Principal Securities Inc. increased its holdings in Kenvue Inc. (NYSE:KVUE - Free Report) by 1,103.6% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 44,378 shares of the company's stock after acquiring an additional 40,691 shares during the period. Principal Securities Inc.'s holdings in Kenvue were worth $947,000 at the end of the most recent quarter.

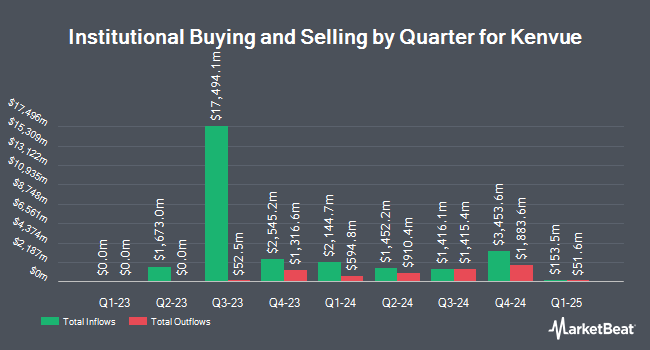

Several other institutional investors and hedge funds have also bought and sold shares of KVUE. AMF Tjanstepension AB grew its holdings in Kenvue by 187.3% during the third quarter. AMF Tjanstepension AB now owns 120,477 shares of the company's stock valued at $2,787,000 after purchasing an additional 78,540 shares during the period. Sequoia Financial Advisors LLC grew its holdings in Kenvue by 6.2% during the third quarter. Sequoia Financial Advisors LLC now owns 24,690 shares of the company's stock valued at $571,000 after purchasing an additional 1,449 shares during the period. Signaturefd LLC grew its holdings in Kenvue by 394.0% during the third quarter. Signaturefd LLC now owns 4,061 shares of the company's stock valued at $94,000 after purchasing an additional 3,239 shares during the period. Global X Japan Co. Ltd. grew its holdings in Kenvue by 8.0% during the third quarter. Global X Japan Co. Ltd. now owns 23,652 shares of the company's stock valued at $547,000 after purchasing an additional 1,748 shares during the period. Finally, Commerzbank Aktiengesellschaft FI bought a new position in Kenvue during the third quarter valued at $292,000. 97.64% of the stock is owned by institutional investors.

Kenvue Price Performance

NYSE KVUE traded up $0.84 during trading hours on Friday, reaching $23.23. 15,232,077 shares of the stock traded hands, compared to its average volume of 13,461,299. The stock has a 50 day simple moving average of $21.29 and a two-hundred day simple moving average of $22.14. Kenvue Inc. has a 1 year low of $17.67 and a 1 year high of $24.46. The company has a debt-to-equity ratio of 0.66, a current ratio of 1.00 and a quick ratio of 0.69. The company has a market cap of $44.53 billion, a price-to-earnings ratio of 43.78, a price-to-earnings-growth ratio of 2.61 and a beta of 1.45.

Kenvue (NYSE:KVUE - Get Free Report) last released its quarterly earnings results on Thursday, February 6th. The company reported $0.26 earnings per share for the quarter, meeting analysts' consensus estimates of $0.26. Kenvue had a return on equity of 20.97% and a net margin of 6.66%. On average, analysts predict that Kenvue Inc. will post 1.14 EPS for the current fiscal year.

Kenvue Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, February 26th. Investors of record on Wednesday, February 12th will be paid a $0.205 dividend. The ex-dividend date is Wednesday, February 12th. This represents a $0.82 annualized dividend and a dividend yield of 3.53%. Kenvue's payout ratio is presently 154.72%.

Wall Street Analyst Weigh In

Several equities research analysts have issued reports on the company. Royal Bank of Canada restated a "sector perform" rating and set a $24.00 target price on shares of Kenvue in a research report on Monday, February 3rd. Citigroup dropped their target price on Kenvue from $25.00 to $21.00 and set a "neutral" rating on the stock in a research report on Wednesday, January 15th. UBS Group dropped their target price on Kenvue from $23.00 to $21.00 and set a "neutral" rating on the stock in a research report on Friday, February 7th. Piper Sandler upgraded Kenvue from a "neutral" rating to an "overweight" rating and increased their target price for the stock from $21.00 to $26.00 in a research report on Monday, January 6th. Finally, Canaccord Genuity Group dropped their target price on Kenvue from $27.00 to $24.00 and set a "buy" rating on the stock in a research report on Friday, February 7th. One analyst has rated the stock with a sell rating, eight have given a hold rating and five have given a buy rating to the company's stock. According to MarketBeat, Kenvue has an average rating of "Hold" and an average price target of $23.00.

View Our Latest Analysis on Kenvue

About Kenvue

(

Free Report)

Kenvue Inc operates as a consumer health company worldwide. The company operates through three segments: Self Care, Skin Health and Beauty, and Essential Health. The Self Care segment offers cough, cold and allergy, pain care, digestive health, smoking cessation, eye care, and other products under the Tylenol, Motrin, Benadryl, Nicorette, Zarbee's, ORSLTM, Rhinocort, Calpol, and Zyrtec brands.

Read More

Before you consider Kenvue, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kenvue wasn't on the list.

While Kenvue currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.