Principal Financial Group Inc. lowered its position in shares of Bloomin' Brands, Inc. (NASDAQ:BLMN - Free Report) by 85.5% in the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 367,484 shares of the restaurant operator's stock after selling 2,161,646 shares during the period. Principal Financial Group Inc. owned about 0.43% of Bloomin' Brands worth $4,487,000 at the end of the most recent reporting period.

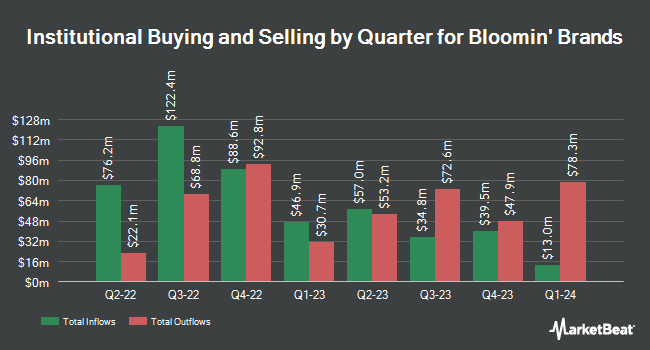

Several other institutional investors have also added to or reduced their stakes in the company. Creative Planning purchased a new stake in shares of Bloomin' Brands during the third quarter worth about $219,000. Farther Finance Advisors LLC raised its holdings in shares of Bloomin' Brands by 17.3% during the third quarter. Farther Finance Advisors LLC now owns 15,521 shares of the restaurant operator's stock valued at $257,000 after acquiring an additional 2,289 shares in the last quarter. Olympiad Research LP purchased a new stake in Bloomin' Brands in the third quarter worth $202,000. Easterly Investment Partners LLC boosted its holdings in Bloomin' Brands by 14.8% in the third quarter. Easterly Investment Partners LLC now owns 676,157 shares of the restaurant operator's stock valued at $11,177,000 after acquiring an additional 87,293 shares in the last quarter. Finally, Verdence Capital Advisors LLC increased its position in Bloomin' Brands by 6.6% during the 3rd quarter. Verdence Capital Advisors LLC now owns 12,676 shares of the restaurant operator's stock valued at $210,000 after purchasing an additional 780 shares during the period.

Bloomin' Brands Stock Up 5.7 %

Shares of NASDAQ:BLMN traded up $0.49 on Friday, hitting $9.05. 1,660,358 shares of the company traded hands, compared to its average volume of 1,684,110. The stock has a 50 day simple moving average of $11.58 and a 200-day simple moving average of $14.00. The company has a quick ratio of 0.22, a current ratio of 0.31 and a debt-to-equity ratio of 4.46. The company has a market cap of $768.20 million, a PE ratio of -82.31 and a beta of 1.97. Bloomin' Brands, Inc. has a 52 week low of $8.00 and a 52 week high of $30.13.

Bloomin' Brands Cuts Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, March 26th. Investors of record on Tuesday, March 11th will be given a $0.15 dividend. The ex-dividend date is Tuesday, March 11th. This represents a $0.60 annualized dividend and a yield of 6.63%. Bloomin' Brands's dividend payout ratio (DPR) is presently -40.27%.

Insiders Place Their Bets

In other Bloomin' Brands news, EVP Patrick M. Hafner sold 9,555 shares of the business's stock in a transaction on Tuesday, March 4th. The shares were sold at an average price of $8.32, for a total transaction of $79,497.60. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 3.14% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

BLMN has been the subject of several research analyst reports. Bank of America cut shares of Bloomin' Brands from a "neutral" rating to an "underperform" rating and dropped their target price for the stock from $18.00 to $13.00 in a research report on Monday, January 27th. Barclays set a $11.00 price objective on shares of Bloomin' Brands and gave the stock an "equal weight" rating in a report on Thursday, February 27th. UBS Group cut their price objective on Bloomin' Brands from $16.00 to $13.00 and set a "neutral" rating on the stock in a research report on Tuesday, January 7th. JPMorgan Chase & Co. decreased their target price on Bloomin' Brands from $19.00 to $14.00 and set a "neutral" rating for the company in a research report on Tuesday, November 12th. Finally, The Goldman Sachs Group dropped their price target on Bloomin' Brands from $13.00 to $10.00 and set a "sell" rating on the stock in a research report on Thursday, February 27th. Two equities research analysts have rated the stock with a sell rating and ten have assigned a hold rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $15.00.

Check Out Our Latest Report on BLMN

Bloomin' Brands Company Profile

(

Free Report)

Bloomin' Brands, Inc engages in the acquisition, operation, design, and development of restaurant concepts. It operates through the U.S. and International geographical segments. The U.S. segment operates in the USA and Puerto Rico. The International segment operates in Brazil, South Korea, Hong Kong, and China.

Further Reading

Before you consider Bloomin' Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloomin' Brands wasn't on the list.

While Bloomin' Brands currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.