Principal Financial Group Inc. lowered its position in shares of ONE Gas, Inc. (NYSE:OGS - Free Report) by 28.4% in the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 171,935 shares of the utilities provider's stock after selling 68,130 shares during the quarter. Principal Financial Group Inc. owned about 0.30% of ONE Gas worth $12,795,000 as of its most recent SEC filing.

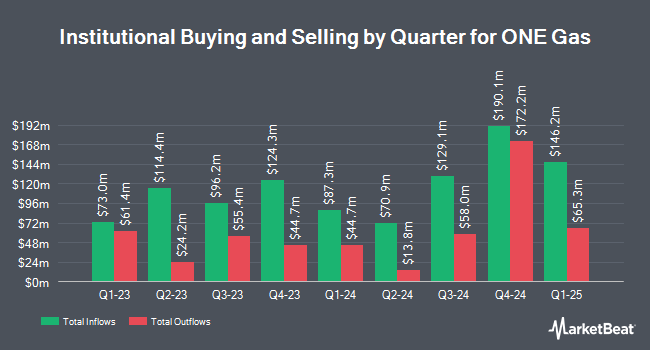

Several other hedge funds and other institutional investors have also bought and sold shares of OGS. Van ECK Associates Corp increased its position in shares of ONE Gas by 7.3% in the third quarter. Van ECK Associates Corp now owns 15,482 shares of the utilities provider's stock worth $1,142,000 after purchasing an additional 1,053 shares during the period. Capital Advisors Inc. OK bought a new position in ONE Gas during the 3rd quarter valued at $208,000. abrdn plc increased its position in shares of ONE Gas by 3.0% during the third quarter. abrdn plc now owns 327,405 shares of the utilities provider's stock valued at $24,365,000 after acquiring an additional 9,487 shares during the last quarter. Nisa Investment Advisors LLC raised its stake in shares of ONE Gas by 4.9% during the 3rd quarter. Nisa Investment Advisors LLC now owns 23,876 shares of the utilities provider's stock worth $1,777,000 after purchasing an additional 1,121 shares during the period. Finally, Insight Folios Inc boosted its stake in ONE Gas by 100.0% in the third quarter. Insight Folios Inc now owns 8,720 shares of the utilities provider's stock valued at $649,000 after acquiring an additional 4,360 shares during the last quarter. Institutional investors and hedge funds own 88.71% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts recently commented on the stock. StockNews.com cut shares of ONE Gas from a "hold" rating to a "sell" rating in a report on Wednesday. Wells Fargo & Company lowered their target price on ONE Gas from $82.00 to $81.00 and set an "overweight" rating on the stock in a research note on Wednesday, November 6th. Finally, Morgan Stanley increased their price target on ONE Gas from $63.00 to $69.00 and gave the stock an "equal weight" rating in a research note on Wednesday, September 25th. Two analysts have rated the stock with a sell rating, two have given a hold rating and two have assigned a buy rating to the company's stock. According to data from MarketBeat, ONE Gas presently has an average rating of "Hold" and a consensus price target of $68.10.

Check Out Our Latest Stock Report on ONE Gas

ONE Gas Price Performance

NYSE OGS traded up $1.21 during trading on Friday, reaching $75.40. The company's stock had a trading volume of 343,659 shares, compared to its average volume of 411,183. The stock has a market capitalization of $4.27 billion, a PE ratio of 19.64, a P/E/G ratio of 3.89 and a beta of 0.67. The company has a debt-to-equity ratio of 0.85, a current ratio of 0.50 and a quick ratio of 0.37. ONE Gas, Inc. has a one year low of $55.50 and a one year high of $76.34. The firm has a fifty day moving average of $72.99 and a 200 day moving average of $67.78.

ONE Gas (NYSE:OGS - Get Free Report) last released its earnings results on Monday, November 4th. The utilities provider reported $0.34 EPS for the quarter, missing the consensus estimate of $0.39 by ($0.05). The company had revenue of $340.40 million during the quarter, compared to the consensus estimate of $287.48 million. ONE Gas had a return on equity of 7.71% and a net margin of 10.52%. The company's revenue was up 1.4% compared to the same quarter last year. During the same period last year, the firm posted $0.45 earnings per share. Analysts expect that ONE Gas, Inc. will post 3.88 EPS for the current fiscal year.

ONE Gas Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 4th. Stockholders of record on Tuesday, November 19th will be given a dividend of $0.66 per share. This represents a $2.64 annualized dividend and a dividend yield of 3.50%. The ex-dividend date of this dividend is Tuesday, November 19th. ONE Gas's payout ratio is currently 68.75%.

ONE Gas Company Profile

(

Free Report)

ONE Gas, Inc, together with its subsidiaries, operates as a regulated natural gas distribution company in the United States. The company provides natural gas distribution services to approximately 2.3 million customers in Oklahoma, Kansas, and Texas. It serves residential, commercial, and transportation customers.

Further Reading

Before you consider ONE Gas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ONE Gas wasn't on the list.

While ONE Gas currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.