Principal Financial Group Inc. lifted its holdings in shares of Sunrun Inc. (NASDAQ:RUN - Free Report) by 33.7% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,460,949 shares of the energy company's stock after buying an additional 367,835 shares during the period. Principal Financial Group Inc. owned approximately 0.66% of Sunrun worth $26,385,000 at the end of the most recent reporting period.

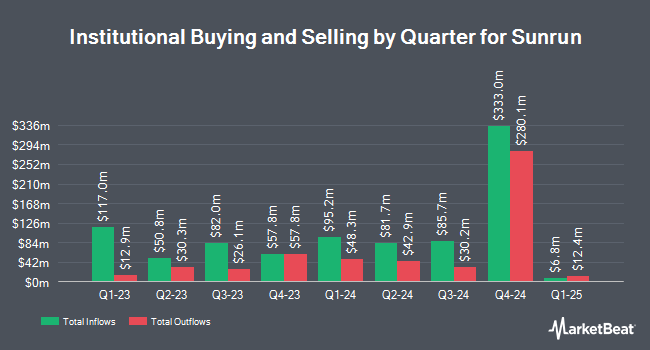

Several other hedge funds and other institutional investors have also bought and sold shares of RUN. International Assets Investment Management LLC raised its stake in shares of Sunrun by 1,706.3% in the third quarter. International Assets Investment Management LLC now owns 1,734 shares of the energy company's stock worth $31,000 after buying an additional 1,638 shares during the period. Blue Trust Inc. raised its position in shares of Sunrun by 385.5% in the 3rd quarter. Blue Trust Inc. now owns 1,845 shares of the energy company's stock valued at $33,000 after purchasing an additional 1,465 shares during the last quarter. Duncker Streett & Co. Inc. acquired a new position in Sunrun in the 2nd quarter worth approximately $36,000. CWM LLC grew its stake in shares of Sunrun by 883.9% during the 2nd quarter. CWM LLC now owns 3,355 shares of the energy company's stock worth $40,000 after purchasing an additional 3,014 shares during the period. Finally, Migdal Insurance & Financial Holdings Ltd. purchased a new position in Sunrun in the 2nd quarter valued at $45,000. Institutional investors own 91.69% of the company's stock.

Analysts Set New Price Targets

RUN has been the topic of several research reports. Wells Fargo & Company reduced their price target on shares of Sunrun from $20.00 to $15.00 and set an "overweight" rating on the stock in a research report on Friday, November 8th. Susquehanna cut their price objective on shares of Sunrun from $24.00 to $23.00 and set a "positive" rating on the stock in a report on Wednesday, October 16th. Oppenheimer decreased their target price on Sunrun from $22.00 to $20.00 and set an "outperform" rating for the company in a research report on Friday, November 8th. StockNews.com upgraded Sunrun to a "sell" rating in a research report on Friday, September 27th. Finally, Barclays lowered their price target on shares of Sunrun from $19.00 to $18.00 and set an "equal weight" rating on the stock in a report on Wednesday, October 16th. Two research analysts have rated the stock with a sell rating, nine have assigned a hold rating and twelve have assigned a buy rating to the company. According to MarketBeat, Sunrun presently has a consensus rating of "Hold" and an average price target of $20.54.

Check Out Our Latest Analysis on RUN

Insider Activity

In other news, Director Lynn Michelle Jurich sold 50,000 shares of Sunrun stock in a transaction that occurred on Friday, October 18th. The stock was sold at an average price of $14.60, for a total transaction of $730,000.00. Following the sale, the director now owns 1,142,446 shares of the company's stock, valued at approximately $16,679,711.60. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. In related news, Director Lynn Michelle Jurich sold 50,000 shares of the firm's stock in a transaction on Friday, October 18th. The shares were sold at an average price of $14.60, for a total value of $730,000.00. Following the transaction, the director now directly owns 1,142,446 shares in the company, valued at approximately $16,679,711.60. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, CFO Danny Abajian sold 2,141 shares of the stock in a transaction on Friday, September 6th. The shares were sold at an average price of $18.23, for a total transaction of $39,030.43. Following the completion of the sale, the chief financial officer now directly owns 276,119 shares of the company's stock, valued at approximately $5,033,649.37. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 155,840 shares of company stock worth $2,755,487. 3.77% of the stock is currently owned by company insiders.

Sunrun Price Performance

Shares of RUN traded up $0.34 during trading hours on Wednesday, reaching $10.08. The company had a trading volume of 6,694,919 shares, compared to its average volume of 12,004,084. Sunrun Inc. has a 12-month low of $9.23 and a 12-month high of $22.26. The company has a market capitalization of $2.26 billion, a price-to-earnings ratio of -5.71 and a beta of 2.61. The firm has a 50 day simple moving average of $16.22 and a 200-day simple moving average of $15.47. The company has a current ratio of 1.47, a quick ratio of 1.15 and a debt-to-equity ratio of 1.92.

About Sunrun

(

Free Report)

Sunrun Inc designs, develops, installs, sells, owns, and maintains residential solar energy systems in the United States. It also sells solar energy systems and products, such as panels and racking; and solar leads generated to customers. In addition, the company offers battery storage along with solar energy systems; and sells services to commercial developers through multi-family and new homes.

See Also

Before you consider Sunrun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunrun wasn't on the list.

While Sunrun currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.