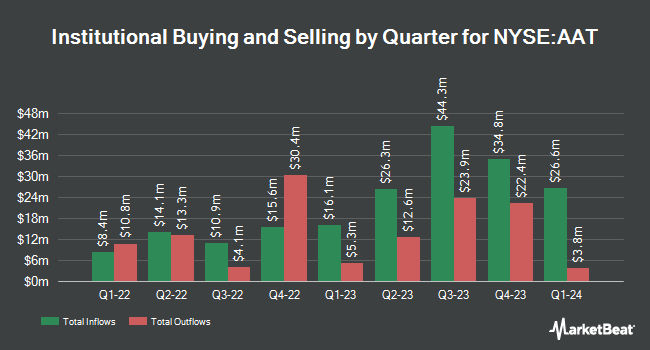

Principal Financial Group Inc. trimmed its holdings in shares of American Assets Trust, Inc. (NYSE:AAT - Free Report) by 7.8% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 244,329 shares of the real estate investment trust's stock after selling 20,603 shares during the period. Principal Financial Group Inc. owned about 0.40% of American Assets Trust worth $6,528,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Russell Investments Group Ltd. lifted its stake in shares of American Assets Trust by 30.4% in the 1st quarter. Russell Investments Group Ltd. now owns 42,957 shares of the real estate investment trust's stock valued at $941,000 after purchasing an additional 10,015 shares in the last quarter. ProShare Advisors LLC increased its position in shares of American Assets Trust by 7.4% in the first quarter. ProShare Advisors LLC now owns 9,841 shares of the real estate investment trust's stock valued at $216,000 after acquiring an additional 681 shares during the last quarter. State Board of Administration of Florida Retirement System lifted its stake in American Assets Trust by 93.3% during the first quarter. State Board of Administration of Florida Retirement System now owns 26,937 shares of the real estate investment trust's stock worth $590,000 after purchasing an additional 13,000 shares during the last quarter. Vanguard Group Inc. grew its holdings in American Assets Trust by 10.9% during the 1st quarter. Vanguard Group Inc. now owns 8,155,531 shares of the real estate investment trust's stock worth $178,688,000 after acquiring an additional 804,009 shares during the period. Finally, O Shaughnessy Asset Management LLC purchased a new position in shares of American Assets Trust in the 1st quarter worth approximately $1,776,000. 90.43% of the stock is owned by hedge funds and other institutional investors.

American Assets Trust Stock Down 0.6 %

Shares of NYSE AAT traded down $0.17 during trading on Wednesday, reaching $27.67. 161,130 shares of the stock were exchanged, compared to its average volume of 275,905. The company has a quick ratio of 8.53, a current ratio of 8.53 and a debt-to-equity ratio of 1.86. American Assets Trust, Inc. has a twelve month low of $18.44 and a twelve month high of $28.96. The business's 50-day moving average price is $27.11 and its 200 day moving average price is $24.81. The company has a market capitalization of $1.69 billion, a price-to-earnings ratio of 30.59 and a beta of 1.29.

American Assets Trust Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 19th. Shareholders of record on Thursday, December 5th will be paid a dividend of $0.335 per share. The ex-dividend date of this dividend is Thursday, December 5th. This represents a $1.34 annualized dividend and a yield of 4.84%. American Assets Trust's dividend payout ratio is currently 147.25%.

Wall Street Analyst Weigh In

A number of equities analysts have weighed in on AAT shares. Mizuho raised their target price on shares of American Assets Trust from $22.00 to $26.00 and gave the company a "neutral" rating in a research note on Monday, August 19th. Morgan Stanley upped their price objective on shares of American Assets Trust from $23.00 to $24.00 and gave the company an "equal weight" rating in a report on Wednesday, October 30th.

Get Our Latest Stock Report on AAT

American Assets Trust Profile

(

Free Report)

American Assets Trust, Inc is a full service, vertically integrated and self-administered real estate investment trust ("REIT"), headquartered in San Diego, California. The company has over 55 years of experience in acquiring, improving, developing and managing premier office, retail, and residential properties throughout the United States in some of the nation's most dynamic, high-barrier-to-entry markets primarily in Southern California, Northern California, Washington, Oregon, Texas and Hawaii.

Further Reading

Before you consider American Assets Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Assets Trust wasn't on the list.

While American Assets Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.