Principal Financial Group Inc. cut its position in shares of Matson, Inc. (NYSE:MATX - Free Report) by 5.9% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 176,011 shares of the shipping company's stock after selling 11,121 shares during the period. Principal Financial Group Inc. owned approximately 0.50% of Matson worth $25,103,000 at the end of the most recent quarter.

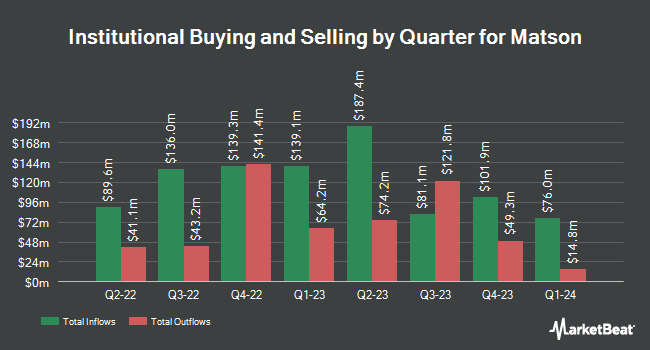

Other large investors also recently added to or reduced their stakes in the company. Vanguard Group Inc. raised its stake in shares of Matson by 5.7% during the 1st quarter. Vanguard Group Inc. now owns 3,984,076 shares of the shipping company's stock worth $447,810,000 after acquiring an additional 215,452 shares in the last quarter. American Century Companies Inc. increased its stake in Matson by 4.2% during the 2nd quarter. American Century Companies Inc. now owns 911,827 shares of the shipping company's stock valued at $119,422,000 after purchasing an additional 36,901 shares in the last quarter. Encompass Capital Advisors LLC increased its stake in Matson by 52.1% during the 2nd quarter. Encompass Capital Advisors LLC now owns 356,416 shares of the shipping company's stock valued at $46,680,000 after purchasing an additional 122,017 shares in the last quarter. Millennium Management LLC increased its stake in Matson by 126.5% during the 2nd quarter. Millennium Management LLC now owns 240,117 shares of the shipping company's stock valued at $31,448,000 after purchasing an additional 134,092 shares in the last quarter. Finally, Forest Avenue Capital Management LP increased its stake in Matson by 50.2% during the 2nd quarter. Forest Avenue Capital Management LP now owns 232,455 shares of the shipping company's stock valued at $30,445,000 after purchasing an additional 77,731 shares in the last quarter. 84.76% of the stock is owned by hedge funds and other institutional investors.

Matson Stock Performance

NYSE MATX traded up $4.95 during mid-day trading on Wednesday, reaching $168.92. 144,356 shares of the stock were exchanged, compared to its average volume of 274,917. The business's 50 day moving average is $138.91 and its 200-day moving average is $129.87. Matson, Inc. has a 1 year low of $91.96 and a 1 year high of $169.00. The company has a market capitalization of $5.61 billion, a P/E ratio of 13.63 and a beta of 1.06. The company has a debt-to-equity ratio of 0.14, a quick ratio of 1.13 and a current ratio of 1.13.

Matson (NYSE:MATX - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The shipping company reported $5.89 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $4.98 by $0.91. The firm had revenue of $962.00 million for the quarter, compared to the consensus estimate of $965.73 million. Matson had a net margin of 12.37% and a return on equity of 16.89%. The firm's quarterly revenue was up 16.3% compared to the same quarter last year. During the same period in the prior year, the firm posted $3.40 earnings per share. On average, equities research analysts forecast that Matson, Inc. will post 13.19 EPS for the current fiscal year.

Matson Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 5th. Shareholders of record on Thursday, November 7th will be given a dividend of $0.34 per share. This represents a $1.36 dividend on an annualized basis and a yield of 0.81%. The ex-dividend date of this dividend is Thursday, November 7th. Matson's dividend payout ratio is presently 11.31%.

Insider Activity

In other news, EVP John P. Lauer sold 3,354 shares of the stock in a transaction dated Wednesday, August 21st. The shares were sold at an average price of $132.48, for a total value of $444,337.92. Following the completion of the sale, the executive vice president now directly owns 27,098 shares in the company, valued at $3,589,943.04. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. In other Matson news, EVP Peter T. Heilmann sold 5,404 shares of the business's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $162.36, for a total value of $877,393.44. Following the transaction, the executive vice president now directly owns 32,952 shares in the company, valued at $5,350,086.72. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, EVP John P. Lauer sold 3,354 shares of the business's stock in a transaction dated Wednesday, August 21st. The shares were sold at an average price of $132.48, for a total transaction of $444,337.92. Following the completion of the transaction, the executive vice president now owns 27,098 shares in the company, valued at $3,589,943.04. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 25,864 shares of company stock worth $3,716,059 over the last three months. Insiders own 2.32% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts have issued reports on the stock. StockNews.com lowered shares of Matson from a "strong-buy" rating to a "buy" rating in a research note on Friday, September 6th. Stephens upped their price objective on shares of Matson from $155.00 to $160.00 and gave the company an "overweight" rating in a report on Friday, August 2nd.

Read Our Latest Stock Analysis on Matson

Matson Company Profile

(

Free Report)

Matson, Inc, together with its subsidiaries, engages in the provision of ocean transportation and logistics services. It operates through two segments, Ocean Transportation and Logistics. The Ocean Transportation segment offers ocean freight transportation services to the domestic non-contiguous economies of Hawaii, Japan, Alaska, and Guam, as well as to other island economies in Micronesia.

Read More

Before you consider Matson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Matson wasn't on the list.

While Matson currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report