Principal Financial Group Inc. decreased its holdings in shares of Graham Holdings (NYSE:GHC - Free Report) by 26.0% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 8,614 shares of the company's stock after selling 3,024 shares during the quarter. Principal Financial Group Inc. owned 0.20% of Graham worth $7,078,000 at the end of the most recent quarter.

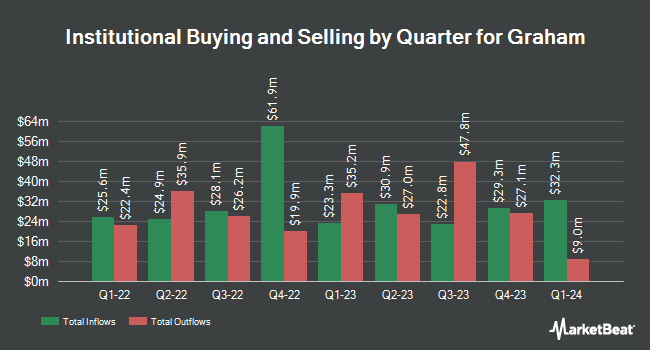

A number of other hedge funds also recently bought and sold shares of the company. ProShare Advisors LLC raised its holdings in shares of Graham by 2.2% during the first quarter. ProShare Advisors LLC now owns 799 shares of the company's stock valued at $613,000 after acquiring an additional 17 shares in the last quarter. Vanguard Group Inc. raised its stake in shares of Graham by 5.9% in the first quarter. Vanguard Group Inc. now owns 371,235 shares of the company's stock worth $284,990,000 after buying an additional 20,629 shares during the period. Gamco Investors INC. ET AL grew its position in shares of Graham by 1.0% during the first quarter. Gamco Investors INC. ET AL now owns 18,091 shares of the company's stock worth $13,888,000 after purchasing an additional 180 shares in the last quarter. Gabelli Funds LLC grew its position in shares of Graham by 1.6% during the first quarter. Gabelli Funds LLC now owns 9,500 shares of the company's stock worth $7,293,000 after purchasing an additional 150 shares in the last quarter. Finally, Epoch Investment Partners Inc. purchased a new position in Graham during the 1st quarter valued at approximately $626,000. Institutional investors own 62.54% of the company's stock.

Graham Stock Down 2.1 %

Shares of GHC traded down $18.88 during trading hours on Wednesday, hitting $900.13. The company had a trading volume of 2,600 shares, compared to its average volume of 15,099. The company has a market capitalization of $3.90 billion, a PE ratio of 17.84 and a beta of 1.11. The company has a current ratio of 1.57, a quick ratio of 1.34 and a debt-to-equity ratio of 0.18. Graham Holdings has a one year low of $613.39 and a one year high of $972.13. The company's fifty day moving average price is $829.49 and its two-hundred day moving average price is $773.49.

Graham Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, November 7th. Investors of record on Thursday, October 17th were paid a dividend of $1.72 per share. The ex-dividend date was Thursday, October 17th. This represents a $6.88 annualized dividend and a yield of 0.76%. Graham's dividend payout ratio (DPR) is 13.47%.

Analyst Upgrades and Downgrades

Separately, StockNews.com raised Graham from a "hold" rating to a "buy" rating in a research note on Monday, November 4th.

Get Our Latest Analysis on GHC

Graham Profile

(

Free Report)

Graham Holdings Company, through its subsidiaries, operates as a diversified education and media company in the United States and internationally. It provides test preparation services and materials; professional training and exam preparation for professional certifications and licensures; and non-academic operations support services to the Purdue University Global; operations support services for online courses and programs; training and test preparation services for accounting and financial services professionals; English-language training, academic preparation programs, and test preparation for English proficiency exams; and A-level examination preparation services, as well as operates colleges, business school, higher education institution, and an online learning institution.

Featured Articles

Before you consider Graham, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Graham wasn't on the list.

While Graham currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.