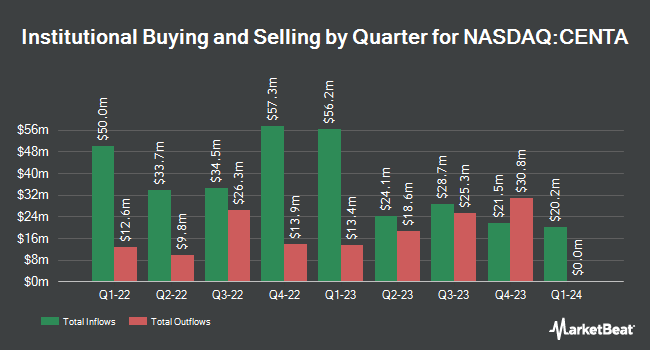

Principal Financial Group Inc. lessened its stake in Central Garden & Pet (NASDAQ:CENTA - Free Report) by 6.4% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 259,442 shares of the company's stock after selling 17,762 shares during the period. Principal Financial Group Inc. owned 0.38% of Central Garden & Pet worth $8,146,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other large investors also recently bought and sold shares of the company. James Investment Research Inc. grew its stake in Central Garden & Pet by 23.2% during the 3rd quarter. James Investment Research Inc. now owns 30,302 shares of the company's stock worth $951,000 after buying an additional 5,712 shares during the last quarter. GHP Investment Advisors Inc. lifted its holdings in Central Garden & Pet by 2.6% during the 3rd quarter. GHP Investment Advisors Inc. now owns 91,775 shares of the company's stock worth $2,882,000 after buying an additional 2,352 shares during the last quarter. Wealth Enhancement Advisory Services LLC raised its position in shares of Central Garden & Pet by 39.2% during the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 12,650 shares of the company's stock worth $397,000 after purchasing an additional 3,560 shares during the period. Allspring Global Investments Holdings LLC increased its position in shares of Central Garden & Pet by 1.8% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 2,100,751 shares of the company's stock valued at $65,964,000 after purchasing an additional 38,077 shares during the period. Finally, CWM LLC boosted its stake in shares of Central Garden & Pet by 72.6% during the 3rd quarter. CWM LLC now owns 1,957 shares of the company's stock worth $61,000 after acquiring an additional 823 shares in the last quarter. 50.82% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several equities research analysts recently commented on the stock. JPMorgan Chase & Co. cut their price objective on shares of Central Garden & Pet from $34.00 to $32.00 and set a "neutral" rating on the stock in a research report on Friday, October 11th. StockNews.com cut shares of Central Garden & Pet from a "buy" rating to a "hold" rating in a report on Wednesday, October 16th. Two analysts have rated the stock with a hold rating, two have assigned a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Buy" and an average price target of $41.33.

Get Our Latest Stock Analysis on Central Garden & Pet

Insider Transactions at Central Garden & Pet

In related news, Chairman William E. Brown sold 60,000 shares of the stock in a transaction dated Friday, August 30th. The shares were sold at an average price of $33.54, for a total value of $2,012,400.00. Following the sale, the chairman now directly owns 1,125,773 shares of the company's stock, valued at $37,758,426.42. This represents a 5.06 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Corporate insiders own 20.28% of the company's stock.

Central Garden & Pet Stock Up 1.9 %

CENTA stock traded up $0.60 during mid-day trading on Wednesday, reaching $32.04. The company had a trading volume of 194,789 shares, compared to its average volume of 279,643. The company has a market capitalization of $2.16 billion, a price-to-earnings ratio of 14.53 and a beta of 0.73. The stock has a 50 day simple moving average of $30.78 and a two-hundred day simple moving average of $33.39. The company has a debt-to-equity ratio of 0.75, a current ratio of 3.66 and a quick ratio of 2.16. Central Garden & Pet has a 52 week low of $27.70 and a 52 week high of $41.03.

Central Garden & Pet Profile

(

Free Report)

Central Garden & Pet Company produces and distributes various products for the lawn and garden, and pet supplies markets in the United States. It operates through two segments: Pet and Garden. The Pet segment provides dog and cat supplies, such as dog treats and chews, toys, pet beds and containment, grooming products, waste management, and training pads; supplies for aquatics, small animals, reptiles, and pet birds, including toys, cages and habitats, bedding, and food and supplements; products for equine and livestock; animal and household health and insect control products; aquariums and terrariums, including fixtures and stands, water conditioners and supplements, water pumps and filters, and lighting systems and accessories; and live fish and small animals, as well as outdoor cushions.

Featured Articles

Before you consider Central Garden & Pet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Central Garden & Pet wasn't on the list.

While Central Garden & Pet currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.