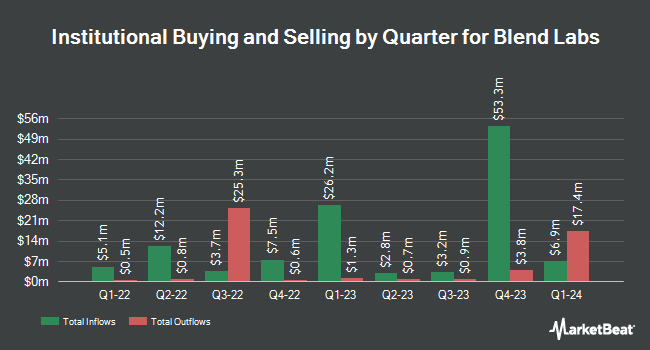

Principal Financial Group Inc. raised its stake in Blend Labs, Inc. (NYSE:BLND - Free Report) by 697.6% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 2,733,004 shares of the company's stock after buying an additional 2,390,337 shares during the period. Principal Financial Group Inc. owned approximately 1.07% of Blend Labs worth $10,249,000 at the end of the most recent reporting period.

A number of other hedge funds have also modified their holdings of BLND. ShawSpring Partners LLC increased its stake in shares of Blend Labs by 58.7% during the 2nd quarter. ShawSpring Partners LLC now owns 6,716,144 shares of the company's stock worth $15,850,000 after purchasing an additional 2,485,283 shares in the last quarter. Acadian Asset Management LLC increased its stake in shares of Blend Labs by 2,656.9% during the 1st quarter. Acadian Asset Management LLC now owns 718,274 shares of the company's stock worth $2,332,000 after purchasing an additional 692,220 shares in the last quarter. Bank of New York Mellon Corp increased its stake in shares of Blend Labs by 3,799.4% during the 2nd quarter. Bank of New York Mellon Corp now owns 654,897 shares of the company's stock worth $1,546,000 after purchasing an additional 638,102 shares in the last quarter. Essex Investment Management Co. LLC purchased a new position in shares of Blend Labs during the 3rd quarter worth approximately $1,803,000. Finally, Lake Street Advisors Group LLC acquired a new stake in Blend Labs during the first quarter worth approximately $1,538,000. 52.56% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at Blend Labs

In related news, insider Winnie Ling sold 20,000 shares of Blend Labs stock in a transaction on Thursday, September 12th. The shares were sold at an average price of $3.33, for a total transaction of $66,600.00. Following the transaction, the insider now owns 286,416 shares in the company, valued at approximately $953,765.28. The trade was a 6.53 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders have sold a total of 54,303 shares of company stock worth $192,926 in the last quarter. 13.21% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of brokerages recently issued reports on BLND. Keefe, Bruyette & Woods raised their target price on shares of Blend Labs from $3.25 to $3.85 and gave the stock a "market perform" rating in a research report on Thursday, November 7th. Canaccord Genuity Group upgraded shares of Blend Labs from a "hold" rating to a "buy" rating and raised their target price for the stock from $3.00 to $4.75 in a research report on Monday, August 12th. William Blair upgraded shares of Blend Labs from a "market perform" rating to an "outperform" rating in a research report on Friday, August 9th. Wells Fargo & Company raised their target price on shares of Blend Labs from $3.50 to $4.50 and gave the stock an "overweight" rating in a research report on Thursday, November 7th. Finally, The Goldman Sachs Group raised their target price on shares of Blend Labs from $3.40 to $3.90 and gave the stock a "buy" rating in a research report on Thursday, November 7th. Two research analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat, Blend Labs presently has an average rating of "Moderate Buy" and an average price target of $4.46.

Check Out Our Latest Stock Analysis on BLND

Blend Labs Trading Up 9.7 %

Shares of BLND traded up $0.44 during mid-day trading on Tuesday, reaching $4.97. The company had a trading volume of 3,151,193 shares, compared to its average volume of 2,290,213. The stock has a market cap of $1.27 billion, a price-to-earnings ratio of -14.62 and a beta of 1.16. The firm has a fifty day simple moving average of $3.83 and a 200-day simple moving average of $3.26. Blend Labs, Inc. has a fifty-two week low of $1.18 and a fifty-two week high of $4.98.

About Blend Labs

(

Free Report)

Blend Labs, Inc engages in the provision of cloud-based software platform solutions for financial services firms in the United States. It operates in two segments, Blend Platform and Title365. The company's Blend Builder Platform offers a suite of products that powers digital-first consumer journeys for mortgages, home equity loans and lines of credit, vehicle loans, personal loans, credit cards, and deposit accounts; and offers mortgage products to facilitate the homeownership journey for consumers comprising close, income verification for mortgage, homeowners' insurance, and realty.

See Also

Before you consider Blend Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blend Labs wasn't on the list.

While Blend Labs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.