Principal Financial Group Inc. trimmed its holdings in FMC Co. (NYSE:FMC - Free Report) by 11.6% in the third quarter, according to its most recent disclosure with the SEC. The fund owned 186,832 shares of the basic materials company's stock after selling 24,464 shares during the period. Principal Financial Group Inc. owned 0.15% of FMC worth $12,320,000 at the end of the most recent reporting period.

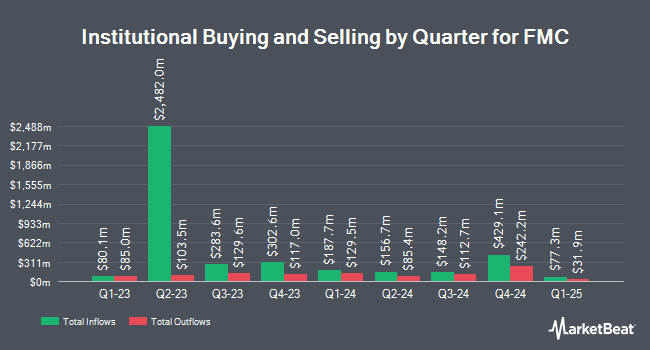

Several other institutional investors have also recently added to or reduced their stakes in FMC. Mather Group LLC. boosted its position in shares of FMC by 250.6% in the 3rd quarter. Mather Group LLC. now owns 554 shares of the basic materials company's stock worth $37,000 after buying an additional 396 shares in the last quarter. LRI Investments LLC bought a new stake in FMC in the first quarter valued at $41,000. UMB Bank n.a. increased its holdings in shares of FMC by 56.9% during the second quarter. UMB Bank n.a. now owns 678 shares of the basic materials company's stock valued at $39,000 after purchasing an additional 246 shares during the period. EntryPoint Capital LLC boosted its position in shares of FMC by 1,282.3% during the 1st quarter. EntryPoint Capital LLC now owns 857 shares of the basic materials company's stock valued at $55,000 after purchasing an additional 795 shares in the last quarter. Finally, GAMMA Investing LLC lifted its position in shares of FMC by 120.9% during the 3rd quarter. GAMMA Investing LLC now owns 919 shares of the basic materials company's stock valued at $61,000 after acquiring an additional 503 shares during the last quarter. Institutional investors and hedge funds own 91.86% of the company's stock.

FMC Trading Down 2.0 %

Shares of NYSE FMC traded down $1.09 during midday trading on Friday, reaching $54.39. 1,586,177 shares of the stock were exchanged, compared to its average volume of 1,209,060. FMC Co. has a twelve month low of $50.03 and a twelve month high of $68.72. The stock has a market capitalization of $6.79 billion, a P/E ratio of 4.68, a PEG ratio of 1.43 and a beta of 0.85. The company has a 50 day simple moving average of $62.22 and a 200 day simple moving average of $61.00. The company has a debt-to-equity ratio of 0.65, a quick ratio of 1.09 and a current ratio of 1.48.

FMC (NYSE:FMC - Get Free Report) last issued its earnings results on Tuesday, October 29th. The basic materials company reported $0.69 earnings per share for the quarter, topping the consensus estimate of $0.49 by $0.20. FMC had a return on equity of 7.68% and a net margin of 34.93%. The business had revenue of $1.07 billion for the quarter, compared to analyst estimates of $1.04 billion. During the same quarter last year, the company earned $0.44 EPS. The business's quarterly revenue was up 8.5% on a year-over-year basis. As a group, equities analysts expect that FMC Co. will post 3.35 earnings per share for the current year.

Insider Activity at FMC

In related news, VP Jacqueline Scanlan sold 4,529 shares of FMC stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $59.67, for a total transaction of $270,245.43. Following the transaction, the vice president now directly owns 28,649 shares of the company's stock, valued at $1,709,485.83. The trade was a 13.65 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 0.85% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

A number of equities research analysts have commented on FMC shares. Citigroup assumed coverage on FMC in a research report on Wednesday, October 23rd. They set a "neutral" rating and a $67.00 price objective for the company. KeyCorp dropped their price target on shares of FMC from $81.00 to $79.00 and set an "overweight" rating on the stock in a research report on Friday, August 2nd. Barclays lifted their price target on FMC from $62.00 to $65.00 and gave the stock an "equal weight" rating in a research report on Monday, August 5th. Mizuho upped their price objective on shares of FMC from $64.00 to $70.00 and gave the company a "neutral" rating in a research report on Friday, November 1st. Finally, Royal Bank of Canada boosted their price target on shares of FMC from $78.00 to $81.00 and gave the company an "outperform" rating in a report on Friday, November 1st. One equities research analyst has rated the stock with a sell rating, ten have issued a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $68.00.

Read Our Latest Research Report on FMC

About FMC

(

Free Report)

FMC Corporation, an agricultural sciences company, provides crop protection, plant health, and professional pest and turf management products. It develops, markets, and sells crop protection chemicals that includes insecticides, herbicides, and fungicides; and biologicals, crop nutrition, and seed treatment products, which are used in agriculture to enhance crop yield and quality by controlling a range of insects, weeds, and diseases, as well as in non-agricultural markets for pest control.

See Also

Before you consider FMC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FMC wasn't on the list.

While FMC currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.