Principal Financial Group Inc. trimmed its holdings in shares of MGP Ingredients, Inc. (NASDAQ:MGPI - Free Report) by 14.0% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 66,661 shares of the company's stock after selling 10,824 shares during the period. Principal Financial Group Inc. owned 0.30% of MGP Ingredients worth $5,550,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

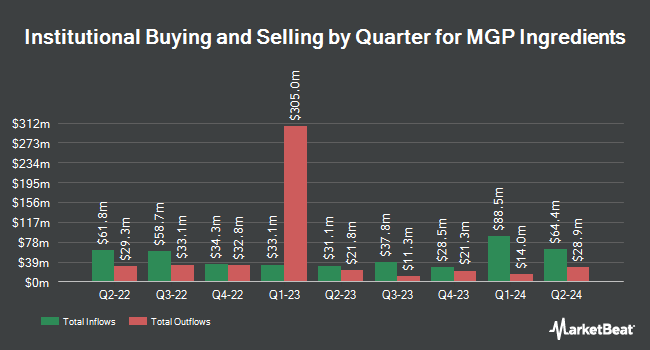

Several other hedge funds also recently added to or reduced their stakes in the stock. CWM LLC lifted its position in MGP Ingredients by 477.9% during the second quarter. CWM LLC now owns 393 shares of the company's stock valued at $29,000 after buying an additional 325 shares in the last quarter. LRI Investments LLC acquired a new stake in MGP Ingredients during the first quarter valued at approximately $43,000. Innealta Capital LLC bought a new position in MGP Ingredients during the second quarter worth $42,000. Farther Finance Advisors LLC grew its position in shares of MGP Ingredients by 45.3% during the 3rd quarter. Farther Finance Advisors LLC now owns 597 shares of the company's stock valued at $50,000 after buying an additional 186 shares during the last quarter. Finally, Covestor Ltd raised its position in shares of MGP Ingredients by 23.3% during the 1st quarter. Covestor Ltd now owns 795 shares of the company's stock worth $68,000 after purchasing an additional 150 shares during the period. 77.11% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of research firms have recently weighed in on MGPI. Loop Capital set a $75.00 price target on shares of MGP Ingredients in a report on Friday, October 18th. Roth Mkm decreased their price objective on shares of MGP Ingredients from $69.00 to $65.00 and set a "buy" rating on the stock in a research note on Monday, November 4th. StockNews.com upgraded MGP Ingredients from a "sell" rating to a "hold" rating in a research report on Friday, November 1st. Lake Street Capital cut MGP Ingredients from a "buy" rating to a "hold" rating and decreased their price objective for the stock from $135.00 to $75.00 in a research note on Friday, October 18th. Finally, TD Cowen downgraded MGP Ingredients from a "buy" rating to a "hold" rating and dropped their price objective for the stock from $66.00 to $50.00 in a research note on Wednesday, November 6th. Three research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $76.67.

Read Our Latest Analysis on MGP Ingredients

Insider Activity

In other MGP Ingredients news, Director Karen Seaberg sold 1,109 shares of the firm's stock in a transaction on Wednesday, September 4th. The stock was sold at an average price of $90.14, for a total transaction of $99,965.26. Following the transaction, the director now directly owns 134,969 shares in the company, valued at $12,166,105.66. This trade represents a 0.81 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, Director Lori L.S. Mingus sold 7,050 shares of the stock in a transaction on Tuesday, November 19th. The shares were sold at an average price of $46.03, for a total value of $324,511.50. Following the sale, the director now directly owns 37,373 shares in the company, valued at $1,720,279.19. This trade represents a 15.87 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 20,251 shares of company stock worth $1,520,617 over the last 90 days. 36.20% of the stock is currently owned by insiders.

MGP Ingredients Price Performance

NASDAQ MGPI remained flat at $46.62 during trading hours on Thursday. 167,713 shares of the company were exchanged, compared to its average volume of 248,193. MGP Ingredients, Inc. has a 1-year low of $45.44 and a 1-year high of $102.42. The firm has a 50-day simple moving average of $67.70 and a 200 day simple moving average of $75.62. The company has a market cap of $1.02 billion, a PE ratio of 9.69, a P/E/G ratio of 0.76 and a beta of 0.66. The company has a quick ratio of 1.94, a current ratio of 6.46 and a debt-to-equity ratio of 0.31.

MGP Ingredients (NASDAQ:MGPI - Get Free Report) last announced its earnings results on Thursday, October 31st. The company reported $1.29 earnings per share for the quarter, topping analysts' consensus estimates of $1.27 by $0.02. The business had revenue of $161.50 million for the quarter, compared to analyst estimates of $161.55 million. MGP Ingredients had a return on equity of 14.39% and a net margin of 14.44%. The company's quarterly revenue was down 23.7% compared to the same quarter last year. During the same period in the prior year, the company earned $1.34 EPS. As a group, sell-side analysts anticipate that MGP Ingredients, Inc. will post 5.57 earnings per share for the current year.

MGP Ingredients Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Shareholders of record on Friday, November 15th will be issued a $0.12 dividend. This represents a $0.48 dividend on an annualized basis and a yield of 1.03%. The ex-dividend date of this dividend is Friday, November 15th. MGP Ingredients's dividend payout ratio (DPR) is presently 9.98%.

MGP Ingredients Profile

(

Free Report)

MGP Ingredients, Inc, together with its subsidiaries, engages in the production and supply of distilled spirits, branded spirits, and food ingredients in the United States and internationally. The company operates through three segments: Distillery Solutions; Branded Spirits; and Ingredient Solutions.

Featured Articles

Before you consider MGP Ingredients, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGP Ingredients wasn't on the list.

While MGP Ingredients currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.