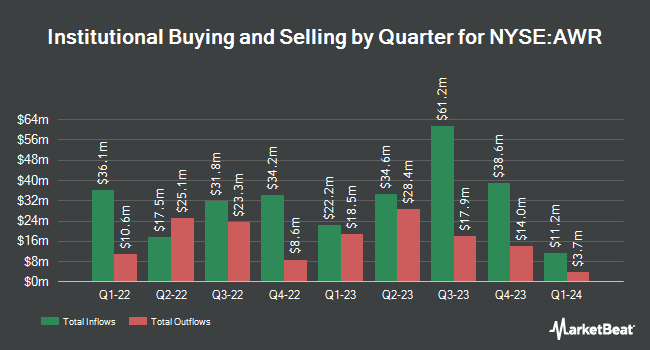

Principal Financial Group Inc. boosted its stake in American States Water (NYSE:AWR - Free Report) by 107.1% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 381,981 shares of the utilities provider's stock after purchasing an additional 197,556 shares during the quarter. Principal Financial Group Inc. owned about 1.02% of American States Water worth $31,815,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also bought and sold shares of the stock. Pathway Financial Advisers LLC boosted its holdings in American States Water by 8,274.7% in the third quarter. Pathway Financial Advisers LLC now owns 309,363 shares of the utilities provider's stock valued at $25,767,000 after acquiring an additional 305,669 shares during the last quarter. Millennium Management LLC boosted its holdings in American States Water by 205.5% in the second quarter. Millennium Management LLC now owns 440,598 shares of the utilities provider's stock valued at $31,974,000 after acquiring an additional 296,361 shares during the last quarter. Assenagon Asset Management S.A. boosted its holdings in American States Water by 114.0% in the third quarter. Assenagon Asset Management S.A. now owns 271,325 shares of the utilities provider's stock valued at $22,599,000 after acquiring an additional 144,510 shares during the last quarter. Victory Capital Management Inc. boosted its holdings in American States Water by 182.8% in the second quarter. Victory Capital Management Inc. now owns 220,718 shares of the utilities provider's stock valued at $16,018,000 after acquiring an additional 142,664 shares during the last quarter. Finally, Vanguard Group Inc. boosted its holdings in American States Water by 2.9% in the first quarter. Vanguard Group Inc. now owns 4,760,524 shares of the utilities provider's stock valued at $343,900,000 after acquiring an additional 132,674 shares during the last quarter. Institutional investors and hedge funds own 75.24% of the company's stock.

American States Water Price Performance

Shares of NYSE:AWR traded down $0.48 on Tuesday, hitting $85.90. The company's stock had a trading volume of 260,688 shares, compared to its average volume of 218,389. The company has a market capitalization of $3.22 billion, a PE ratio of 29.18, a PEG ratio of 4.53 and a beta of 0.49. The company has a debt-to-equity ratio of 0.86, a current ratio of 0.69 and a quick ratio of 0.64. American States Water has a 1 year low of $66.03 and a 1 year high of $87.50. The company has a 50-day simple moving average of $83.48 and a 200 day simple moving average of $78.94.

American States Water (NYSE:AWR - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The utilities provider reported $0.95 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.98 by ($0.03). American States Water had a return on equity of 13.53% and a net margin of 19.26%. The company had revenue of $161.78 million for the quarter, compared to the consensus estimate of $161.00 million. During the same quarter in the previous year, the business earned $0.85 earnings per share. American States Water's revenue was up 6.6% compared to the same quarter last year. Sell-side analysts forecast that American States Water will post 3.03 EPS for the current fiscal year.

American States Water Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 2nd. Stockholders of record on Friday, November 15th will be paid a $0.4655 dividend. This represents a $1.86 annualized dividend and a dividend yield of 2.17%. The ex-dividend date is Friday, November 15th. American States Water's dividend payout ratio is currently 62.63%.

Analysts Set New Price Targets

AWR has been the topic of several recent analyst reports. StockNews.com raised American States Water from a "sell" rating to a "hold" rating in a research note on Friday. Wells Fargo & Company upgraded American States Water from an "underweight" rating to an "equal weight" rating and upped their price objective for the company from $80.00 to $87.00 in a research note on Wednesday, July 31st.

Read Our Latest Report on AWR

Insider Transactions at American States Water

In related news, Director Anne M. Holloway sold 500 shares of American States Water stock in a transaction on Thursday, August 22nd. The stock was sold at an average price of $80.89, for a total value of $40,445.00. Following the completion of the sale, the director now owns 38,519 shares of the company's stock, valued at $3,115,801.91. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Company insiders own 0.82% of the company's stock.

About American States Water

(

Free Report)

American States Water Company, through its subsidiaries, provides water and electric services to residential, commercial, industrial, and other customers in the United States. It operates through three segments: Water, Electric, and Contracted Services. The company purchases, produces, distributes, and sells water, as well as distributes electricity.

Featured Articles

Before you consider American States Water, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American States Water wasn't on the list.

While American States Water currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.