3,776,000 after acquiring an additional 1,437 shares during the period. Waldron Private Wealth LLC boosted its holdings in Warner Bros. Discovery by 5.4% in the third quarter. Waldron Private Wealth LLC now owns 28,348 shares of the company's stock valued at $234,000 after acquiring an additional 1,461 shares in the last quarter. PFG Investments LLC increased its position in Warner Bros. Discovery by 1.4% during the 3rd quarter. PFG Investments LLC now owns 112,307 shares of the company's stock valued at $927,000 after purchasing an additional 1,517 shares during the period. Finally, Dynamic Advisor Solutions LLC raised its holdings in Warner Bros. Discovery by 13.1% in the 3rd quarter. Dynamic Advisor Solutions LLC now owns 13,476 shares of the company's stock worth $111,000 after purchasing an additional 1,565 shares in the last quarter. 59.95% of the stock is owned by hedge funds and other institutional investors.

Warner Bros. Discovery Stock Up 1.0 %

WBD traded up $0.10 during trading on Thursday, hitting $9.82. 21,990,395 shares of the company's stock traded hands, compared to its average volume of 29,302,586. Warner Bros. Discovery, Inc. has a 12-month low of $6.64 and a 12-month high of $12.70. The company's 50 day simple moving average is $8.01 and its two-hundred day simple moving average is $7.86. The company has a current ratio of 0.80, a quick ratio of 0.80 and a debt-to-equity ratio of 1.03. The stock has a market capitalization of $24.08 billion, a price-to-earnings ratio of -2.12 and a beta of 1.48.

Warner Bros. Discovery (NASDAQ:WBD - Get Free Report) last posted its earnings results on Thursday, November 7th. The company reported $0.05 earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.07) by $0.12. Warner Bros. Discovery had a negative net margin of 28.34% and a negative return on equity of 27.56%. The business had revenue of $9.62 billion for the quarter, compared to analysts' expectations of $9.79 billion. During the same quarter in the prior year, the business earned ($0.17) EPS. The business's revenue for the quarter was down 3.6% compared to the same quarter last year. Analysts predict that Warner Bros. Discovery, Inc. will post -4.41 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

WBD has been the topic of several research analyst reports. Evercore ISI reduced their price target on shares of Warner Bros. Discovery from $10.00 to $9.00 and set an "outperform" rating on the stock in a research report on Thursday, August 8th. JPMorgan Chase & Co. reduced their target price on Warner Bros. Discovery from $10.00 to $8.00 and set a "neutral" rating on the stock in a report on Friday, August 9th. Wolfe Research upgraded Warner Bros. Discovery from an "underperform" rating to a "peer perform" rating in a research note on Monday. Barrington Research reaffirmed an "outperform" rating and issued a $12.00 price target on shares of Warner Bros. Discovery in a research note on Thursday, November 7th. Finally, Deutsche Bank Aktiengesellschaft decreased their price objective on Warner Bros. Discovery from $16.00 to $15.00 and set a "buy" rating for the company in a report on Thursday, August 8th. Twelve research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $10.55.

Read Our Latest Stock Report on Warner Bros. Discovery

About Warner Bros. Discovery

(

Free Report)

Warner Bros. Discovery, Inc operates as a media and entertainment company worldwide. It operates through three segments: Studios, Network, and DTC. The Studios segment produces and releases feature films for initial exhibition in theaters; produces and licenses television programs to its networks and third parties and direct-to-consumer services; distributes films and television programs to various third parties and internal television; and offers streaming services and distribution through the home entertainment market, themed experience licensing, and interactive gaming.

Further Reading

Before you consider Warner Bros. Discovery, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warner Bros. Discovery wasn't on the list.

While Warner Bros. Discovery currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.