Principal Financial Group Inc. reduced its stake in shares of The Timken Company (NYSE:TKR - Free Report) by 1.2% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 753,149 shares of the industrial products company's stock after selling 9,106 shares during the period. Principal Financial Group Inc. owned 1.07% of Timken worth $63,481,000 as of its most recent SEC filing.

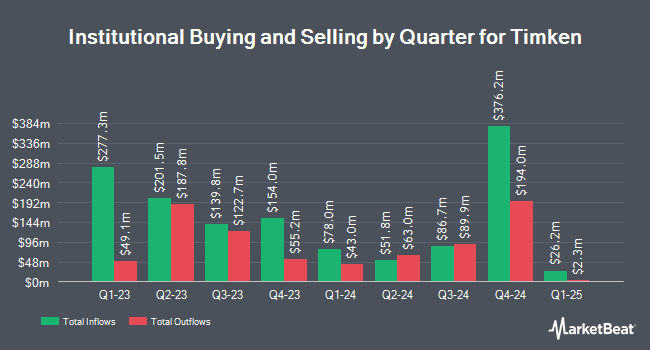

A number of other large investors have also made changes to their positions in the stock. Vanguard Group Inc. boosted its stake in Timken by 5.6% during the first quarter. Vanguard Group Inc. now owns 6,515,972 shares of the industrial products company's stock worth $569,691,000 after buying an additional 347,794 shares during the last quarter. Interval Partners LP acquired a new stake in Timken during the first quarter worth about $22,907,000. American Century Companies Inc. raised its stake in Timken by 4.8% during the second quarter. American Century Companies Inc. now owns 2,817,294 shares of the industrial products company's stock worth $225,750,000 after purchasing an additional 128,791 shares during the period. Kodai Capital Management LP purchased a new position in Timken during the first quarter worth about $9,130,000. Finally, Dimensional Fund Advisors LP grew its stake in shares of Timken by 4.9% in the 2nd quarter. Dimensional Fund Advisors LP now owns 2,104,910 shares of the industrial products company's stock valued at $168,667,000 after buying an additional 97,550 shares during the period. 89.08% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several analysts have recently commented on TKR shares. Citigroup assumed coverage on shares of Timken in a research report on Monday, October 14th. They set a "neutral" rating and a $90.00 price target on the stock. Oppenheimer cut their target price on Timken from $102.00 to $97.00 and set an "outperform" rating for the company in a research note on Wednesday. Evercore ISI decreased their price target on Timken from $94.00 to $87.00 and set an "in-line" rating on the stock in a research note on Monday, August 19th. KeyCorp cut their price objective on Timken from $104.00 to $90.00 and set an "overweight" rating for the company in a research report on Wednesday. Finally, DA Davidson decreased their target price on shares of Timken from $103.00 to $99.00 and set a "buy" rating on the stock in a research report on Wednesday. Eight investment analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $89.60.

Read Our Latest Report on Timken

Timken Trading Down 0.2 %

NYSE:TKR traded down $0.15 on Friday, reaching $76.85. 679,690 shares of the company's stock were exchanged, compared to its average volume of 604,614. The firm has a market capitalization of $5.39 billion, a price-to-earnings ratio of 15.98, a price-to-earnings-growth ratio of 1.14 and a beta of 1.43. The Timken Company has a 52-week low of $70.15 and a 52-week high of $94.71. The company has a quick ratio of 1.64, a current ratio of 3.00 and a debt-to-equity ratio of 0.71. The business has a fifty day moving average of $82.41 and a 200-day moving average of $83.73.

Timken (NYSE:TKR - Get Free Report) last announced its earnings results on Tuesday, November 5th. The industrial products company reported $1.23 earnings per share for the quarter, missing the consensus estimate of $1.38 by ($0.15). Timken had a return on equity of 14.82% and a net margin of 7.41%. The business had revenue of $1.13 billion for the quarter, compared to analysts' expectations of $1.12 billion. During the same period in the previous year, the company earned $1.55 earnings per share. Timken's quarterly revenue was down 1.4% on a year-over-year basis. As a group, analysts expect that The Timken Company will post 5.62 earnings per share for the current year.

Timken Profile

(

Free Report)

The Timken Company designs, manufactures, and sells engineered bearings and industrial motion products, and related services in the United States and internationally. The company's Engineered Bearings segment provides various bearing products, including tapered, spherical, and cylindrical roller bearings; plain bearings, metal-polymer bearings, and rod end bearings; radial, angular, and precision ball bearings; thrust and specialty ball bearings; journal bearings; and housed or mounted bearings.

See Also

Before you consider Timken, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Timken wasn't on the list.

While Timken currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.