Principal Financial Group Inc. trimmed its position in EchoStar Co. (NASDAQ:SATS - Free Report) by 4.3% during the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 568,991 shares of the communications equipment provider's stock after selling 25,771 shares during the quarter. Principal Financial Group Inc. owned approximately 0.21% of EchoStar worth $14,122,000 as of its most recent SEC filing.

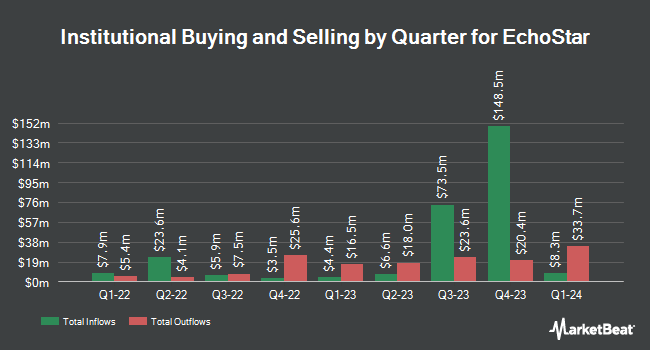

Several other hedge funds and other institutional investors also recently made changes to their positions in the business. Darsana Capital Partners LP bought a new stake in EchoStar in the 2nd quarter valued at about $36,908,000. State of New Jersey Common Pension Fund D acquired a new position in EchoStar in the second quarter valued at about $1,830,000. UniSuper Management Pty Ltd acquired a new stake in EchoStar during the first quarter worth about $398,000. Vanguard Group Inc. raised its position in shares of EchoStar by 238.7% in the 1st quarter. Vanguard Group Inc. now owns 13,707,909 shares of the communications equipment provider's stock valued at $195,338,000 after buying an additional 9,661,167 shares in the last quarter. Finally, Ensign Peak Advisors Inc bought a new position in EchoStar in the second quarter valued at approximately $833,000. 33.62% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

SATS has been the subject of a number of research analyst reports. Raymond James cut shares of EchoStar from a "strong-buy" rating to a "market perform" rating in a research report on Tuesday, October 1st. StockNews.com raised EchoStar to a "sell" rating in a research note on Saturday, November 9th. Morgan Stanley increased their price objective on shares of EchoStar from $14.00 to $20.00 and gave the stock an "equal weight" rating in a research report on Friday, September 13th. TD Cowen dropped their target price on shares of EchoStar from $37.00 to $30.00 and set a "buy" rating on the stock in a report on Wednesday. Finally, JPMorgan Chase & Co. reiterated an "underweight" rating and issued a $12.00 target price on shares of EchoStar in a report on Monday, August 12th. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat.com, EchoStar presently has an average rating of "Hold" and an average target price of $19.25.

Get Our Latest Stock Analysis on SATS

EchoStar Stock Performance

Shares of NASDAQ SATS traded up $0.80 during mid-day trading on Friday, reaching $22.79. 2,995,015 shares of the company's stock traded hands, compared to its average volume of 1,617,248. The company has a quick ratio of 0.32, a current ratio of 0.67 and a debt-to-equity ratio of 1.11. The business has a 50-day simple moving average of $24.79 and a 200 day simple moving average of $20.62. EchoStar Co. has a 1-year low of $9.53 and a 1-year high of $30.08.

Insider Buying and Selling at EchoStar

In other news, Chairman Charles W. Ergen acquired 1,551,355 shares of the firm's stock in a transaction on Tuesday, November 12th. The stock was purchased at an average price of $28.04 per share, for a total transaction of $43,499,994.20. Following the purchase, the chairman now owns 1,551,355 shares in the company, valued at approximately $43,499,994.20. This represents a ∞ increase in their position. The purchase was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Company insiders own 55.90% of the company's stock.

EchoStar Company Profile

(

Free Report)

EchoStar Corporation, together with its subsidiaries, provides networking technologies and services worldwide. The company operates in four segments: Pay-TV, Retail Wireless, 5G Network Deployment, Broadband and Satellite Services. The Pay-TV segment offers a direct broadcast and fixed satellite services; designs, develops, and distributes receiver system; and provides digital broadcast operations, including satellite uplinking/downlinking, transmission and, other services to third-party pay-TV providers; and multichannel, live-linear and on-demand streaming over-the-top internet-based domestic, international, Latino, and Freestream video programming services under the DISH and SLING brand names.

Read More

Before you consider EchoStar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EchoStar wasn't on the list.

While EchoStar currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.