Principal Financial Group Inc. cut its stake in MDU Resources Group, Inc. (NYSE:MDU - Free Report) by 30.5% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 472,130 shares of the utilities provider's stock after selling 206,768 shares during the period. Principal Financial Group Inc. owned 0.23% of MDU Resources Group worth $12,941,000 at the end of the most recent reporting period.

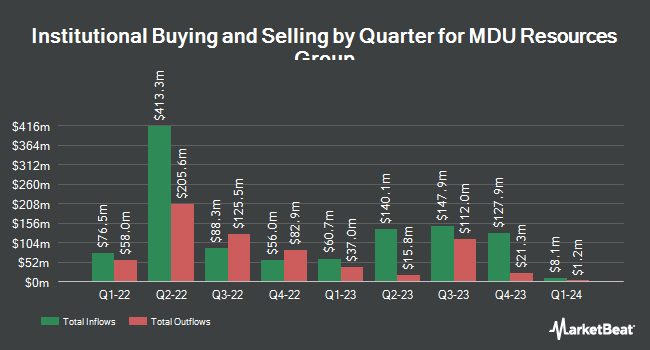

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. V Square Quantitative Management LLC bought a new position in MDU Resources Group during the 3rd quarter valued at about $25,000. Atlas Capital Advisors LLC acquired a new stake in MDU Resources Group in the second quarter worth about $27,000. Northwestern Mutual Wealth Management Co. increased its stake in MDU Resources Group by 23.9% during the 2nd quarter. Northwestern Mutual Wealth Management Co. now owns 2,142 shares of the utilities provider's stock valued at $54,000 after purchasing an additional 413 shares in the last quarter. Blue Trust Inc. lifted its position in MDU Resources Group by 238.1% during the 3rd quarter. Blue Trust Inc. now owns 2,935 shares of the utilities provider's stock worth $74,000 after acquiring an additional 2,067 shares during the period. Finally, Point72 Asia Singapore Pte. Ltd. purchased a new position in shares of MDU Resources Group during the second quarter worth $163,000. Hedge funds and other institutional investors own 71.44% of the company's stock.

MDU Resources Group Price Performance

Shares of MDU Resources Group stock traded up $0.45 during midday trading on Friday, reaching $18.34. The company had a trading volume of 1,728,060 shares, compared to its average volume of 3,245,961. The company has a market capitalization of $3.74 billion, a price-to-earnings ratio of 9.41, a price-to-earnings-growth ratio of 2.37 and a beta of 0.76. The company has a current ratio of 1.15, a quick ratio of 1.07 and a debt-to-equity ratio of 0.73. MDU Resources Group, Inc. has a 1-year low of $14.91 and a 1-year high of $30.52. The stock has a fifty day simple moving average of $25.47 and a 200 day simple moving average of $25.33.

MDU Resources Group (NYSE:MDU - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The utilities provider reported $0.32 EPS for the quarter, beating the consensus estimate of $0.31 by $0.01. MDU Resources Group had a return on equity of 11.24% and a net margin of 8.92%. The firm had revenue of $1.05 billion during the quarter, compared to analysts' expectations of $969.17 million. During the same period in the prior year, the firm posted $0.29 earnings per share. The business's quarterly revenue was up 5.0% compared to the same quarter last year. As a group, equities research analysts forecast that MDU Resources Group, Inc. will post 1.13 earnings per share for the current year.

MDU Resources Group Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, January 1st. Stockholders of record on Thursday, December 12th will be issued a dividend of $0.13 per share. The ex-dividend date is Thursday, December 12th. This represents a $0.52 annualized dividend and a dividend yield of 2.84%. MDU Resources Group's dividend payout ratio (DPR) is presently 26.67%.

Analyst Upgrades and Downgrades

Several research analysts have recently commented on the company. StockNews.com assumed coverage on MDU Resources Group in a report on Tuesday, November 5th. They set a "hold" rating on the stock. Bank of America raised shares of MDU Resources Group from a "neutral" rating to a "buy" rating and lowered their price target for the stock from $31.00 to $17.00 in a research note on Tuesday, November 5th. Finally, Siebert Williams Shank upgraded MDU Resources Group from a "hold" rating to a "buy" rating and set a $19.00 price objective on the stock in a report on Monday, November 4th.

Read Our Latest Research Report on MDU

MDU Resources Group Company Profile

(

Free Report)

MDU Resources Group, Inc engages in the regulated energy delivery, and construction materials and services businesses in the United States. It operates through four segments: Electric, Natural Gas Distribution, Pipeline, and Construction Services. The Electric segment generates, transmits, and distributes electricity for residential, commercial, industrial, and municipal customers in Montana, North Dakota, South Dakota, and Wyoming; and operates 3,400 miles of transmission lines, 4,800 miles of distribution lines, and 82 transmission and 298 distribution substations.

Read More

Before you consider MDU Resources Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MDU Resources Group wasn't on the list.

While MDU Resources Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.